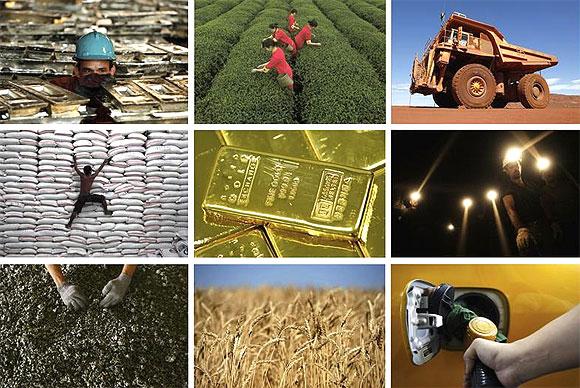

Photographs: Sanjay Sawant/Rediff

A large part of the current slowdown can be attributed to the execution bottlenecks and falling investor sentiment in the country, Ajit Ranade, Chief Economist, Aditya Birla Group, tells A Ganesh Nadar

India's economy grew at a decade low of five per cent in 2012-13.

Though the economy began a feeble recovery in the first quarter of 2013, weak private consumption, capital investment and slowing public spending offer little hope for a fast rebound in the coming quarters.

While Indians, to a large extent, are not too worried about the country's weak GDP, galloping inflation fuelled by frequent rise in the price of diesel is indeed unnerving.

But what is really alarming is the falling rupee -- it had recently dropped to a record low of 60.72 against the US dollar.

In a candid chat Ajit Ranade, chief economist of the Aditya Birla Group tells A Ganesh Nadar the reasons behind India's economic woes.

Click on NEXT to read the interview...

'A large part of the current slowdown can be attributed to the execution bottlenecks'

Photographs: Reuters

When recession was ravaging the West, we proclaimed that we were insulated, and our stable GDP growth showed the same. Then what happened suddenly that our growth slowed to a decade's low? Do we need an industrial revival or an agrarian revival to get the economy back on track?

We were able to withstand the immediate fallout of the Lehman crisis due to a coordinated fiscal and monetary stimulus. In fact during FY10 and FY11 we clocked high growth rates, partly due to the stimulus, partly due to an apparent ‘V’ shaped recovery anticipated globally. That, unfortunately, could not be sustained.

Let us now delve deeper in the problems plaguing the Indian economy.

Policy bottlenecks: A large part of the current slowdown can be attributed to the execution bottlenecks and falling investor sentiment in the country.

Supply constraints such as land acquisition, coal linkages, environmental and policy clearances and raw material availability have all contributed to the investment slowdown that has dragged down growth over the past few years.

Withdrawal of fiscal stimulus: To add on, fiscal tightening is accentuating the recent slowdown with policymakers left with no choice given the threat of a sovereign ratings downgrade.

India’s fiscal deficit was reduced sharply by 1.5 per cent of its GDP in FY13, largely by squeezing expenditures, contributing to further slowing down growth this year.

Unsustainable drivers of growth: The drivers of growth in pre-Lehman years and post-Lehman were different. Pre-Lehman investment grew at an average rate of 15 per cent for three years while in the post-Lehman period this fell to seven per cent.

Consumption spending drove growth in the post-Lehman period (11 per cent year-on-year) while investment languished, which was obviously not sustainable (as no new capacity was being created).

Thus the nine per cent average growth rate seen in FY10 and FY11 (post-Lehman) was buoyed by consumption (especially rural), rising subsidies, export growth and not to forget a huge fiscal stimulus which was still present in the system and is now being withdrawn.

You see, monetary and fiscal policy are not perfect substitutes, thus it would be unwise to expect that a loose monetary policy will counter the effects of fiscal consolidation.

And finally, industrial revival is imperative for higher growth. Industry has been the worst performer in the current scenario.

The poor performance of the industrial sector can be largely attributed to the slump in corporate investments.

Corporate sector investment, which reached a peak of 17.3 per cent of GDP in 2007-08, dipped to 11.3 per cent with the onset of the global financial crisis in 2008-09 and improved marginally to 12.1 per cent in 2010-11.

Only a better policy environment and macro-economic certainty can ensure the much needed boost to corporate investments.

Click on NEXT for more...

'The rupee's slide is in line with other current account deficit economies'

Photographs: Reuters

The dollar is rising alarmingly against the rupee, why is the RBI not doing anything?

The Indian rupee has plunged almost 10 per cent against the US dollar over the last two months, falling below 60 (on June 26) from 54 in mid-May.

The trigger for the current slide is the fear that US Federal Reserve might taper its asset purchase programme sooner than expected, ie, the bond buyback programme will end soon.

The buyback of bonds by the Fed resulted in injection of huge liquidity in the American banking system. This was flowing out to emerging market economies like India, South Africa, Brazil and Turkey.

As the bond buyback slows down, all emerging markets will experience heavy outflows, resulting in re-pricing of all assets.

This effect is more pronounced in case of countries with high current account deficit. The rupee’s slide is in line with other current account deficit economies like Brazil, Turkey and South Africa where interest rate differentials with US treasury is driving outflows. (These countries have a bigger debt market compared to India).

With a slowdown in equity flows and rising trade deficit the rupee has been constantly under pressure. There should be some relief for the rupee as this abates.

Short-term measures are unlikely to help the rupee in the long term. It is difficult to defend a depreciating currency. This is because you have to keep selling dollars from your stock of foreign exchange. Sooner or later you run out of stock.

The RBI has intervened periodically to prevent further weakness, but such interventions will only help the rupee in the short term and cannot be sustained over time. As Reserve Bank of India Governor Duvvuri Subbarao said, a “failed intervention is worse than no intervention”.

To get out of this mess, the Government of India needs to address structural issues -- twin deficits and inflation risks need to be managed to control rupee volatility.

Click on NEXT for more...

'Oil and gold are not the real culprits behind high CAD'

Photographs: Reuters

It is said India’s high current account deficit is because of oil and gold imports. Oil we cannot do without but can we ban gold imports?

Oil and gold are NOT the real culprits. These two commodities account for 40 per cent of our total import bill.

India’s dependency on oil and obsession with gold is quite well known and it was believed that a slowdown in global commodity prices, especially gold, will bring down the deficit. That, unfortunately, did not happen.

Coal, fertiliser, metal scrap imports have surged owing to policy challenges: Contrary to the conventional wisdom of blaming oil and gold for widening of the CAD, in the last two years the deterioration has been mainly attributed to doubling of coal imports, spike in fertiliser imports, increase in metal scraps and muted iron ore exports, following the iron ore mining bans in Karnataka and Goa.

Together they accounted for 50 per cent of the deterioration in the last two years ($25 bn). Gold demand remains sticky. Surge in gold demand in April and May might be a result of some hoarding of gold based on the fear that the recent price dip is temporary and prices might rise going forward.

There is also growing fear that the government might take further steps to curb gold demand after increasing import duty.

Thus we might see some correction as some of this speculative demand unwinds. But we also must remember that purchase of gold is both for investment as well as consumption.

Even though Finance Minister P Chidambaram urged Indians not to buy gold, demand for the yellow metal remains high despite duty hikes, regulatory tightening, and moderating gold prices.

The government also announced the launch of inflation indexed bonds in a bid to disincentivise gold imports. Banning gold imports doesn’t seem to be the best approach.

To sum up, I can say, better policy environment can certainly help the country's economy.

article