Photographs: Reuters Yoshita Singh in New York

Indian-origin hedge fund portfolio manager Mathew Martoma has been found guilty by a jury here for his role in the most lucrative insider trading scheme in the US history totalling $275 million involving secret informations about clinical trials for an Alzheimer's drug.

Martoma, 39, was Thursday convicted of one count of conspiracy to commit securities fraud and two counts of securities fraud by the jury of seven women and five men after two days of deliberations in the trial that lasted four weeks.

The maximum prison sentence on all the three counts is 45 years but Martoma could be given a lesser prison time under federal sentencing guidelines.

…

All you need to know about Mathew Martoma's insider trading case

Image: Mathew Martoma with his wife Rosemary Martoma.Photographs: Reuters

The former portfolio manager of CR Intrinsic Investors, a division of SAC Capital, also faces a fine of over $5 million on the charges.

Martoma, wearing a dark suit and blue tie, sat expressionless next to his lawyer as the verdict was read out.

His wife Rosemary, sitting behind him in the courtroom, cried with her hands clasped together on hearing the verdict.

The Martomas did not speak to reporters as they exited the courthouse, holding each other's hands.

…

All you need to know about Mathew Martoma's insider trading case

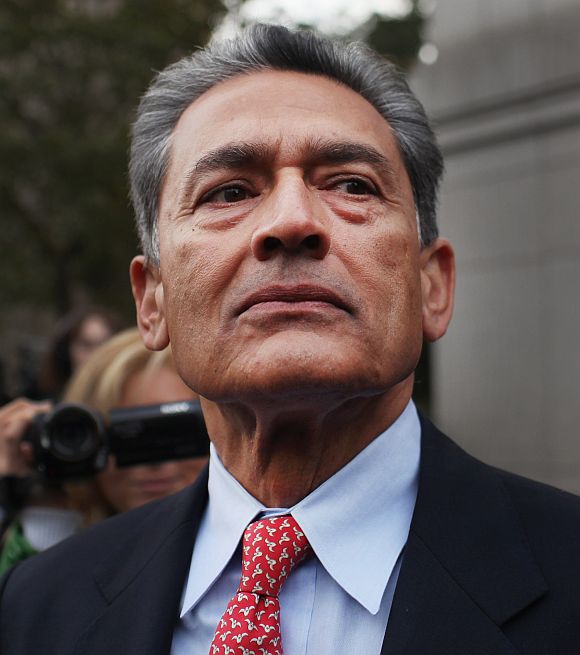

Image: Preet Bharara.Photographs: Reuters

Martoma's lawyer Richard Strassberg said he was "very disappointed" with the verdict and plans to appeal.

US District Judge Paul Gardephe did not immediately set a sentencing date.

The verdict is another victory for India-born prosecutor Preet Bharara who had an unbroken record in insider trading cases having secured 78 convictions since 2009 during his tenure as US attorney for the Southern District of New York.

Martoma is the 79th person convicted of insider trading.

…

All you need to know about Mathew Martoma's insider trading case

Image: Rajat Gupta.Photographs: Getty Images.

Fifty-eight of the 79 individuals have been sentenced, including prominent Wall Street executives like ex-Goldman director Rajat Gupta and billionaire hedge fund founder Raj Rajaratnam. Ten other cases are still pending.

Following the verdict, Bharara said Martoma "cultivated and purchased" the confidence of doctors with secret knowledge of an experimental Alzheimer's drug, and used it to engage in illegal insider trading, helping make profits and avoid losses for SAC in an amount totaling approximately $276 million.

Martoma was arrested in November 2012 from his home in Boca Raton, Florida and was free on a $5 million bail.

…

All you need to know about Mathew Martoma's insider trading case

Image: SAC Capital Advisors hedge fund manager and founder Steven A. Cohen.Photographs: Reuters

"Martoma bought the answer sheet before the exam - more than once - netting a quarter billion dollars in profits and losses avoided for SAC, as well as a $9 million bonus for him. In the short run, cheating may have been profitable for Martoma, but in the end, it made him a convicted felon, and likely will result in the forfeiture of his illegal windfall and the loss of his liberty," Bharara said.

Martoma's verdict was the eighth insider trading conviction of a current or former employee at SAC Capital, the $14 billion hedge fund founded by Steven Cohen.

While Cohen has not been accused of any wrongdoing, SAC Capital had last year pleaded guilty to fraud charges stemming from insider trading by its employees and agreed to pay a $1.8 billion penalty.

…

All you need to know about Mathew Martoma's insider trading case

Photographs: Spencer Platt/Getty Images

Commenting on the verdict, FBI Assistant Director George Venizelos said, "a competitive advantage gained through superior research and analysis is one thing. Cheating is another matter altogether. If material information isn’t public, you can’t trade on it."

According to evidence presented at trial, Martoma was an SAC Capital portfolio manager responsible for investment decisions in public companies in the health care sector, including pharmaceutical companies Elan and Wyeth that were involved in the development of experimental drugs to combat Alzheimer's disease.

…

All you need to know about Mathew Martoma's insider trading case

Image: Dr Sidney Gilman.Photographs: Reuters

At the time, scientists and investors were awaiting the results of a clinical trial being conducted by Elan and Wyeth for a drug called bapineuzumab, which offered a new but untested approach to the treatment of the disease.

In order to obtain inside information about the drug trial, Martoma began harbouring relations with doctors involved in the drug trial and who had access to confidential information.

Through these efforts, Martoma arranged dozens of paid consultations with one of the drug trial's principal investigators, Dr. Joel Ross, and the chairman of the Drug Trial’s Safety Monitoring Committee Sidney Gilman.

…

All you need to know about Mathew Martoma's insider trading case

Photographs: Reuters

At the time, scientists and investors were awaiting the results of a clinical trial being conducted by Elan and Wyeth for a drug called bapineuzumab, which offered a new but untested approach to the treatment of the disease.

In order to obtain inside information about the drug trial, Martoma began harbouring relations with doctors involved in the drug trial and who had access to confidential information.

Through these efforts, Martoma arranged dozens of paid consultations with one of the drug trial's principal investigators, Dr. Joel Ross, and the chairman of the Drug Trial’s Safety Monitoring Committee Sidney Gilman.

…

All you need to know about Mathew Martoma's insider trading case

Photographs: Spencer Platt/Getty Images

Based in part on the positive safety information, Martoma purchased and held shares of Elan and Wyeth, and further recommended to Cohen that he purchase and hold Elan and Wyeth securities.

SAC Capital held approximately $700 million worth of Elan and Wyeth equity securities.

Elan and Wyeth planned to release the full results of the drug trial to the investing public in July 2008.

Gilman was selected to present the results and was "unblinded" to the full safety and efficacy results of the drug trial.

He had only been privy to the safety results of the drug trial.

…

All you need to know about Mathew Martoma's insider trading case

Image: Dr. Sidney Gilman.Photographs: Reuters

Gilman later received a draft presentation marked 'Confidential, Do Not Distribute', which showed that the drug trial results were negative, particularly in comparison with market expectations.

Later Martoma called Gilman from his home and spoke to him in detail about the draft presentation during a phone call that lasted one hour and forty-five minutes.

He then flew to meet Gilman in his University of Michigan office and review the draft presentation further.

…

All you need to know about Mathew Martoma's insider trading case

Image: Hedge fund manager Steven A. Cohen, founder and chairman of SAC Capital Advisors.Photographs: Reuters

Martoma then sent Cohen an email in which he wrote that "It's important [that we speak,]" which they did, for approximately 20 minutes.

Cohen then directed his hedge fund to sell Elan and Wyeth securities and over the next seven days, SAC Capital liquidated its entire equity position in Elan and almost all of its equity position in Wyeth - a total of 17.7 million shares worth approximately $700 million.

…

All you need to know about Mathew Martoma's insider trading case

Image: Mathew Martoma.Photographs: Reuters

Gilman had testified at trial that he gave Martoma an advance look at the final results weeks before they were made public.

Once the trial results were out, Elan stock closed approximately 42 per cent lower, and Wyeth shares fell approximately 11 per cent. Through this trading activity SAC.

Capital earned profits and avoided losses of approximately $275 million.

article