Photographs: Rediff Archives Neha Pandey Deoras in Bangalore

Suffered a heart attack and don't have a health insurance policy? It is very unlikely that you would get one.

While pre-existing heart ailments should be covered like any other pre-existing disease, that is, after a waiting period of four to five years, most insurers politely deny this.

Now, such patients can heave a sigh of relief. Chennai-based Star Health and Allied Insurance has launched Cardiac Care, a new product dedicated to those who have undergone angioplasty or bypass surgery.

This comes at a time when even youngsters are suffering from heart attacks and run the risk of not being covered for life.

India is estimated to have 32 million heart patients; by 2015, it could become the cardiac ailments capital of the world.

...

Now, heart patients can get a health insurance

Photographs: Rediff Archives

Cardiac Care has a small waiting period, as it offers coverage after 91 days of the commencement of a policy to patients who have undergone angioplasty or bypass surgery once in the last two to three years.

One can apply for this six months after the surgery to a maximum of 3 years after the surgery and not later than that.

Mahavir Chopra of medimanage.com says, "If X underwent a bypass surgery on June 1, 2013, he can apply for this plan on December 2, 2013 and up to May 31, 2016. If Y underwent angioplasty in May 2011, he can apply for this plan up to April 2014."

The six-months-to-three-years criterion is because of the high risks on the company's books.

...

Now, heart patients can get a health insurance

Photographs: Jacky Naegelen/Reuters

"When one undergoes a heart surgery, the chances of its recurrence are high either soon after the surgery, say within six months to a year, or after five years. Therefore, if one has undergone a surgery six months before buying the policy, the company would know how the patient has responded to it and decide whether or not to accept his proposal. And, if the surgery took place three years ago, the company would have enough time to collect premiums from the patient before a claim can be made," says Arvind Laddha of Vantage Insurance Brokers.

However, acceptance of a proposal is subject to medical tests. "Those who have other diseases as well, and if those diseases could complicate matters or if the patient has not maintained his health as he/she should after the surgery/angioplasty, the proposal could be rejected," says Chopra.

...

w, heart patients can get a health insurance

This plan is renewable for life. The product offers to cover pre-existing diseases other than those related to the heart from the fifth policy year, as is the case with any standard health plan. Knee replacement, hernia, cataract, piles, stone, sinus, etc, are covered after two years.

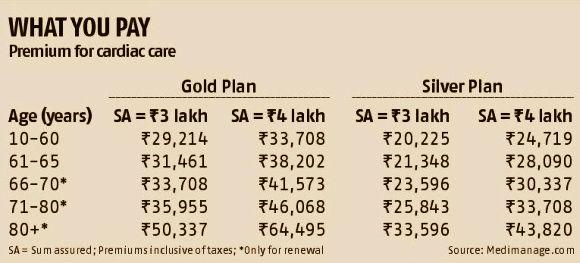

Though the premium for the plan isn't low, it helps save a lot by covering heart ailments. To that extent, it is reasonable if you don't have any heath policy, as this functions like a standard mediclaim that covers heart ailments.

But if you already have a comprehensive policy and want to buy this only to cover heart ailments, it might appear expensive, says Laddha. For someone aged between 30 and 35, the premium of a Rs 400,000 policy would be Rs 4,000-4,500.

But you're aged 50 or more, buy this policy even if you have a comprehensive one. Cardiac treatment in India could easily cost Rs 400,000-500,000.

...

Now, heart patients can get a health insurance

Photographs: Reuters

According to the plan, the sum insured would be restricted to 80 per cent of the (claim) amount, if the hospital has billed the patient for a package.

Deepak Yohannan of Myinsuranceclub.com says, "These days, most hospitals, especially high-end ones, offer surgeries as a package. They charge a lump sum for the surgery, room rent diagnostic tests, doctor fee, etc, in a package, against separate bills for each. In such cases, if you have a claim of Rs 100,000, you'll be paid only Rs 80,000. Those aged above 60 would need to spend an additional 10 per cent of the claim amount, as the plan levies co-payment on those taking the policy while aged 60 or more."

These days, co-payment is applicable on senior citizens for group policies, too.

S Prakash, executive director of Start Health and Allied Insurance, says the policy is a part of the company's corporate social responsibility initiatives.

article