Photographs: Parivartan Sharma/Reuters Neha Pandey Deoras

The demand for a higher health insurance cover is increasing.

Renuka Kanvinde, assistant vice-president, health insurance, Bajaj Allianz General Insurance, says the company has seen a 35-40 per cent increase in demand for their Extra Care, a top-up plan, in the past two years.

They also saw buyers shift from a Rs 3,00,000-Rs 5,00,000 policy to Rs 7,50,000-10,00,000 in the period.

This led the private insurer to believe health insurance policy buyers want a bigger cover.

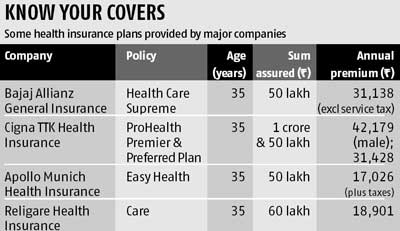

Hence, a fortnight earlier, it launched a Health Care Supreme product, offering a cover between Rs 5,00,000 and Rs 50,00,000.

...

Should you opt for a high-value health cover?

Image: Few high-value plans revise premiums every year unlike others where premiums are revised every few yearsPhotographs: Uttam Ghosh/Rediff

Typically, an individual buys a health cover between Rs 3,00,000 and Rs 5,00,000.

However, there has been a shift in consumer behaviour in recent years and more insurance companies have been launching high-value health insurance covers.

The latest entrant in the segment, Cigna TTK Health Insurance, offers customers a sum assured ranging from Rs 25,00,000 to Rs 1 crore across four variants - ProHealth Protect, ProHealth Plus,

ProHealth Preferred and ProHealth Premier. The highest sum assured, of Rs 1 crore, is offered under ProHealth Premier and Rs 50,00,000 under ProHealth Preferred Plan.

...

Should you opt for a high-value health cover?

Image: A large cover doesn't mean it will reimburse every expense.Photographs: Uttam Ghosh/Rediff

Pitfalls of high-value cover

The entire sum assured does not get utilised even in high-end hospitals in metros.

There's no room rent cap but there are room categorisations which mostly allows lowest category in 5-star hospitals.

HNIs may want suites in hospitals, which is not covered by most of these plans.

These policies also have a co-pay clause at 20 per cent for senior citizens.

A large cover doesn't mean it will reimburse every expense.

These may promise of dedicated relationship managers, but you may not find one in an emergency.

Global treatment mostly is allowed if only similar treatment does not exist in India.

Few high-value plans revise premiums every year unlike others where premiums are revised every few years.

Should you opt for a high-value health cover?

Image: The entire sum assured does not get utilised even in high-end hospitals in metros in a high-value cover.Photographs: Uttam Ghosh/Rediff

Two years earlier, Religare Health Insurance launched Care; it offered up to Rs 60,00,000 cover.

Max Bupa Health Insurance and Apollo Munich Health Insurance offer Rs 50,00,000 as the highest sum assured.

Bajaj Allianz, Apollo Munich, Religare Health Insurance and Cigna TTK's high-value products are available both on the individual and family floater platform.

Max Bupa offers it only as family floater. SBI General Insurance is also likely to launch a Rs 30,00,000 cover.

...

Should you opt for a high-value health cover?

Image: One should be cautious while buying a high-risk insurance cover.Photographs: Reuters

Extra benefits

Most of these policies cover treatment in India; Cigna TTK Health Insurance and Religare Health Insurance's policies also cover international treatment.

Religare's covers treatment anywhere in the world for the entire sum assured of Rs 60,00,000.

This can be availed for treatment of cancer, benign brain tumour, major organ/bone marrow transplant, heart valve replacement and heart bypass surgery.

Cigna TTK's ProHealth Premier and Preferred Plan offer world-wide emergency cover of up to Rs 10,00,000.

Says Antony Jacob, chief executive officer (CEO) of Apollo Munich Health Insurance,

"The quality of health care facilities available in India is comparable to other developed nations and demands for insurance plans covering planned international treatment is yet to see a significant upward trend in India.

All our health plans are developed primarily for treatments in India.

However, we offer an Easy Travel insurance plan that takes care of the emergency medical needs of people travelling abroad, besides the travel inconveniences."

...

Should you opt for a high-value health cover?

Image: Hig-risk cover may not cover all risks as perceived by you while buying it.Photographs: Reuters

Bajaj Allianz provides the option for 100 per cent reinstatement of the sum insured, if hospitalisation expenses exhaust this and the insured faces a new accident or is hospitalised for a new illness.

Additionally, it offers 100 per cent cover for ayurvedic and homoeopathic treatment, with no sub-limits. Apollo Munich also covers Ayush (ayurvedic, unani, sidha and homoeopathy) treatment up to Rs 50,000.

Says Manasije Mishra, CEO of Max Bupa Health Insurance, "We introduced a Rs 50,00,000 cover under Heartbeat for HNI (wealthy) customers in 2010. We also provide specialised services to our HNI customers like personalised consultation through relationship doctors, OPD benefit and maternity benefit up to Rs 1,00,000.

Also, we have no sub-limits built in our products under any of the variants." An estimated 25 per cent of Max Bupa's total customers in the last financial year have opted for sum insured of Rs 10,00,000 and above.

...

Should you opt for a high-value health cover?

Image: Consult an expert before buying an insurance cover.Photographs: Reuters

Cost

Given the high sum assured, these products are expensive. The premium for Apollo Munich's Easy Health policy for an individual aged 35 years for a Rs 50 lakh policy is Rs 17,026 plus taxes.

In the case of an Easy Health family floater policy for a Rs 50,00,000 sum insured, the premium is Rs 24,125 plus taxes (eldest member's age 35 years).

Religare Health Insurance's Care would cost Rs 18,901 annually for a 35-year-old, for a Rs 60,00,000 cover.

As a Rs 60 lakh family floater for a couple with the oldest member aged 40 years, it would cost Rs 43,321 a year and for a family of four (oldest member aged 40 years), Rs 56,127.

Cigna TTK's product would cost Rs 37,970 a year for an individual of 30 years (male) from Zone 1 (Mumbai, Thane, New Mumbai and Delhi/National Capital Region).

For females of the same age and zone, it will be Rs 38,250 (see table).

...

Should you opt for a high-value health cover?

Image: Consider your priorities while buying an insurance policy.Photographs: Reuters

Meant for whom?

While anyone can buy these high-value products, they are targeted at high net worth individuals (HNIs).

"There exists a specific customer segment that would prefer to avail health care treatment overseas; since cost for this would obviously be higher than in India, it is evident that they would need a higher sum insured to adequately finance their requirements," says Anuj Gulati, managing director and CEO, Religare Health Insurance.

Insurers say, historically, HNIs relied on their savings to pay for health care expenses. Now they are beginning to realise the risk that rising health care inflation poses.

This is a segment that seeks high-end medical services and treatment; hence, the level of insurance they require is high.

Medical inflation is 16-18 per cent annually, say experts.

A serious health problem like an organ transplant would cost Rs 20,00,000-Rs 25,00,000 for a person as opposed to Rs 8,00,000-10,00,000 a few years earlier.

Similarly, a serious heart problem or advance stage cancer treatment will easily cost you up to Rs 30,00,000 in a good hospital.

....

Should you opt for a high-value health cover?

Image: You can enhance the coverage by way of top-up covers or benefits plans going forward, as per your needs/ responsibilities.Photographs: Danish Siddiqui/Reuters

High-value covers required?

Divya Gandhi, principal officer and head of general insurance at Emkay Insurance Brokers feels a policy of Rs 25,00,000-Rs 30,00,000 should be sufficient even if you are planning to get treated in the best of hospitals (in metros).

Even renowned hospitals offer a package of Rs 20,00,000-Rs 25,00,000 for health problems like serious heart issues or advance stage cancer treatment.

You should not compromise on your health coverage and a cover of Rs 10,00,000 might not suffice for treatment of any critical illness, especially in the metros. Y

et, you need not buy a huge sum assured right from the start. To begin with, buy a Rs 3,00,000-Rs 5,00,000 indemnity or hospitalisation cover as soon as you start earning, as covers get expensive as you age.

You can enhance the coverage by way of top-up covers or benefits plans going forward, as per your needs/ responsibilities.

For instance, Apollo Munich's Easy Health Individual would cost Rs 6,137 a year for a Rs 5,00,000 cover (age 18-34 years).

Even if you add a top-up of Rs 5,00,000 (Apollo Munich Optima Plus), your premium cost would go up by another Rs 2,246. A Rs 25,00,000 individual plan with Religare (age 25-35 years) would cost Rs 9,682 a year.

...

Should you opt for a high-value health cover?

Image: The high-value covers are more beneficial if you may opt for international treatment.Photographs: Reuters

If you still feel the need for a Rs 50,00,000 cover and affordability is an issue, then, one could look at buying a lower sum assured, say Rs 25,00,000, and making up for the rest of the money by investing.

After a Rs 25,00,000 individual health cover, if you invest another Rs 7,000-8,000 a month for 10 years, you will accumulate Rs 20,00,000.

Total investment = Rs 17,000-18,000; total healthcare corpus = Rs 45,00,000 (Rs 25,00,000 cover + Rs 20,00,000 cash).

For a family of four members, a cover of Rs 25,00,000 would cost Rs 26,162 (age 36-40 years) annually with Religare Health Insurance's Care.

The high-value covers are more beneficial if you may opt for international treatment.

"Otherwise, even if you can afford the high premiums, you might not be able to utilise the entire sum assured. Then, what's the point of paying such high premiums?" asks Gandhi. There are also other pitfalls of high-value health plans.

...

Should you opt for a high-value health cover?

Image: Before buying an insurance cover, take into account primary factors.Photographs: Reuters

Pay attention to factors such as the network of hospitals, sub-limits in the policy, exclusions, waiting period for pre-existing disease, additional benefits such as maternity cover, neonatal cover, dental treatment and so on. In case of high-value policies, there may not be any caps or sub-limits on the room rent.

However, there may be a definition of the category of the room covered by the policy.

For instance, in case of Religare for sum insured of Rs 5,00,000 and above there is a room category cap.

Such a cap allows only the lowest category private room in the hospital.

So even if you opt for a 5-star hospital, you have to opt for the lowest category of the private room.

article