Photographs: Roy Madhur/Reuters Surajeet Das Gupta in New Delhi

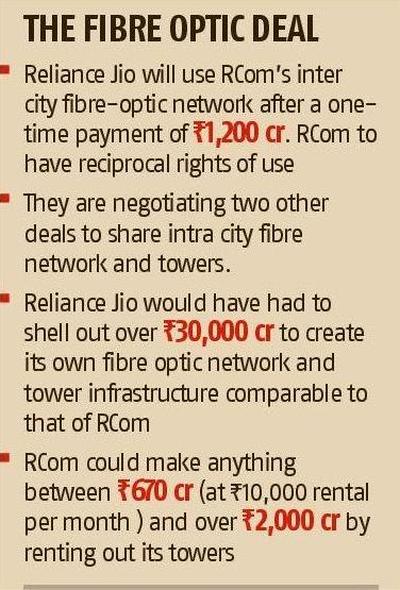

Last week, Mukesh Ambani's Reliance Jio, the telecom arm of Reliance Industries, signed a deal with Anil Ambani-controlled Reliance Communications (RCom) to use the latter's fibre-optic network after a one-time payment of Rs 1,200 crore (Rs 12 billion).

RCom, in turn, will have reciprocal right to use the network, which Reliance Jio will build in the future.

It is a small deal by any standards. If the deal is for 25 years, the average length of such agreements, the one-time payment will work out to an annual revenue of Rs 48 crore (Rs 480 million) for RCom.

It would only have a limited impact on RCom's financials. But what makes it interesting is that it could open up a larger area of cooperation between the two brothers: towers, intra-city fibre and so on.

It looks as if the brothers, who had famously split their empire into separate units in 2005, are getting back together.

...

Future of Ambani brothers' telecom deal

Image: A man talks on a mobile phone in front of an advertisement for Reliance Communications in Mathura.Photographs: K K Arora/Reuters

But is it the brotherly spirit of cooperation driving this convergence or is it the exigencies of business?

What the two have put in place is a three-stage deal - for utilisation of inter-city fibre, followed by intra-city fibre and the towers of RCom.

It's a win-win for both. Reliance Jio on its own, say analysts, would have had to fork out over Rs 30,000 crore (Rs 300 billion) to create a fibre optic and tower infrastructure similar in size to RCom's.

Now, it will be saving huge costs by launching its services on the under-utilised but large infrastructure which RCom has created.

For RCom, which is reeling under Rs 36,000 crore (Rs 360 billion) of debt, it means much-needed revenue to clean up its books.

More importantly, it also means it will be able to leverage Jio's infrastructure without making its own investments to expand its network and consumer coverage.

...

Future of Ambani brothers' telecom deal

The new alignment has been necessitated by the fact that both companies in the future plan to bank on data in a big way.

Unlike in GSM voice service where fibre requirement is limited, for high-speed data, a large fibre backbone is a must with most towers connected by the pipes rather than through cheaper microwave connectivity.

But it needs large investments. Obviously, if resources are pooled in, it will ease the investment burden for both.

Sea change

This budding partnership is a far cry from the situation eight years back. Under the terms of the settlement between the brothers, it was Anil Ambani who was handed over RCom.

The two brothers also signed a non-compete agreement to not get into each other's businesses.

But that ended in May 2010, and Mukesh Ambani re- entered the telecom sector by buying 95 per cent in Infotel Broadband, which had won a pan-India licence for broadband wireless access in the 2300 Mhz band.

...

Future of Ambani brothers' telecom deal

Image: A woman uses her mobile phone.Photographs: Jorge Silva/Reuters

For Reliance Jio, which has chosen to launch 4G LTE services by the end of the year, the strategy is simple. As it is starting from scratch, it needs to woo subscribers with a unique-selling proposition.

It is entering the market when net additions have gone negative month-on-month and the customer base has been shrinking.

On the other end, teledensity in urban India, which will be the focus for Reliance Jio in the first phase, is already 140 per cent, meaning everyone owns a mobile phone and almost half of them have two.

So, Reliance Jio will have to woo subscribers who already use mobile phones and also use some data.

With its vast bank of spectrum (it has 20 Mhz of spectrum compared to one fourth with 3G players), the obvious selling point will be to offer high- speed data at dramatically lower tariffs bundled with phones and even voice service. It can, however, do so only if it can pare its costs and save time by rolling out faster.

...

Future of Ambani brothers' telecom deal

Image: A customer leaves a Reliance communication store in Ahmedabad.Photographs: Amit Dave/Reuters

RCom, in this scenario, provides the right fit. It has over 120,000 km of optic fibre across the country, which includes inter-city fibre.

If Reliance Jio had to build a similar network, it would have had to fork out Rs 12,000 crore (Rs 120 billion).

Furthermore, with right of way in cities becoming very restrictive, it would have taken the company three to five years to create the infrastructure.

The second part of the deal between the two, which is being negotiated, will be for Reliance Jio to use RCom's intra-city fibre, which is more expensive to build.

Presumably, Reliance Jio may have to fork out much more as a one-time payment to use this fibre.

RCom has a fibre penetration of over 72 per cent in 330 cities across India where it currently offers 3G services. Insiders say these are the same cities where Reliance Jio plans to launch services in the first phase.

...

Future of Ambani brothers' telecom deal

Image: The British Telecom Tower is seen in central London.Photographs: Stefan Wermuth/Reuters

But the utilisation of this fibre, experts say, is not more than 18 per cent. Similarly in another 690 cities, RCom has fibre, which supports CDMA operations including data dongles.

Even here the utilisation is less than 80 per cent. Reliance Jio could also use RCom's submarine cable capacity across the globe to take its data. But that, till now, is not a part of the three-stage deal.

The third area of cooperation is the tower business. RCom has over 56,000 towers across the country. Out of this, 21,000 towers are in the 330 cities where Reliance Jio is expected to launch services in the first phase.

Rolling out fresh network would have cost Mukesh at least Rs 16,800 crore or Rs 168 billion (based on prevailing cost of a tower at Rs 30 lakh). That is big money. It would have, say analysts, required 15 years to recover it.

However, the deal doesn't mean Reliance Jio can roll out services without any investment.

As the 2300 Mhz LTE spectrum is not as efficient as 2G (900 and 1800 Mhz) or 3G spectrum, Reliance Jio will need more towers to give the same service.

...

Future of Ambani brothers' telecom deal

Image: Sun rises over the telecommunication towers in New Delhi.Photographs: B Mathur/Reuters

Those in the know say it will require 125,000 towers with half of it coming from RCom. Reliance Jio is already looking at low-cost towers, which look like lamp posts and cost less than Rs 10 lakh (Rs 1 million).

With an average tenancy of around 1.8, RCom's tower company, Reliance Infratel, mostly has captive tenants from its CDMA and GSM business.

Its tenancy is lower than that of its competitors like Viom (2.38) or even Indus (1.94).

After Reliance Jio joins in, average tenancy will rise to 2.8, making it the best amongst all tower players.

More incentives

There are other advantages as well. About 30 per cent of RCom's towers have a fibre optic backhaul (intermediate link between core network) which is key to offering high-speed data. In cities this number is as high as 70 per cent.

Once Reliance Jio builds its towers and fibre optic backbone, RCom will be able to double its coverage of mobile services to cover 90 per cent of India by using its infrastructure.

...

Future of Ambani brothers' telecom deal

Image: Mukesh Ambani and Anil Ambani are seen in Mumbai.Photographs: Roy Madhur/Reuters

However, the deals are not going to be sweet if Reliance Jio's discussions with other telecom companies are anything to go by.

Reliance Jio has been asking for rock-bottom rentals of Rs 10,000 a month. Tower company CEOs say it is a third of the prevailing rates and, therefore, unviable.

Reliance Jio wants to take advantage of the huge surplus capacity of towers (there are 380,000 towers) lying idle, especially since the Supreme Court cancelled licences of many telecom players last year.

Still, there is a business case for Anil's RCom. It could make anything between Rs 670 crore (at Rs 10,000 rental) and Rs 2,000 crore (at Rs 30,000 rental) annually if it is able to rent out all its towers.

Reliance Infratel's annual revenue was over Rs 7,500 crore (Rs 75 billion) in 2011-12. Even if only 21,000 towers are rented, it could bring Rs 250 crore to Rs 750 core (Rs 7.5 billion) to RCom annually.

...

Future of Ambani brothers' telecom deal

Photographs: Roy Madhur/Reuters

Will the relationship go beyond just sharing infrastructure? If the policy permits and trading of spectrum is allowed, could Reliance Jio also share 2G spectrum from RCom to offer voice services?

In the 2300 Mhz band where Reliance Jio operates, the quality is not great. He could also buy content, which will be a key driver of 4G, available with Anil's entertainment and broadcasting business.

At the moment, top executives on both sides rule out any possibility of expanding the relationship beyond what has been hinted at.

Competitors do not see it as any threat: "Reliance Jio would obviously prefer to deal with RCom which does not compete with it in the 4G space. Considering its large needs which can be provided only by its competitors who are also in the 4G space or will get into it, it was a foregone conclusion," says a senior executive of a leading GSM telco.

For the two brothers, however, the future will clearly depend on how they throw away their past mistrust and look at building a new working relationship together.

article