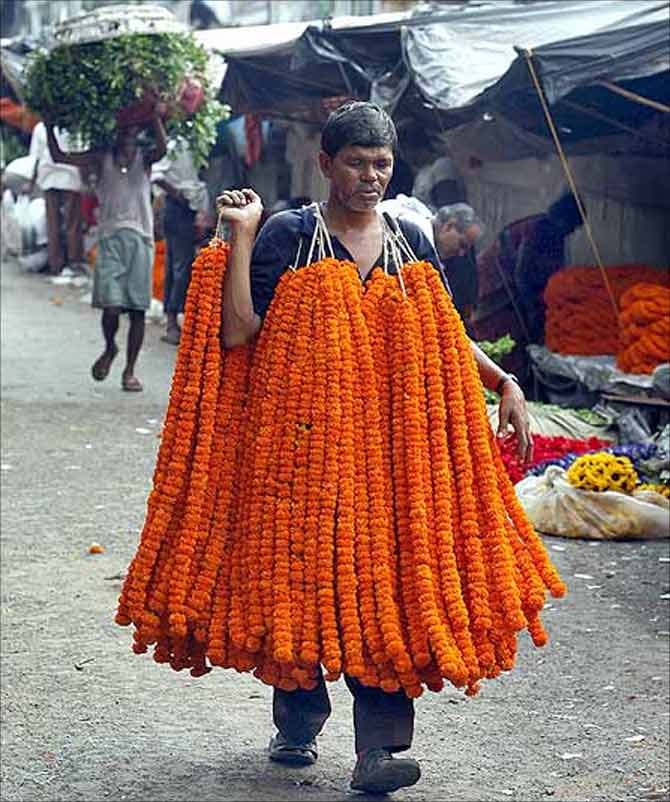

Photographs: Hitesh Harisinghani/Rediff.com

The Reserve Bank must continue its tight monetary policy until stability in the rupee value is achieved, Prime Minister's key economic advisor C Rangarajan said.

"The current stance of monetary policy has to continue until stability in the rupee is achieved.

“Thereafter, if the current trend in the moderation of wholesale price inflation continues, which is in fact expected, the monetary authorities can switch to a policy of easing," Rangarajan said while releasing the Economic Outlook for 2013-14.

. . .

RBI to keep monetary policy tight till rupee stabilises: PMEAC

Image: Raghuram Rajan (L), newly appointed governor of Reserve Bank of India, hugs the outgoing governor Duvvuri Subbarao during the taking over ceremony at the bank's headquarters in Mumbai.Photographs: Danish Siddiqui/Reuters

The time frame for this is difficult to specify and much depends on stability in the foreign exchange markets, he said.

The rupee depreciated to 63.50 against the dollar on Thursday from 54.99 on December 31.

Raghuram Rajan, who took over as RBI Governor on September 4, said that apart from monetary stability, the central bank has the mandate for inclusive growth and development as well as financial stability.

The Chairman of the Prime Minister's Economic Advisory Council said, "There is a big dilemma facing the RBI because controlling inflation, maintaining price stability, is one of the major objectives of the monetary authority."

. . .

RBI to keep monetary policy tight till rupee stabilises: PMEAC

Photographs: Reuters

It has to take into account the impact on growth and what is happening in the real sector, but the primary responsibility of price stability rests with the Reserve Bank of India, he said.

Rangarajan on Friday lowered the growth forecast for the current fiscal to 5.3 per cent from 6.4 per cent projected earlier.

Inflation at the end of March is estimated at 5.5 per cent.

If pressure on the rupee had not mounted, he said, the policy easing would have continued, he said.

"Therefore, the dominant factor influencing the monetary authority will be the stability in the foreign exchange markets and if the stability in the foreign exchange markets continues, it will give greater room for the monetary authorities to act," he added.

. . .

RBI to keep monetary policy tight till rupee stabilises: PMEAC

Photographs: Reuters

The RBI has multiple objectives, Rangarajan said.

Price stability is one objective, while promoting growth and financial stability are the others, he said.

A balancing act is required as the Indian monetary authorities have been caught in a classic dilemma between inflation and growth in the past two years, he said.

Such a predicament arises when inflation remains high and output growth is also significantly below potential, he added.

While WPI inflation is coming down, consumer price inflation, at 9.52 per cent in August, remains high.

In 2012-13, Rangarajan said, the pace of GDP expansion fell to 5 per cent and growth in manufacturing was 1 per cent.

. . .

RBI to keep monetary policy tight till rupee stabilises: PMEAC

Photographs: Reuters

The RBI did not act till January 2013, when it cut the repo rate to 7.75 per cent from 8 per cent as growth concerns became dominant, he said.

The rate was reduced further to 7.5 per cent in March and 7.25 per cent in May.

The easing of inflation as measured by the wholesale price index and more particularly, non-food manufacturing inflation, induced the RBI to lower the repo rate, he said.

Rangarajan said the central bank had to reverse its stance due to capital outflows that followed a statement from the US Federal Reserve that it may taper its stimulus programme as the economy recovers.

Subsequently, he said, the rupee came under pressure, resulting in higher import costs.

article