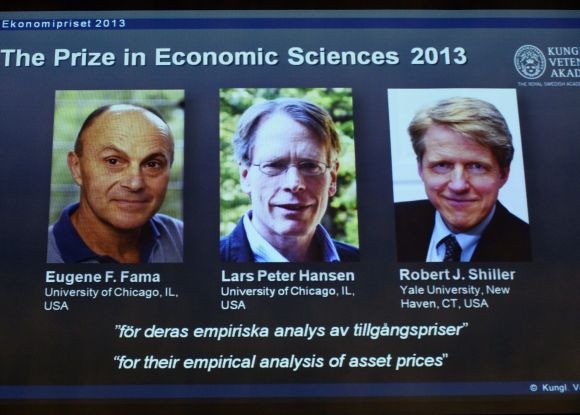

Photographs: Reuters Mukul Pal

The prize highlights that that if researchers from different fields work together, the quality of results is better and more definite.

Somehow my inter-disciplinary mind registered Eugene faster than Fama. After all, Eugene Stanley, the father of econophysics, could also get a Nobel.

If psychologists could get the biggest award for economics, a physicist could have been there, too.

But then the surprise became bigger, not because it was Fama not Stanley, but because Robert Shiller shared the award.

When behavioural finance got the Nobel for economics in 2005, the Economist magazine carried an article pointing out how a new theory had junked 200-year old classical economics.

It was not just media, but even psychologists who were bent on burying classical economics. Efficient market hypothesis was presumed dead. It was considered deficient.

I indulged in it too (early 2007). But over the years, defending the underdog changed to understanding the new theories and then finally even questioning them (Shiller’s exuberance, end of behavioural finance).

It’s a fight between perception and reality at a certain point of time, which of course is dynamic, leading to new perceptions and new realities at new points in time.

…

How research will change after this year's Nobel Prize

Image: Robert Shiller, professor of Economics at Yale University, speaks regarding "Why Did Economists Not Predict the Economic Crisis" as Economic Advisor with the University of Chicago Raghuram G. Rajan (R) listens at the American Economic Association Conference in Atlanta, Georgia.Photographs: Tami Chappell/Reuters

Now that Fama has been acknowledged yet again, his tough stand against behavioural finance as stories of anomalies can be seen in milder light.

After all, standing there with Shiller would definitely make him believe “even together we don’t know all the truth”. The blind men and the elephant metaphor remains a strong theme.

‘My elephant is efficient while yours is inefficient’ has been overruled by the Nobel committee which believes that the elephant is both efficient and inefficient sometimes.

The failure of behavioural finance to take it from the fundamentalists can be viewed as a victory of sorts, but it’s still an illusion. The Nobel Prize bashers like Taleb also won’t enjoy this as their randomness theories get weaker by the day.

The committee needed Lars Peter Hansen to balance. What did Hansen do? Hansen says that both efficient and inefficient schools could be understood better with more testing as the economic system is not static, it’s a dynamic system with multiple moments.

Is this not a step ahead toward assuming markets as natural systems? Are the laureates not struggling to understand divergence: why are markets not predictable in the short term and why are they predictable in the long term?

Where does the predictive element vanish and reappear? Is the question for the Nobel Prize winners not about understanding error in the context of time?

…

How research will change after this year's Nobel Prize

Image: Members of the Royal Swedish Academy of Sciences Torsten Persson (L-R), Per Krusell, Staffan Normark and Per Stromberg announce the winners of the Nobel Prize in Economics, officially called the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, during a news conference at the Royal Swedish Academy of Sciences in Stockholm.Photographs: Reuters

Which is what Hansen is saying; we need to look at the fluctuations, errors and divergences over multiple moments before we start to understand what works and why it works.

We may call it conflict resolution or Hansen’s way to explain why interconnected variables fail and succeed but at the end of the day the objective is to understand complexity and risk.

So, the 2013 Nobel concluded a few things. First, markets are natural, dynamic systems with coexisting efficiency and inefficiency.

And we may use psychology to explain the effects but we are still far away from determining the underlying laws driving risk, growth and decay in all natural systems.

Do the answers still lie in understanding the framework for universal laws, their confluences and interactions and the macrocosm in which they operate and influence the multitude of groups creating the deterministic, disordered chaos?

The 2013 Nobel has forced us further in the interdisciplinary path where fundamentalists, statisticians, psychologists and physicists must work hand in hand to find new universal laws which can select, invest and predict trends.

The author is CMT, and Founder, Orpheus CAPITALS, a global alternative research firm

article