Photographs: Punit Paranjpe/Reuters G Ganapathy Subramaniam

While aviation ministry went out of the way to make Jet-Etihad deal happen, it raised an alarm when AirAsia applied to start India operations. In absence of the aviation policy, the working of ministry remains non-transparent and it changes rules at the drop of a hat.

It was a pleasant morning in March this year when officials of the Finance Ministry in North Block received a googly from Rajiv Gandhi Bhavan, which houses the civil aviation ministry.

As preparations were on for a meeting of the Foreign Investment Promotion Board (FIPB) that would, among other things, discuss AirAsia's proposal to invest in an Indian airline, came in the opinion of wise men in the civil aviation ministry like a bombmshell: the freshly liberalised foreign direct investment policy (FDI) would apply only to airlines which are already in operation and not new venture like the one proposed by the Malaysia-based budget carrier.

In effect, the argument was that AirAsia cannot invest in the airline that was to be jointly promoted by the Tata Group and Telestra Tradeplace, owned by Lakshmi Mittal's son-in-law, along with AirAsia.

Remember, this was the time the government was pushing hard to attract more foreign investment to stem the rupee's slide and prevent India's credit rating from being downgraded.

When all the big guns in the economic ministries were trying to promote FDI, Rajiv Gandhi Bhavan was moving in the opposite direction!

...

Jet-Etihad deal: Curious case of missing aviation policy

Image: James Hogan (L), chief executive of Abu Dhabi's Etihad Airways, Ahmad Ali-al-Sayegh (2nd L), a board member of Etihad Airways, India's Civil Aviation Minister Ajit Singh (C) and Naresh Goyal (R), Chairman of Jet Airways.Photographs: Mansi Thapliyal/Reuters

Such are the vagaries of policies governing India's civil aviation industry that only a few 'resourceful' people could successfully find their way across this jungle, while others often found themselves stumped by non-transparent rules of the game that could change at the drop of a hat.

That the Finance Ministry and the Commerce & Industry Ministry teamed up to over-rule the civil aviation ministry and say that foreign carriers can invest in start-ups too is another story.

It is this backdrop that makes the Jet Airways stake sale to Etihad Airways of Abu Dhabi much more interesting and intricate than any other deal involving half-a-billion dollars.

According to well-placed insiders, it is several factors rolled into one, involving bilateral flying rights to Abu Dhabi, an aviation 'race' between two Emirates, an investment protection pact with UAE which is worried about investments like Etisalat; the impending arrival of AirAsia in India; and last, but not the least, blessings of the right people at both ends.

So much so that the civil aviation ministry did all possible to see the Jet-Etihad combine through, reversing the anti-FDI perception brought on by the AirAsia controversy only a month earlier.

...

Jet-Etihad deal: Curious case of missing aviation policy

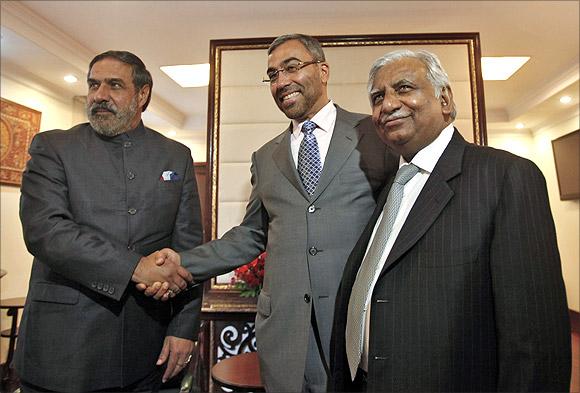

Image: Trade Minister Anand Sharma shakes hands with Ahmed Ali-al-Sayegh, a board member of Abu Dhabi's Etihad Airways, as Jet Airways Chairman Naresh Goyal (L-R) looks on.Photographs: Mansi Thapliyal/Reuters

Even as the Jet-Etihad negotiations were dragging on, officials of the civil aviation ministry were considering a request from Abu Dhabi to enhance bilateral flying rights that will enable Etihad to fly more frequently to India.

Abu Dhabi wanted enhancement of 42,000 seats per week, explained a senior official at civil aviation ministry, and their idea to compete on a stronger footing with Dubai-based Emirates, which now has the rights to fly 54,200 seats per week out of India.

No other foreign airline enjoys that much access to the Indian market. Ultimately, the civil aviation ministry agreed that additional entitlement of 36,670 seats per week would be provided to Abu Dhabi.

That the additional entitlement would be put to use over a period of time extending to the winter of 2015 has not attracted as much attention as the coincidence of Jet-Etihad deal getting wrapped up, as if on cue.

That has led to allegations of a 'sweetened' deal with the government pitching in with the liberal bilateral entitlements to enable Jet clinch it without further delay.

...

Jet-Etihad deal: Curious case of missing aviation policy

Image: Air India aircrafts stand on the tarmac at the airport in Mumbai.Photographs: Punit Paranjpe/Reuters

Apart from the coincidence, the clearance of additional bilaterals for Abu Dhabi has been done despite opposition from national carrier Air India that fears that increasing competition will make its recovery even more difficult.

The government has committed Rs 30,000 crore (Rs 300 billion) to revive Air India and Rs 5,000 crore (Rs 50 billion) has been provided in the 2013-14 budget.

All this is taxpayer's money and the entire Rs 30,000 crore will sink without a trace if market access is liberalised so fast.

Air India has accumulated losses of Rs 43,000 crore (Rs 430 billion) and the pains due to the merger with Indian Airlines continues to hurt the national carrier.

No wonder Air India is apprehending that other countries too will come up with similar demands for additional bilaterals and that will leave a sick Air India to face an unequal fare war.

...

Jet-Etihad deal: Curious case of missing aviation policy

Image: AirAsia staff greet passengers arriving from Kota Kinabalu to the Low Cost Carrier Terminal in Sepang outside Kuala Lumpur.Photographs: Bazuki Muhammad/Reuters

Even private sector players like IndiGo and SpiceJet who are on a much better wicket are feeling the heat. It is not just a reinvigorated Jet in alliance with Etihad that they will have to face - AirAsia too will be here soon with a hub at Chennai and the race is going to be furious.

Despite being a bureaucrat, Air India's chairman Rohit Nandan has expressed his reservations emphatically, but his protests have been brushed aside.

Emirates has already put in a request to enhance its bilateral entitlement to 80,000 seats per week. The race between Etihad and Emirates will only cut Air India to size in the Gulf market while AirAsia's entry is giving the national carrier the jitters in the case of south-east Asia.

The other side of the story is that there is need for competition that benefits the consumer. There is no doubt that consumer should benefit, but the policy of reviving Air India with taxpayer money works at cross purpose with the competition argument.

Rather than trying to infuse fresh equity into the national carrier under government management, which in the first place is response for the mountain of losses that Air India is sitting on, it will be a better idea to privatise the airline and find it an international partner strong enough to turn things around.

...

Jet-Etihad deal: Curious case of missing aviation policy

Image: Arun Shourie, former Minister of Disinvestment.Photographs: Horasis/Wikimedia Commons

The government, being the owner of Air India, should go all out to find domestic as well as international partners who can successfully pilot the national carrier in a competitive environment.

That brings us to the failed bid during the NDA regime when Arun Shourie almost brought in Singapore Airlines-Tata Group combine to pick up strategic stake in Air India.

The vested interests that then opposed Singapore Airlines have now become 'FDI positive' as a senior bureaucrat describes it.

All this flip-flop and contradictions are not possible because we still do not have a comprehensive civil aviation policy despite years of deliberations.

It is difficult to forget the paradox of allowing FDI in civil aviation, but barring foreign carriers. Several players like Virgin Atlantic and Lufthansa could not enter India despite their interest.

As much as 40 per cent of Jet Airways was owned by foreign carriers, before this controversial barrier was imposed.

...

Jet-Etihad deal: Curious case of missing aviation policy

Image: Vijay Mallya and G R Gopinath.Photographs: Reuters

The stubborn bar was removed only when the entire aviation industry got caught in a minefield and even strong players like Jet Airways started struggling due to growing burden of accumulating debt.

By the time the policy changed, it was too late for the likes of Paramout Airways and Kingfisher as they were already grounded. Sahara and Capt Gopinath's Air Deccan made an exit when it was still possible to sell out.

No wonder Jet, considered the strongest and smartest among full-service carriers, has attracted a valuation of less than Rs 10,000 crore (Rs 100 billion).

Etihad is paying $379 million for 24 per cent stake; and even if we consider the $70 million the Abu Dhabi carrier is paying for Heathrow slots of Naresh Goyal's airline and the $150 million committed to pick up majority stake in 'Jet Privilige' frequent flier programme, the total commitment comes to only $599 million.

...

Jet-Etihad deal: Curious case of missing aviation policy

Image: Kalanithi Maran, chairman and MD of Sun Group, and promoter of SpiceJet.Photographs: Courtesy, Bombardier Aerospace.

The valuation may not be whooping, but Jet Airways Naresh Goyal has steered his airline out of trouble at a time when others like Vijay Mallya of Kingfisher have found the door shut and Kalanidhi Maran of SpiceJet continues to scout for a strategic partner.

In addition to these contradictions, there are two other factors. UAE wants a strong investor protection agreement with India so investment of Etihad does not go the Etisalat way.

That has not happened so far, but top government managers say there was pressure to conclude an agreement before the Etihad deal was inked.

Quiet assurances have saved the day for the deal, but is it right for the government to provide such 'sweeteners' for a single deal? The doors are now open for similar demands from other countries.

When any such deal is under negotiation, the concerned government may push for liberal bilateral and investment protection pacts or other safeguards citing Abu Dhabi as a precedent, is the apprehension among bureaucrats.

...

Jet-Etihad deal: Curious case of missing aviation policy

Image: Passengers walk towards their departure gates in the newly opened Terminal 3 at Singapore's Changi Airport.Photographs: Vivek Prakash/Reuters

The other concern is about the airport sector. Following the Jet-Etihad deal and liberalisation of bilaterals, it is felt that Abu Dhabi will attract a huge volume of traffic from India, making it difficult for development of hubs like Delhi and Mumbai where huge amounts have been invested in airport development.

Efforts are also on to develop Chennai, Kolkata, Bangalore and Hyderabad as hubs. The push for airport hubs will be neutralised if we keep losing to Dubai and Abu Dhabi.

On the other direction, Singapore has developed as a huge hub despite its small population and Hong Kong, Malaysia and Bangkok are also catching up.

With both airlines and airports struggling, where is the lack of civil aviation policy leading India to? Unfortunately, all this is happening despite India's growth as a huge aviation market.

G Ganapathy Subramaniam is the Chief of Delhi Bureau at the Puthiya Thalaimurai Tamil channel.

Views are his own

article