Photographs: Reuters Nupur Pavan Bang

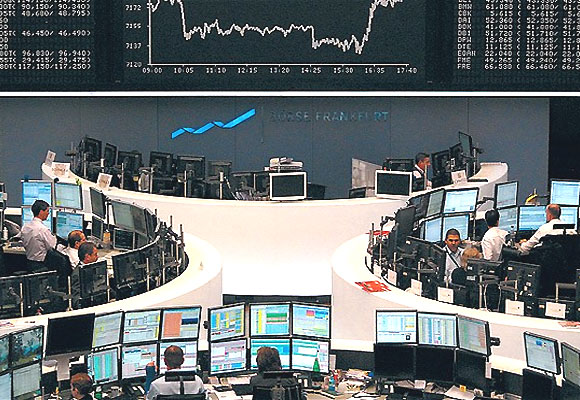

ETFs are like stocks as they trade on the bourses but they are shares of a portfolio, and not of a company.

Exchange Traded Funds (ETFs) have become universally acceptable as an alternative investment instrument. Since ETFs denote a collection of stocks, they can be compared to Mutual Funds (MFs). However, they differ from MFs in that, like closed-end funds (CEFs), ETFs are traded all through the day. They are like stocks as they trade on the stock exchan#8805 but they are shares of a portfolio, not of a company.

ETFs closely monitor various market indexes. There is no limitation on the number of shares that ETFs can have, hence these are not CEFs. ETFs, like MFs and CEFs, are sold by prospectus, can be bought on margin and can be purchased through traditional and online brokers.

The trading value of ETFs is determined by market price of index securities throughout the day. To cite an example, Nifty ETFs will attempt to replicate CNX Nifty returns.

There is significant flexibility in the trading pattern of ETFs, they have lower expense ratio when compared to more actively managed investment tools like MFs and CEFs. There are no backend redemption charges too, hence, cost wise ETFs are highly competitive.

Besides the cost factor, ETFs are diverse, simple, tax efficient and transparent. The quantities of stocks are clearly spelt out, and underlying stocks are known. The mode of investment is simple and can either be made directly through a fund house or the stock exchange.

ETFs and CEFs do not require a minimum investment, while MFs do. ETFs, thus, are an asset to first time investors as investments can be made with a small corpus. The minimum ticket size is 1 unit (in case of IIFL Nifty ETF, 1 unit is approximately 1/10th of the Nifty level, i.e. INR 500, when Nifty is at INR 5000).

Investors who are looking for low-cost diversified portfolios and traders who are unable to invest in index futures due to less capital, welcome ETFs as a suitable investment option. ETFs have also found takers among those institutional investors who may be looking to make temporary investments during a portfolio's transition. Arbitrageurs who carry out operations with low impact cost often use ETFs.

Click on NEXT for more...

All you wanted to know about Exchange Traded Funds

Photographs: Reuters

ETFs have several factors going for them, but they have yet not made inroads into India as they have globally.

Fund managers of ETFs have limited freedom to pick securities from outside the index to which the ETF is pegged. Thus, unlike CEFs, ETFs do not allow fund managers any level of leverage to attempt a style drift.

This feature may sometimes dampen the prospects of ETF as a preferred investment tool, especially among risk-taking investors.

ETF investments do not closely follow the widely accepted indexes. Since these investments are confined to market indexes that have a narrow base, there is the possibility of high costs and higher risks.

As some countries believe in large-cap stocks, profits from investments in mid or small-cap stocks could be denied to such investors. Long-term investors find ETFs unattractive as these are possible only in intra-day trading.

The natural corollary to this is that ETF investments may result in a higher bid-ask spread, as they are made in a low volume index as compared to actual stocks.

Finally, ETFs may be losing out because selling them is difficult if the market is volatile or there is a thinly traded issue.

Click on NEXT for more...

All you wanted to know about Exchange Traded Funds

Photographs: Reuters

How are ETFs used?

Investors and active traders use a plethora of strategies when it comes to investing in ETFs. ETFs allow investors to diversify portfolios across asset classes as well as loosely correlated investments like commodities, real estate, small-cap stocks, etc.

While investors troubled by untimely inflation can hedge it by investing in inflation-protected bond ETFs, those worried about foreign currency exposure can hedge it with currency ETFs. Until long-term investment decisions are taken, ETFs provide investors with the option to put their money in stocks.

This prevents them from missing out on price rises and the resultant income. Another strategy, Tax-loss harvesting, is used for coping with capital losses in a taxable income and then re-applying the sale proceeds among similar investments.

This leaves investor portfolios largely unchanged. When an investor wants to gain exposure to specific sectors, styles or asset classes without obtaining any expertise, completion strategy is often used.

Fund managers also adopt different strategies when it comes to trading on ETFs. In the Large-Cap Value Strategy Fund, managers use a bottom-up approach by concentrating on things like the fundamentals of a particular company rather than an industry.

With Large-Cap Growth Equity Strategy Funds, managers identify investment opportunities and construct the ETF portfolio by combining fundamental and quantitative analysis with risk management. Several macroeconomic factors, market conditions, and a company's financial condition are considered while using this strategy.

Click on NEXT for more...

All you wanted to know about Exchange Traded Funds

Photographs: Ali Jarekji/Reuters

Current scenario and road ahead

Lured by gold as an investment option, Indians are increasingly investing in assets held through gold ETFs. Gold ETFs, compared to physical gold, have additional benefits like security from theft and zero storage cost. While investment in gold in the futures market requires only 4 per cent upfront cash, gold ETF requires 100 per cent.

Launched in February 2007, the value of gold ETFs stood at Rs 10,402.37 crore in India. Compared to the popularity of gold ETFs, equity ETFs have not picked up much in India. In fact ETFs are far more popular in other emerging markets.

In an interview with Mint, Debashish Mallick, MD & CEO, IDBI Asset Management Limited, stated that with increased liquidity, the bid-ask spread would get narrowed, which would result in ETFs picking up in India.

He emphasised that market-makers should ensure that there are buyers for ETFs or they should position themselves to get a huge credit line to overcome the liquidity crunch.

Lack of investor confidence and retail participation in ETFs hinders their growth, as investors prefer to either buy stocks directly or invest in MFs.

The current state is that neither have fund houses launched ETFs regularly, nor do brokers feel too comfortable with them. They still prefer individual stocks and derivative markets.

The writer is senior researcher, Centre for Investment, Indian School of Business, India. She can be reached at: Nupur_bang@isb.edu

article