Photographs: Amit Dave/Reuters Surajeet Das Gupta and Sharmistha Mukherjee in New Delhi

India's passenger car industry has been hit by a double whammy -- while sales of petrol cars have been poor, those of diesel ones, too, have been declining due to the recent reduction in gap between prices of the two fuels.

Some economists have said the industry's woes have shown signs of bottoming out.

But R C Bhargava, chairman of Maruti Suzuki India Ltd, the country's largest passenger car maker, differs.

He says there are no such signs, hinting at tough times ahead.

If this prognosis wasn't dark enough, he says, with economic uncertainty fuelling job insecurity, even falling interest rates would be of little help, as buyers would postpone purchase.

In such a scenario, carmakers would sharpen their focus on surviving the slowdown with a focus on aggressive cost cuts centred around inputs and engineering.

Though Bhargava says Maruti will stay the course in so far as committed investments are concerned, he admits it is difficult to read what the market will be like after three years.

In a freewheeling interview with Business Standard, he also says his company will be the parent's flag-bearer in markets like Africa, Southeast Asia and West Asia.

Edited excerpts:

. . .

Car industry's woes far from over, says Maruti chief

Image: Chairman of Maruti Suzuki India R.C. Bhargava speaks during an interview for the Reuters India Investment Summit at his residence in Noida.Photographs: B Mathur/Reuters

Car sales fell nine per cent in May. Do you see the trend of declining sales reversing anytime soon?

Economists have been saying that we are near the bottom. But that doesn't seem to be happening.

Even interest rate cuts are not key to reviving the economy or sales in the industry.

In India, over 70 per cent of car purchases are financed by banks.

An interest rate reduction of, say, one percentage point doesn't change a person's decision of buying or not buying a car -- his equated monthly instalment comes down by only Rs 50.

With the uncertainties prevalent today, a consumer does not know what his job would be like after a year -- whether or not he will have an incremental income, or even a job.

. . .

Car industry's woes far from over, says Maruti chief

Image: Maruti Suzuki Swift Dzire.Photographs: Courtesy, Maruti Suzuki

Last year, diesel and utility vehicles shored up the overall car sales. Won't that happen this year?

The industry has been hit by a double whammy -- sales of petrol cars are down and the diesel ones, too, are showing a declining trend.

Last year, sales of diesel-driven vehicles were spurred by the gap between the prices of diesel and petrol. Since then, diesel prices have risen significantly.

And, people know those will only rise further in the times to come.

Since a vehicle has a life of six-seven years, it is not very advantageous to buy a diesel vehicle anymore.

Those are no longer hot favourites.

However, this does not even mean that the petrol ones are selling.

. . .

Car industry's woes far from over, says Maruti chief

Image: Keys hang from the door of a Maruti Suzuki Swift car at its stockyard on the outskirts of the western Indian city of Ahmedabad.Photographs: Amit Dave/Reuters

How is the auto industry addressing this challenge?

To survive, companies have to keep costs down.

They are no longer looking for big margins; it's more about ensuring survival till the slowdown is over.

The biggest cost cuts can happen in materials -- through higher productivity, less waste, redesigning, substitute materials and value engineering.

How important is Maruti Suzuki in Suzuki's global operations?

Suzuki has transferred to Maruti Suzuki the responsibility of producing and marketing cars to Africa, West Asia and some Southeast Asian markets where it doesn't have operations.

Suzuki will focus on Europe, China and the rest of the markets.

. . .

Car industry's woes far from over, says Maruti chief

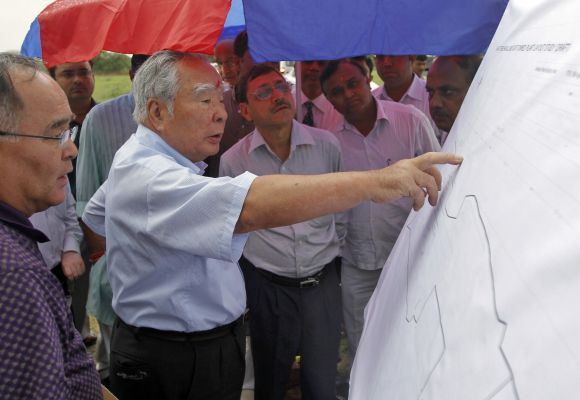

Image: Suzuki Chairman and CEO Osamu Suzuki, wearing a traditional tikka or a red mark on his forehead, checks the site map during his visit to the site of the proposed Maruti Suzuki plant at Hansalpur village in Gujarat.Photographs: Amit Dave/Reuters

So, does that mean all investments will be made by the Indian company? And, have you identified some markets where you will set up manufacturing facilities?

If manufacturing units have to be set up in Africa, Maruti Suzuki will do that.

We are also responsible for West Asia and parts of Southeast Asia (Bangladesh, Nepal and Sri Lanka).

But, even when Suzuki sets up a factory, such as in Indonesia, we export components from India for projects there.

Operations are getting integrated between Japan and India.

The selection of a country to commence assembly operations will depend on two or three factors.

First, the volume has to be large enough to justify setting up assembly operations. Second, there has to be a distinct advantage in starting completely knocked-down operations over exports.

This will depend both on volumes and the taxation policy of the country.

Sri Lanka keeps changing its tax rates.

. . .

Car industry's woes far from over, says Maruti chief

Image: Maruti SX4.Photographs: Courtesy, Maruti Suzuki

When rates were low, it was a big market for us.

We were exporting 17,000-18,000 vehicles to the country every year.

In 2012, when tax laws were changed, duties became very high and sales dropped dramatically.

We are studying whether it would be viable to set up assembly operations there.

This will be done by Maruti.

In Africa, the only country worth looking at is Algeria.

But no decision has been taken yet.

We have not even started a study for that market.

That is another area where Maruti will look into.

Will expansion plans proceed as scheduled, despite the slowdown?

If we assume demand grows by six per cent every year till 2015, we would have grown to around 1.44 million units over three years.

As far as the third assembly line in Manesar is concerned, there is no point in slowing it down.

The project is in the final stage of completion.

There will be three lines at Manesar, with a combined capacity of 750,000 units that can go up to 850,000-900,000 units.

At the Gujarat plant, even if we were to start work now, it would take about three years to commission the project.

It is very difficult to forecast how the market will be in 2015-16.

Till 2014-15, we have to rely on Gurgaon and Manesar.

At present, we are producing about 1.2 million vehicles.

. . .

Car industry's woes far from over, says Maruti chief

Photographs: Mukesh Gupta/Reuters

A serious issue seems to be cropping up between farmers and the Gujarat government over the land that has been allotted to you. Is it a Singur in the making?

I have spoken to Gujarat's principal secretary.

Our officers have also gone there.

They have said there is no problem between the government and the farmers.

So far, the Gujarat government has been able to sort out such issues without any real problem.

And, we have bought the land from the government.

The Land Acquisition Bill is about to be passed and it is quite generous for landowners.

It will increase cost of projects, as land prices will go up.

For Manesar, we spent around Rs 150 crore (Rs 1.5 billion) to purchase land and another Rs 5,500 crore (Rs 55 billion) to set up the three assembly lines.

Land cost was three per cent of the total project cost.

Now, with land prices rising 3-4 times, the project cost will rise 10-12 per cent.

Bajaj Auto has said the proposed quadricycles would be much more efficient than cars in terms of emission.

. . .

Car industry's woes far from over, says Maruti chief

Image: Maruti Ritz.Photographs: Courtesy, Maruti Suzuki

They emit only about 60g of carbon dioxide per km, compared with the 92 g a car emits per km.

Why have you all been raising the issue of quadricycles being less efficient?

Our view (which is close to the government's) is that quadricycles can be a good substitute for three-wheelers.

However, we do feel that, quadricycles must conform with the normal rules for a small car if they are to be used on a large scale for personal passenger transport.

Otherwise, how would anyone differentiate between quadricycles and personal cars?

For example, the Tata Nano was not given a special treatment; it followed all the rules of a car.

If the driving cycles are the same, the emissions of a small car are a fourth of those of a quadricycle (while travelling at the same speed).

That is never divulged.

What has been said is that they emit less carbon dioxide -- there's no mention of the speed differential.

People deserve a cheaper car but the non-car users, too, deserve safe roads and a cleaner atmosphere.

The issue is, what's the trade-off?

Also, you cannot have a very under-powered passenger vehicle (in quadricycles) and compromise on safety; it might not be able to climb on a steep slope road.

Maruti has been developing a 800-cc diesel engine which could be mounted on an entry-level car. Is this a possibility?

An entry-level customer is someone who has stretched his means to buy a car.

He does not drive more than 10,000 km a year.

For him, diesel adds value when the price difference between diesel and petrol is significant.

But, given the premium on diesel vehicles (it would cost at least Rs 100,000 lakh more) and the narrowing of price differential between the two fuels, he loses out if he buys a small diesel car. At the entry-level, an 800-cc diesel engine does not have relevance.

. . .

Car industry's woes far from over, says Maruti chief

Image: Maruti Ertiga.Photographs: Courtesy, Maruti Suzuki

Are you still bullish on diversifying your SUV portfolio?

We are working on SUVs with Suzuki. But the whole market for SUVs needs to be reappraised in the context of what is happening.

The price differential between diesel and petrol has come down to Rs 10 a litre from Rs 25-30 a litre -- the potential for sales of diesel vehicles needs to be worked out.

The kind of numbers we were selling when diesel was cheap is not likely to happen now; the fuel has now become more expensive.

So it is not surprising that the volumes of the Ertiga will also follow the same trend.

. . .

Car industry's woes far from over, says Maruti chief

Photographs: Courtesy, Maruti Suzuki

How different will your strategy be for the sale of light commercial vehicles that you plan to introduce?

We have decided that the sale of LCVs cannot be from the same showrooms as those for passenger cars.

There have to be other outlets.

However, the dealers would be the same, you cannot appoint a dealer separately for LCVs; that's not viable.

In India, LCVs have no future without diesel options.

Now, with diesel engine coming up, we will launch LCVs. Some components will be common with our passenger cars, such as seats, electrical systems, etc.

The assembly line has to be different.

We need to do major modifications at Gurgaon or Manesar to produce LCVs.

In Gujarat, an assembly line for LCVs can be built from the beginning itself.

We will also export LCVs from India to Africa, Pakistan and Indonesia, so proximity to a port will have the added advantage in Gujarat.

We will phase out the A-Star and Estilo and replace those with a new small car to be launched in 2014.

article