Photographs: Uttam Ghosh/Rediff.com Sreelatha Menon in New Delhi

The Employees’ Pension Scheme (EPS), which provides retirement benefits to about 85.5 million subscribers of the Employees Provident Fund, could be merged with its rival, the National Pension System.

The finance ministry has asked EPS, run by the Employees’ Provident Fund Organisation (EPFO), a statutory body under the labour ministry, to close down and shift its beneficiaries to NPS “on a mandatory basis”.

…

Why Chidambaram wants to close down Employees' Pension Scheme

Photographs: Uttam Ghosh/Rediff.com

The National Pension System (NPS) is run by the finance ministry, with no contribution from the government or any guaranteed benefits to subscribers.

The Employees’ Pension Scheme (EPS) should be wound up or “grandfathered”, said Finance Minister P Chidambaram in a letter to former labour minister Mallikarjun Kharge in August 2012, according to a person in the know of the development.

Incidentally, a World Bank study using PROST (Pension Reform Options Simulation Toolkit) model had in July 2011 certified EPS as a sustainable scheme. “In view of the size of the scheme, the base shortfall is insignificant because if assumptions are even slightly modified, the shortfall turns into a surplus,” the study noted.

…

Why Chidambaram wants to close down Employees' Pension Scheme

Photographs: Uttam Ghosh/Rediff.com

Chidambaram’s letter to Kharge was recently followed up with a meeting between officials of the EPFO, the Pension Fund Regulatory and Development Authority (PFRDA) and the finance ministry, with the EPFO officials making a strong case for keeping EPS alive.

According to Chidambaram, EPS’ guaranteed and defined benefits - the features that make it attractive to subscribers - are untenable.

“A defined benefit pension scheme like EPF (the Employees Provident Fund) with a committed liability at the end would be subject to constant calibration of either benefit structure or the contribution structure or a combination of both to meet that liability. All this puts constant pressure on finances…,” said a person with direct knowledge of the letter, quoting the letter.

…

Why Chidambaram wants to close down Employees' Pension Scheme

Photographs: Uttam Ghosh/Rediff.com

The financial viability of EPS was a concern and that any parametric change to EPS may not yield to long-term financial sustainability of EPS, he said, quoting the letter.

“It is recommended that EPS may be grandfathered and all new employees covered under the Employees Provident Fund and Miscellaneous Provisions Act, 1952, may be brought under the New Pension System on mandatory basis rather than tinkering with the benefit structure to guarantee a minimum pension of Rs 1,000.”

The letter suggested the government had for long been considering shutting down EPS. “In view of the persistent deficit in EPS, it has been suggested repeatedly by the Department of Financial Services that it would be better to cap the financial liability of the government by closing EPS at the earliest and switching over to NPS.”

…

Why Chidambaram wants to close down Employees' Pension Scheme

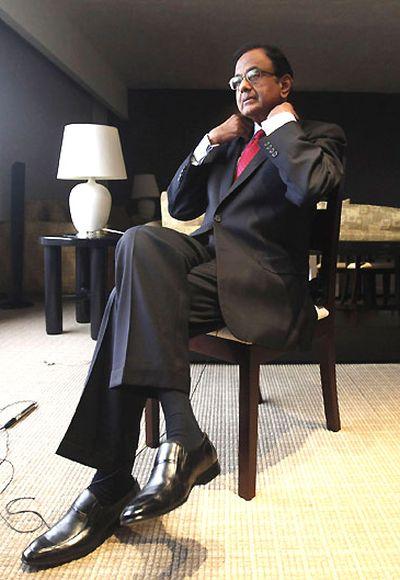

Image: Finance Minister P ChidambaramPhotographs: Edgard Garrido/Reuters

Chidambaram suggested that officials in the ministry and PFRDA would engage with officials in the labour ministry to work out the modalities of the transition. He added switching over to NPS would be beneficial for employees as they would get decent returns and adequate pension, and the government would be free from any open-ended and financially unsustainable liability of EPS.

EPFO officials said the pension scheme was becoming a victim of turf war between government departments. “Each department wants its scheme to survive,” said an official.

The NPS architecture is based on strong information technology infrastructure, which allows prompt client servicing and can provide real-time information on investment returns... Further, it is cost-effective and provides portability of account,” Chidambaram said in the letter.

article