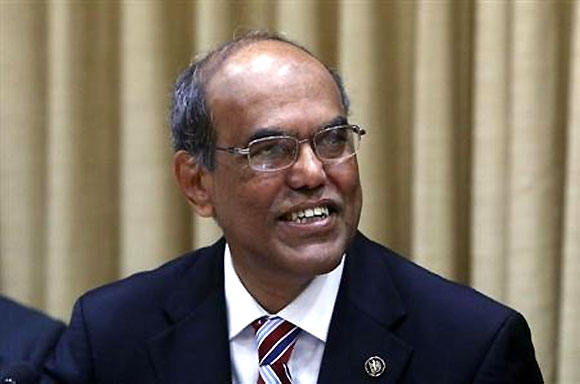

Photographs: Vivek Prakash/Reuters

At a press conference after announcing the central bank’s first-quarter review of monetary policy, Reserve Bank of India (RBI) Governor D Subbarao talks about the reasons behind the central bank’s recent liquidity-tightening measures, as well as its exchange rate strategy: Excerpts:

Rationale behind the liquidity-tightening measures

In the last three years, the current account deficit (CAD) has been above sustainable levels. The rupee should have depreciated as a consequence of the high CAD.

In other words, depreciation was programmed into the rupee. That did not happen because we were able to finance the CAD; we were able to finance it because of extraordinary liquidity in the global system.

Because of the large CAD and the way we financed it, we became vulnerable to the external outlook; we became vulnerable to financial markets and to a sudden stop or reversal of capital flows in the consequence of the stabilisation of the exchange rate.

The only unknown was when it might happen; the vulnerability came sooner than everyone in the world expected. The rupee dropped from 57/$ to 61/$ in a matter of four weeks, without any change in our fundamentals. There was 5.8 per cent depreciation on May 22, when the first announcement was made (by the US Federal Reserve), and on July 26.

This rapid depreciation of the currency put us in a vicious spiral, amplified unidirectional movements and encouraged a hurting instinct. In addition to the rupee’s movement, there was comfortable liquidity in the system. On July 5, the liquidity adjustment facility briefly went to a reserve repo mode. So, the easy liquidity provided fertile ground for speculation on the exchange rate.

At our meeting with the technical advisory committee last week, one of the members asked what vulnerability was. Vulnerability is if something goes wrong, suddenly a lot goes wrong, very quickly. That is what happened to our system. So, we determined the volatility in the exchange rate hurtful to the economy for a number of reasons.

First, if the exchange rate overshoots, it might not return to the original level. So, it is very important for us to see the adjustment is in line with the fundamentals. Second, a rapid depreciation of the exchange rate would have impacted the balance sheets of banks, corporates, and households, too.

Click on NEXT for more...

Subbarao on why RBI is taking such harsh steps

Photographs: Vivek Prakash/Reuters

Intervention in foreign exchange market

Forex intervention is a standard tool for defending against volatility. As much as we resorted to that instrument, we were also conscious whatever we did shouldn’t fuel speculation. The first standard of defence against excessive exchange rate volatility is monetary policy instruments.

We want to mention we were not altering the fundamental path of the exchange rate. Our action was entirely based on the need to curb volatility and disorderly movement.

When and how to roll back

We did not use the word ‘temporarily’ advisably. This is because temporary means different things to different people. And, you would pressure us to define ‘temporary’; we were not in a position to define what it was and in the event, we would have created more confusion than thrown light.

The rollback of the measures would be stake-contingent, data-dependent and linked to a decline in volatility and disorderly movements in the exchange rate.

Some of the indicators we would look at is the bid-ask spread, the intra-day volatility in exchange rate, volumes of forward contract to evaluate importers’ assessment regarding the stability of exchange rate, volumes and open interest positions in the currency futures market, forward premia and a number of other indicators as well.

We will also make an assessment of global markets and see how vulnerable these remain to further announcements or actions.

There has been a lot of speculation in the market that RBI is targeting an exchange rate. That speculation is completely misinformed. We are not defending any exchange rate target and not altering the movement of the exchange rate according to fundamentals. What RBI wants is to reduce volatility and ensure the orderly adjustment of the exchange rate to its market level.

Finally, I want to say RBI is sensitive to the short-term costs of tight liquidity measures to economic activity. And, we are as anxious as everyone else to roll these back. But getting locked into a time frame is both infeasible and inadvisable.

Click on NEXT for more...

Subbarao on why RBI is taking such harsh steps

Photographs: Vivek Prakash/Reuters

On the rupee slipping after the policy announcement

We don’t make a determination of whether to sound dovish or hawkish. We are not targeting any level for the rupee; if the rupee is adjusting gradually, that is the way it should be.

As far as the broader monetary policy stance is concerned, there would have been reasonable arguments for further monetary easing because growth has moderated more than we expected and inflation is not as uncomfortable as earlier, though there are risk factors.

That is the reason behind the language. So, there would have been a case for monetary policy easing, but for external sectors concerns.

I would like it to be read as the importance RBI is attaching to containing exchange rate volatility.

Are more steps likely in case the rupee depreciates further

I cannot comment on that. It is not about rupee depreciation per se; it is volatility we would be looking at. So, the level is what you should be looking at.

article