Photographs: Uttam Ghosh/Rediff.com

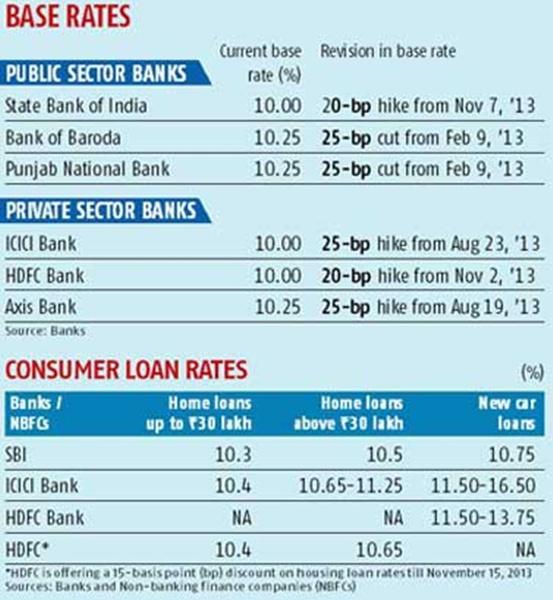

State Bank of India (SBI), the country's largest lender, has decided to increase its base rate or minimum lending rate by 20 basis points (bps) from Thursday, to 10 per cent from the present 9.8 per cent.

HDFC Bank, the second- largest private sector lender, has also increased its base rate by 20 bps, to 10 per cent from last Saturday.

...

Home and auto loans get dearer

These come after the Reserve Bank of India (RBI) decided last week to raise its own key policy rate, the repo rate at which it lends to banks for the short term, by 25 bps. The repo rate is up by 50 bps since September, to 7.75 per cent.

According to R K Saraf, chief financial officer and deputy managing director of SBI, the rise was due to the increase in cost of funds. “With restrictions (by RBI) on borrowing at the Liquidity Adjustment Facility (LAF) in the second quarter and now, banks are tapping the Marginal Standing Facility (MSF), where borrowings are at a higher rate,” he said. “We have done a minimal hike, keeping in mind the millions of retail borrowers.”

...

Home and auto loans get dearer

Image: SBI, MumbaiPhotographs: Manjul Kumar/Wikimedia Commons

SBI's new home loan rate will be 10.30 per cent (up to Rs 30 lakh) which will result in a rise in EMI of Rs 13 per Rs 1 lakh. In case of car loans (seven years), the EMI will rise by 10 per cent a month or Rs 1,699 per lakh.

SBI and HDFC Bank have also increased their benchmark prime lending rate (BPLR), the erstwhile reference interest rate. While HDFC Bank’s revised BPLR is now 18.50 per cent, SBI will increase it to 14.75 per cent with effect from Thursday.

...

Home and auto loans get dearer

Image: Raghuram Rajan.Photographs: IMF/Wikimedia Commons.

The decisions by these leading banks is contrary to what RBI Governor Raghuram Rajan said he expected.

“In May, they (banks) did not pass on the interest rate cuts that had taken place earlier. To that extent, it would not be surprising if...they left rates where they are because they have not passed on the earlier rate cuts,” he’d said in a meeting with journalists after the monetary policy review last week. RBI had cut interest rates by 75 bps between January and May.

...

Home and auto loans get dearer

Image: A woman walks past an ICICI Bank.Photographs: Amit Dave/Reuters

Other top lenders, including ICICI Bank, Axis Bank, Bank of Baroda and Punjab National Bank, are yet to announce any revision in their minimum lending rate.

HDFC Bank, however, has pared interest rates on deposits maturing in 46 days to six months by 25 bps.

The lender now offers 8.25 per cent interest on these deposits compared to 8.50 per cent earlier.

article