Photographs: Danish Siddiqui/Reuters Siddesh Mayenkar in Mumbai

Faced with high premiums to secure scarce supplies of gold, relatives and guests at Indian weddings are having their old heirlooms melted down to be reused as traditional presents.

Along the narrow lanes of Mumbai's historic Zaveri jewellery bazaar, many shops display placards saying ‘we buy old gold jewellery’, tempting buyers who face a $125 an ounce premium over London prices as the government cracks down on surging imports.

"My brother is getting married next month, and we require jewellery for the bride," said 35-year-old Shazia Iqbal Ahmed, who brought in bulky bangles and a necklace to be recycled.

. . .

Gold scarce, wedding buyers recycle jewellery

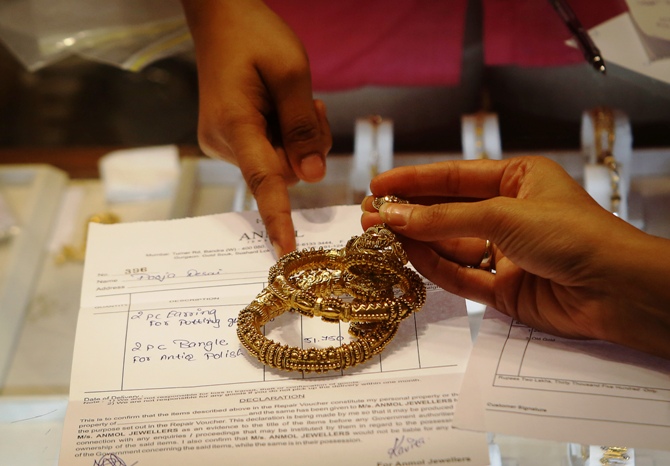

Image: An employee explains the bill to a customer as gold bangles are placed on top of it inside a jewellery showroom in Mumbai.Photographs: Danish Siddiqui/Reuters

"The family thought it was better to make use of our old jewellery sets for the new bride. “We will end up saving 50,000 rupees on just the premium.

“It's profitable for us at the end."

About 1 million couples are expected to marry in the current wedding season which has 71 auspicious wedding days and runs through to May.

About 33,000 weddings took place on November 19 alone, the most of any day this year.

Gold is always in demand, with a typical gift of a pendant, earings or a ring, weighing 5-10 grams depending on financial circumstances.

. . .

Gold scarce, wedding buyers recycle jewellery

Image: A bejewelled bride attends a mass marriage ceremony in Ahmedabad.Photographs: Amit Dave/Reuters

Parents of the bride generally give heavier items like a necklace or bangles weighing 50 grams or more.

But a government clampdown on runaway gold imports that fuelled a blow-out in the current account deficit has led to new rules imposing higher duties, limiting imports and making it hard for jewellers to source supplies.

Jewellers say the move could help mobilise more of an estimated 20,000 tonnes of gold stored in Indian households, some 35 times the Reserve Bank of India's official reserves.

. . .

Gold scarce, wedding buyers recycle jewellery

Image: A shopkeeper waits for customers at his gold and silver jewellery shop in the old quarters of Delhi.Photographs: Mansi Thapliyal/Reuters

"In this wedding season, since there is no gold available in the market, people have started coming with recycled gold.

“They have started exchanging the old gold for new and pay the labour charges," said Kumar Jain, who owns a retail gold shop in the Zaveri Bazaar.

Jain expects about 400 tonnes of recycled gold to enter the market this fiscal year to March 2014, compared with normal rates of about 130 tonnes, according to Thomson Reuters GFMS data.

"Overall sentiment is weak, the import policy is not favourable, which has resulted in high premiums.

. . .

Gold scarce, wedding buyers recycle jewellery

Image: A pawn shop worker sorts through gold jewellery at Easy Money Pawn shop.Photographs: Athit Perawongmetha/Reuters

“Most consumers are looking to exchange old for new," said Haresh Soni, chairman of All India Gems and Jewellery Federation, which groups more than 300,000 jewellers.

The Indian government will welcome the increased recycling of gold as it tries to rein in the current account deficit to an acceptable range of 3.6 per cent to 3.8 per cent of gross domestic product, from 4.9 per cent in the June quarter, and is unlikely reverse its recent measures any time soon.

"I think (gold) strictures will be there for at least the next six to twelve months," said Naina Lal Kidwai, president of the Federation of Indian Chambers of Commerce and Industry.

article