Photographs: Uttam Ghosh/Rediff Yogini Joglekar in Mumbai

This is the appraisal season. Most of you might be concerned about how much raise you'll get. However, equally important, if not more, is how the raise is given and how it'll affect your salary structure.

Suppose, for instance, you get a 20 per cent raise on your CTC (cost-to-company). While technically, your salary has gone up by 20 per cent, your net (take-home) salary hasn't increased by the same quantum.

A real increment would, then, be when your fixed pay increases and non-taxable perks are added to your salary structure, which increases the net salary.

Sangeeta Lala, vice-president at TeamLease Services, says, "A junior-level employee would want a higher net salary, whereas a senior grade officer wants to pay less tax on his fat pay."

Salary structure for a junior-level employee: Employees at the junior levels need a higher take-home salary.

...

How salary hike affects your tax outgo

Photographs: Uttam Ghosh/Rediff

Tax experts say in this case, they try to add more fixed allowances in the salary structures such as food coupons, conveyance and telephone.

These allowances are fixed and payable monthly to the employee. However, employees get taxed on these to a certain extent.

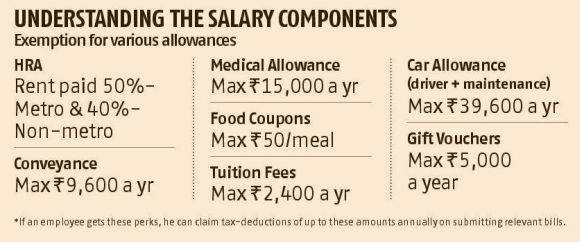

For instance, your employer gives you a monthly conveyance allowance of Rs 2,000. However, in this case, you will get tax deduction on conveyance only of Rs 800 a month, and not Rs 2,000.

This is because the maximum tax exemption on conveyance one can claim is Rs 9,600 per annum.

Sunil Goel, director at Global Hunt, says, "Getting a customised salary structure is difficult because employers design it in a fixed way, common to all employees."

If the company is small, you can still consider negotiating. Hence, if your employer has added allowances in your appraisal, be happy! Reason: While it increases your net salary, the additional income is tax-free.

...

How salary hike affects your tax outgo

According to a survey by staffing company Mercer, performance-based pay and rewards will gain prominence this appraisal cycle.

Apart from house rent allowance (HRA) and leave travel allowance (LTA), allowances can be in the form of food coupons, conveyance, driver's salary, and uniform/wardrobe allowance.

At the same time, to get full reimbursements, employees need to submit actual bills. For instance, telephone, medical, LTA and so on. However, one should know how to make most such reimbursements.

Homi Mistry, partner at Deloitte, says, "If these are not supported with relevant bills, one gets taxed. One should not misuse this facility by producing fake bills, as this can land you in trouble."

Salary structure for a senior-level employee: Here, the employee anyway comes in a higher tax bracket.

The concern here is not only to maintain a higher take-home salary but also to reduce one's tax burden. Hence, there is a need to add more benefits/perks in the salary structures of employees at senior levels.

...

How salary hike affects your tax outgo

Photographs: Uttam Ghosh/Rediff

Perks can be in the form of services rendered to the employee by way of providing paid servant, transport services, education facility to the spouse, club memberships, etc. These services or amounts received from these perks are not taxable.

Increase in HRA, LTA and other perks directly raises your take-home salary and reduces the burden on tax. An office car is the most common benefit given to employees at this level.

"If an employee is given an office car, he gets a particular amount monthly as allowance. He can get up to Rs 3,300 a month or Rs 39,600 a year, depending on the car," says Mistry of Deloitte.

This money gets added to your annual income. If the employer is flexible, it will find ways to save you from this tax trap.

For instance, some employers may decide to give the car in his wife's name, instead of the employee to save his tax."

...

How salary hike affects your tax outgo

Photographs: Uttam Ghosh/Rediff

Usually, these employees have higher special allowances, bonuses and basic, which attract tax. Senior employees also get taxed on the stock options they get as benefits from his employer.

The value of shares received under such plans/schemes will be taxed as perquisite in the hands of the employees.

If your employer has opted for superannuation scheme, you are entitled for tax deduction up to Rs 100,000. This is generally opted by senior employees and also scores over the National Pension System (NPS), as it attracts tax on withdrawal.

The contribution made by an employee gets tax deduction under Section 80C within the Rs 100,000 limit only.

However, according to tax experts, your employer's contribution up to 10 per cent of basic plus dearness allowance is eligible for deduction under Section 80CCE over and above the Rs 100,000 limit.

Hence, this instrument is tax-friendly for both, employee and his employer.

...

How salary hike affects your tax outgo

Photographs: Uttam Ghosh/Rediff

If the employee is provided with a company-leased accommodation, then he can claim up to 15 per cent of his basic salary.

One can claim tax deductions either on HRA or the housing loan allowance. You can claim up to 40 per cent of the HRA if you reside in a non-metro or 50 per cent, if you are based in a metro.

Reimbursements: These are also taxable but can get tax deductions upon actual bills. This component is added to both the junior- and senior-level employees' salary structures, as it gives tax-free income and helps increase the net salary.

Hence, one should use life/health insurance, equity-linked saving schemes, tax-free bonds, Public Provident Fund, and National Savings Certificate to save tax.

Along with this, people taking first-time home loan of up to Rs 25 lakh (Rs 2.5 million) can avail of additional tax deduction towards interest repayment up to Rs 100,000 this financial year. This is also over and above the Rs 100,000 limit in Section 80C.

article