Photographs: Reuters Viveat Susan Pinto and Sayantani Kar in Mumbai

Advertisers are worried about the imminent ratings blackout.

The country’s sole ratings agency, TAM, has expressed its inability to undo its cross-holdings in a month, following a government notification.

The new alternative ratings system from the Broadcasters Audience Research Council is not expected to go live before October, 2014.

While the Indian Broadcasting Federation, the Indian Society of Advertisers comprising most large advertisers and Advertising Agencies Association of India rallied around to form BARC, the over-nine months delay has left many scrambling for other sources of data on media consumption.

At stake is a kitty of around Rs 9,000-10,000 crore (Rs 90-100 billion) that would be spent on news, Hindi general entertainment and sports channels this year.

. . .

Why do brands fret over ratings blackout

Image: Muthar Kent, Chairman and Chief Executive Officer, Coca-Cola visits Agra.Photographs: Courtesy, Coca-Cola

Advertisers say they will turn to their media agencies for support.

“Media agencies do in-house research and have proprietary tools to gauge how a show is doing,” says Suresh Kumar Bandi, deputy divisional managing director, Panasonic India. “We will turn to them and rely on their expertise,” he says.

Anita Sharma, assistant vice-president, marketing communications, Honda Cars India, says, “We will work closely with our agency, Zenith Optimedia. In case there is no TAM data, we will assess what other sources are available.”

Coca-Cola executives also say they would rely on the proprietary research of its media agency Lodestar.

PepsiCo, which is sponsoring the Indian Premier League (IPL), declined to comment, as did a few other ISA members.

. . .

Why do brands fret over ratings blackout

Photographs: Danish Siddiqui/Reuters

Executives at Hindustan Unilever, the country’s largest advertiser, say that it would be difficult without ratings.

“We cannot be in a situation without data. We will have to find a way to extend the current system till the alternative comes into effect,” a top official says.

Internal brand tracks could also come to the rescue.

Devendra Garg, senior executive director, consumer care business, Dabur India, says, “We will have to depend on our own brand track studies and informal research.

“That said, we expect that either TAM will be allowed to function in the interim or BARC will be implemented faster.”

Some like McDonald’s, Karbonn Mobiles and Danone Waters say they will turn to historical data.

. . .

Why do brands fret over ratings blackout

Image: Honda Jazz.Photographs: Courtesy, Honda

“There is no other option. Historical data should give us some direction,” says Tarun Arora, chief executive, India business, Danone Waters.

Shashin Devsare, executive director, Karbonn Mobiles, says, “Brands and media buying organisations will have to rely on past data and their gut instinct.”

The TV rating guidelines, notified by the government on 16 January, prevent any single entity from having paid-up equity in excess of 10 per cent simultaneously in a ratings agency and a broadcaster, advertiser or advertising agency.

TAM’s 50 per cent shareholder, Kantar, which belongs to the WPP Group, has approached the Delhi High Court challenging the guidelines, which it says will render it out of business.

. . .

Why do brands fret over ratings blackout

Photographs: Courtesy, Karbonn Mobiles

But with the Ministry of Information & Broadcasting keen on the deadline and also indicating that it will contest TAM’s claims in court, a ratings blackout seems inevitable in the event the court verdict is not in Kantar’s favour.

In many ways, the blackout that advertisers are staring at is unprecedented since there has never been this long an absence of TV ratings.

In October, 2012, when TAM temporarily stopped providing ratings due to digitisation, it was only for a period of nine weeks.

Sharma of Honda says, “I hope there is some sort of understanding that is struck (with regard to extending the deadline of the TV rating guidelines).

. . .

Why do brands fret over ratings blackout

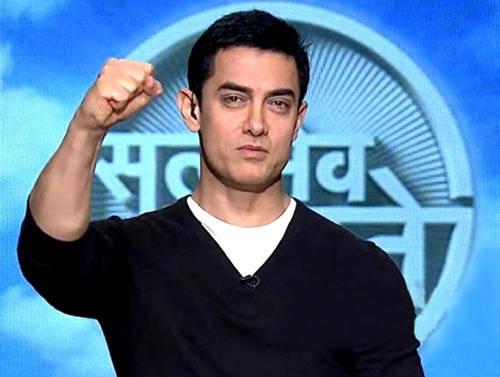

Image: Aamir Khan in Satyamev Jayate.Photographs: Rediff Archives

“Managing media plans based on previous year’s data is not foolproof at all and neither are internal tracks.

“The audience is dynamic.

“Especially with the upcoming Auto Expo 2014, we have a slew of launches to plan for.”

The first half of this year will be crucial for media buying.

Apart from the general elections, the calendar includes the second season of the Aamir-Khan-anchored Satyamev Jayate on Star Plus and the seventh edition of IPL (SET Max). Nearly half of the total advertising pie is expected to be spent in the first half of 2014.

Companies will be in a pickle when deciding on how much money to park in TV spots if there is a gap in ratings.

With inputs from Devina Joshi

article