Photographs: Reuters Puneet Wadhwa in New Delhi

The month is traditionally lean worldwide, so much so that fund managers prefer to go on vacation than trade. But the air of expectancy around the election outcome has kept things heated.

For the past few months, the markets have been riding high on a hope that the outcome of the elections will bring a new, pro-reform government at the Centre.

Benchmark indices -the S&P BSE Sensex and the CNX Nifty - have rallied 6.7 per cent so far this year and 25 per cent since their lows of August 2013.

Stocks of high-beta cyclical sectors such as banking, automobiles, capital goods and infrastructure have seen strong up-moves, primarily driven by flows from foreign institutional investors (FIIs).

Ahead of the announcement of the election results next month, it is being debated whether May will see the markets rise further or it profit-booking is on the cards.

Analysts say traditionally, May isn’t considered the best month for global equity markets such as those in Europe and the US, as fund managers in those countries typically go on long summer vacations.

…

Manic May: Should you sell stocks or wait it out?

Photographs: Reuters

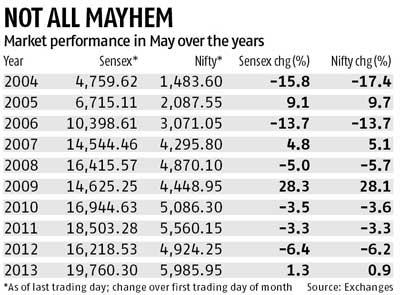

According to data compiled by the BS Research Bureau, since 1993, Indian markets have seen losses in May on 11 occasions.  In 2006 and 2004, the losses stood at 14 per cent and 16 per cent, respectively.

In 2006 and 2004, the losses stood at 14 per cent and 16 per cent, respectively.

In 2009, however, they rallied 28 per cent, following the United Progressive Alliance (UPA) government returning to power in the Lok Sabha elections.

“Through the years, it has been observed a lot of profit-booking by fund managers happens in May. ‘Sell in May and go away’, goes the saying,” said Amisha Vora, joint managing director, Prabhudas Lilladher Group.

Will this May be different? Analysts seem to think so. “We have a big event — the election results. Most opinion polls suggest a change of government. This becomes important in the context that since August–September 2010, the UPA rule was marked by policy paralysis and deceleration in growth,” says Harshad Patwardhan, executive director and head of equities, JPMorgan Asset Management.

…

Manic May: Should you sell stocks or wait it out?

Photographs: Reuters

Runaway rally?

Assuming the outcome of the elections is what opinion polls predict, how high can the markets rise and how will FII flows pan out?

In a recent report, Gautam Chhaochharia, head of research, UBS Securities India, said: “We have been highlighting Nifty at 6,900 would be a possibility if markets start believing in a positive election outcome. Current valuations for the Nifty show a positive election outcome might not be priced in yet.”

...

Manic May: Should you sell stocks or wait it out?

Photographs: Hitesh Harisinghani/Rediff.com

Patwardhan of JPMorgan AMC expects the markets to re-rate significantly if opinion polls prove correct. Manishi Raychaudhuri, Asia-Pacific strategist at BNP Paribas, believes Indian equities will perform in line with earnings growth.

He expects the Sensex to stand at 24,000 by 2014-end and 24,800 by March 2015.

In a recent report, Neelkanth Mishra, India equity strategist for Credit Suisse, said given India’s relative attractiveness and the perceived favourable outlook for the economy after the elections, FII flows were likely to be robust.

…

Manic May: Should you sell stocks or wait it out?

Photographs: Reuters

Worst-case scenario

Analysts suggest one can still invest in equity as an asset class, as the risk-reward ratio remains favourable.

“Even if the election outcome is not exactly in line with opinion polls and there is a weak National Democratic Alliance government at the Centre, with a compromise candidate as the prime minister, there could be a knee-jerk reaction to the overall market sentiment and the market will de-rate. However, a year from now, it will likely return to current levels, given the earnings trajectory of India Inc. Irrespective of the election outcome, equity, as an asset class, looks attractive from a risk–reward perspective,” Patwardhan says.

…

Manic May: Should you sell stocks or wait it out?

Photographs: Reuters

“If the election result is decisive, utilities, state-owned enterprise banks, energy, industrials and materials could gain the most. In contrast, if the elections produce a fragmented coalition government, the equity market could revert to quality stocks, and technology and pharmaceuticals could be the major outperformers. The rupee could lose about 10 per cent,” says Ridham Desai, managing director, strategist and head of India equity research at Morgan Stanley.

Vora of Prabhudas Lilladher, however, says the markets might show over-exuberance and surpass 7,200 (Nifty) in case of positive election results; these will consolidate in a range of 6,500–7,200 by December, before the economy starts showing signs of a revival.

article