Photographs: Getty images Ujjval Jauhari

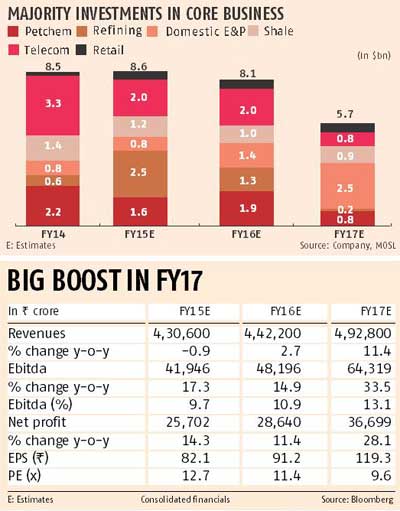

Reliance Industries’ announcement of its largest-ever investment plan of $30 billion or Rs 180,000 crore over the next three years, even as it was largely known by the Street, is being looked at in a positive light.

This is despite the near-term pressure it could put on the return ratios. The company had been under pressure to utilise the cash on its books and these investment plans show how it has charted a way forward.

RIL derives a majority of its revenue and profit from oil refining & marketing (ORM) and petrochemicals.

...

RIL's $30 bln capex plan has cheered the Street

Image: RIL wants to foray into businesses which have high growth potential.Photographs: Reuters

So, it is not surprising that the lion’s share of the investments is going to these. ORM contributed 78 per cent to gross turnover in FY14; petrochemicals was next at 20.6 per cent.

Except for a few occasions, these two verticals have also generated a healthy return on capital employed (RoCE) of 15-25 per cent in the past 10-odd years.

These provided RIL the cash to foray into new high growth areas over the longer term.

Says Ambareesh Baliga, managing partner (global wealth management), Edelweiss Financial Services,

“For a company like Reliance to keep ahead of competition, it is necessary to keep investing and increasing capacities. Additionally, new capacities (in core business) added, with advanced technology, will add to margins.”

...

RIL's $30 bln capex plan has cheered the Street

Image: Investments in the petrochemical segment will further improve overall profitability for RIL.Photographs: Reuters

Investments in the petrochemical segment will further improve overall profitability.

Produce from refineries is utilised for making value-added petrochemical products.

Daljeet S Kohli of India Nivesh Securities says backward integration in this segment will always be positive for RIL’s profitability.

Chirag Dhaisule at LKP Securities adds that utilisation of feedstock can lead to improvement in gross refining margins (GRMs) to the extent of $1.5-2 a barrel.

The GRMs, usually higher than the Singapore-based industry benchmark, could see the gap widen.

The investment of around $11 billion in the refining and petrochemical segment, thus, bodes well.

...

RIL's $30 bln capex plan has cheered the Street

Image: Apart from internal accrual, RIL might also have to raise capital to fund these investments, leading to a drag on profits.Photographs: Reuters

Though the current outlook for petrochemicals remains weak, looking at excess capacities in China, its improved profitability over a period of time should help offset these pressures.

Some analysts believe the global petchem cycle is already at the bottom.

In the interim, though, the investments into these businesses are likely to lead to lower return ratios for the company.

Apart from internal accrual, RIL might also have to raise capital to fund these investments, leading to a drag on profits.

Yet, Baliga says this is an opportune time (with the historically low interest rates, globally) and raising funds will not be difficult for Reliance.

...

RIL's $30 bln capex plan has cheered the Street

Image: Mukesh Ambani along with his wife, mother and daughter at the company's annual general meeting in Mumbai.Photographs: Reuters

Analysts at Motilal Oswal Securities observe that large non-core investments (excluding petchem, refining and exploration & production or E&P) could be accretive over the long term but the gains will be back-ended, diluting overall the return ratio profile in the interim.

Even in the core businesses, many of the projects (especially refinery off-gas cracker and polyester intermediates) are expected to get commissioned only from FY16 onwards.

Nevertheless, the Street might not look at it in a negative light, as these are in the right direction and will yield significant benefits in the long run, feel analysts.

For instance, the investment of around Rs 70,000 crore (Rs 700 billion) in its telecom foray is likely to be a game changer for RIL, feels Baliga.

Currently, RIL’s telecom investments are considered at a discount while valuing the stock.

Reliance plans to launch the services in 2015, covering at least 90 per cent of urban India and a third of rural India.

Once the business starts yielding returns, it will add to the overall numbers. How fast RIL is able to scale up the business will have a bearing on the valuations of the telecom investments.

...

RIL's $30 bln capex plan has cheered the Street

Image: Reliance Industries' KG-D6 facility located in Andhra Pradesh.Photographs: Reuters

The company has also explained that the recent acquisition of the Network18 media group is one aspect of the digital services play.

Notably, its investment (earlier in the form of debt and now converted into equity) in Network18 has started to yield results, with TV18 having become profitable.

The retail segment is now a small contributor for RIL but is growing fast. Reliance expects to double revenues every three to four years, implying a 20-25 per cent compounded annual growth rate, say analysts at Motilal Oswal Securities.

More important are the likely gains on profitability and return ratios from here on. Baliga says the company has completed its initial learning lessons in retail and will now grow faster.

The business has already turned profitable at the pre-tax and interest level.

...

RIL's $30 bln capex plan has cheered the Street

Image: Reliance Retail has registered good numbers in FY14.Photographs: Reuters

More important are the likely gains on profitability and return ratios from here on. Baliga says the company has completed its initial learning lessons in retail and will now grow faster.

The business has already turned profitable at the pre-tax and interest level.

...

RIL's $30 bln capex plan has cheered the Street

Image: Mukesh Ambani with crude from KG Basin.Photographs: Reuters

While these announcements sound positive, analysts are still watching developments on the gas price rise issue and E&P approvals by the hydrocarbons sector regulator.

These can have a significant impact on prospects.

On earnings, though, analysts are still to work out the FY17 numbers, the year when significant benefits of the capex should start flowing.

article