Photographs: Danish Siddiqui/Reuters Prashant Sharma

Stock markets are susceptible to volatility in the run-up to the general elections in May, 2014, says Prashant Sharma.

India’s equity markets have witnessed extreme volatility in the last six months.

While flows and sentiments deteriorated during the first half of this financial year, a slew of measures announced by Reserve Bank of India Governor Raghuram Rajan, positive performance of China’s economy and deferment of quantitative easing tapering by the US Federal Reserve raised investor sentiments in later months.

However, the sharp market rally in a relatively short period of time is more based on sentiments and hope.

Domestic dynamics

India is among the five largest economies on the basis of purchasing power parity.

Its economy is much more integrated with the world economy than in the past and it is no longer possible to remain insulated from developments in the global market.

Most countries -- developed nations of Europe or emerging economies like China -- are facing slowdown in their economic growth rates.

All these developments have adversely affected India, too.

. . .

Markets to trade with an upward bias

Image: A broker works while sitting in front of a screen displaying live stock quotes on the floor of a trading firm in Mumbai.Photographs: Vivek Prakash/Reuters Prashant Sharma

Indian economic growth hit a low of five per cent in the financial year ended March 31,2013 and further slowed in the first quarter of FY14.

Even in the second quarter gross domestic product growth was below five per cent levels at 4.8 per cent.

In spite of that, India has the highest growth rate after China among the large economies.

Key risks to India’s economy are high inflation, high interest rates, and lower economic growth.

Inflation is particularly high in agricultural commodities owing to factors such as structural changes, supply-side issues and higher aspirations.

Apart from agriculture, core inflationary levels are within RBI’s comfort zone and we expect the trajectory to move downwards in the short-term.

. . .

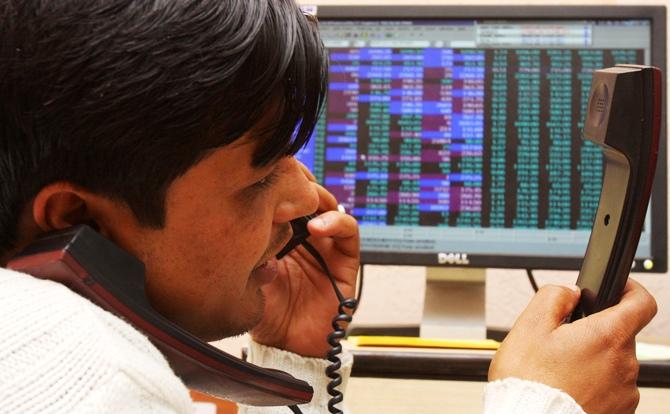

Markets to trade with an upward bias

Image: A terminal operator speaks on telephones at a local stock market in Chandigarh.Photographs: Ajay Verma/Reuters

A key positive in the second half of FY14 would be a pick-up in rural economy due to increased agricultural production aided by good monsoons, which will also help in lowering agricultural inflation.

With the rupee stabilising and RBI’s recent actions, India’s macro-economic environment is showing some signs of recovery.

In the immediate term, slowdown risks could come from the government contracting expenditure to contain its fiscal deficit and a lack of pick up in industrial and service sectors.

While the measures announced by RBI are intended to achieve the dual objectives of economic growth and inflation control, it will take some time before we can see some tangible results.

. . .

Markets to trade with an upward bias

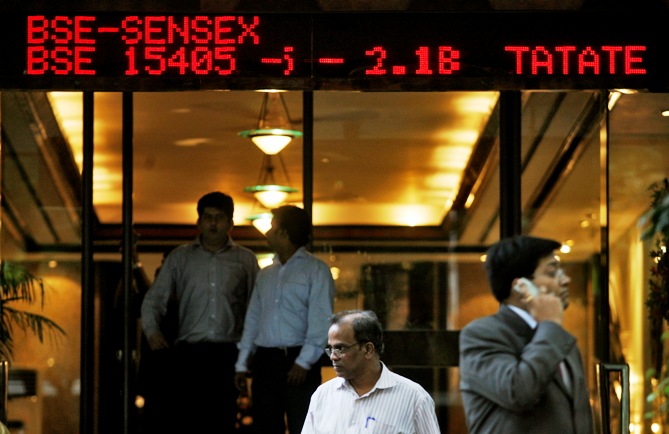

Image: People walk past a digital screen displaying India's benchmark share index in Mumbai.Photographs: Punit Paranjpe/Reuters

External cues

The Fed deferred QE tapering, which has caused a rally in risky assets including emerging markets equity.

Flows from foreign institutional investors have improved substantially following the deferment of tapering.

FIIs have invested $2 billion each in September and October this year.

A large proportion of these flows is consequent to their increased allocations in emerging markets exchange-traded fund investments.

Whenever the US Fed decides to taper, investors will be less worried about the consequences, as India’s foreign vulnerability has reduced since July as the current account deficit has significantly contracted and foreign exchange reserves have been boosted through foreign currency non-resident (bank) swaps and other instruments.

. . .

Markets to trade with an upward bias

Image: A broker looks at a computer screen at a stock brokerage firm in Mumbai.Photographs: Arko Datta/Reuters

Future upbeat

Long-term prospects of Indian economy remain strong.

Stock markets, however, are susceptible to volatility in the run-up to the general elections in May, 2014.

Although markets and investors are party-agnostic, a stable political landscape lends itself to optimal performance.

If the upcoming elections are successful in achieving this objective, we can expect increased inflows from institutional investors, both foreign and domestic.

Economic activity is forecasted to pick in the second half of the financial year owing to better agricultural output.

The macro-economic environment is recuperating against the backdrop of improved global cues.

While we expect markets to be volatile over the next three to six months since there are a number of events lined up, we believe markets to trade with an upward bias with mid-caps outperforming the large caps.

We also see value in selective information technology, infrastructure and media stocks and are underweight on fast moving consumer goods stocks.

Prashant Sharma is chief investment officer, Max Life Insurance

article