Photographs: Reuters BS Bureau

The bids are particularly high in Delhi, Mumbai and Kolkata, where the licences of the early incumbents will expire later this year.

The auctions for spectrum in the 900 MHz and 1800 MHz bands came to an end on Thursday after 10 days of aggressive bidding by the country’s major telecom operators.

While Finance Minister P Chidambaram has every reason to feel happy with the auctions that earned the government a total revenue of a little over Rs 61,000 crore (the actual benefit for the exchequer this year, however, will only be about 30 per cent of this amount in view of the mandated payment schedule), investors in the telecom companies appear to be a worried lot.

Stock prices of many telecom companies have fallen ever since the auction started on February 3. Investors are worried because the outgo threatens to strangle the telcos’ cash flows.

All of them have just come out of a serious crisis caused by former telecom minister Andimuthu Raja’s decision to hand out telecom licences to a host of newcomers in 2008 and the expensive purchase of third-generation, or 3G, spectrum in 2010.

...

Panicked telcos shell out vast sums for spectrum

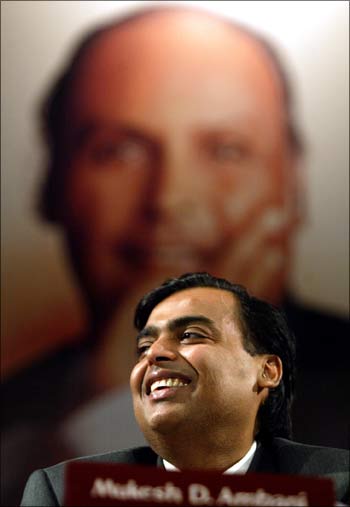

Image: Mukesh AmbaniPhotographs: Reuters

It was only in recent quarters that tariffs had begun to show some corrections, and telcos were able to arrest the fall in profits. The last thing investors want now is a new crisis.

The bids are particularly high in Delhi, Mumbai and Kolkata, where the licences of the early incumbents will expire later this year. Bharti Airtel needs to buy back spectrum in eight circles and Vodafone in 10 circles by March 2016.

Idea Cellular has to renew nine licences in the next two years. It is clear that telcos are bidding aggressively for spectrum because Mukesh Ambani’s Reliance Jio has joined the race.

Mr Ambani had acquired nationwide 4G spectrum in 2010, which is used for data services; he now wants to acquire spectrum in the 900 MHz and 1800 MHz bands in order to offer voice services as well. Telecom is not an unknown field for Mr Ambani.

...

Panicked telcos shell out vast sums for spectrum

Photographs: Reuters

It is feared that his entry will trigger a fresh round of price wars, which are likely to benefit consumers but will also take their toll on the health of the industry.

What has contributed to the scramble is that the telcos do not know when spectrum will come up for auction next. The Department of Telecommunications, or DoT, has not laid out a clear road map for spectrum auction. In its absence, telcos cannot plan properly.

The now-or-never factor has made them submit bids that might prove unsustainable. The suggestion made by Telecom Regulatory Authority of India Chairman Rahul Khullar that DoT should plan to auction 3G spectrum in the 2100 MHz band immediately after the new government takes over is worth looking into.

It would have also helped if DoT had cleared the air on spectrum sharing: telcos would have bid reasonably if they knew they could buy idle spectrum from an incumbent.

...

Panicked telcos shell out vast sums for spectrum

Photographs: Reuters

Trai has already recommended it, though with an important caveat: only spectrum that has been bought in an auction or for which the operator has paid the market price can be traded; spectrum that has been allocated by the government – at a significant discount to the market price – cannot be traded.

The high bids submitted in the ongoing auction also raise questions about the credibility of the industry’s earlier criticism that the base price had been set at an unreasonably high level.

In November last year, when the empowered group of ministers on telecom had slashed the price of spectrum in the 1800s MHz band by almost 26 per cent over that in March 2013 and 37 per cent over November 2012 auctions (these had elicited a very poor response), the industry had said the price was still too high — way beyond their ability to pay.

Now, they have exceeded the base price by a wide margin. For the industry, too, it is time for some introspection.

article