Photographs: Reuters Arvind Panagariya

The new finance minister has more flexibility in reframing the Budget than his predecessor but only if the marginally higher deficit is devoted to boosting capital expenditure and comes with a credible road map of reforms, says Arvind Panagariya.

A controversy was recently triggered when I told an interviewer that the fiscal deficit at 4.5 per cent of gross domestic product (GDP) in the fiscal year 2014-15 was within tolerance limits if accompanied by an increase in capital expenditure from 1.76 per cent of GDP in the interim Budget to two per cent.

Former finance minister P Chidambaram reacted sharply to the suggestion, asking rhetorically, "Will the government follow the Kelkar-recommended path and affirm the Budget estimate fiscal deficit of 4.1 per cent for 2014-15 (as provided in his interim Budget)? Or will the government take the advice of Arvind Panagariya (wrong advice in my view) and allow the fiscal deficit to rise?"

There are both political and economic responses to the objections aided by Mr Chidambaram. The political response is twofold.

First, as R Jagannathan has already noted in a brilliant column, Mr Chidambaram himself is responsible for the original sin of deviating from the Kelkar-recommended path.

…

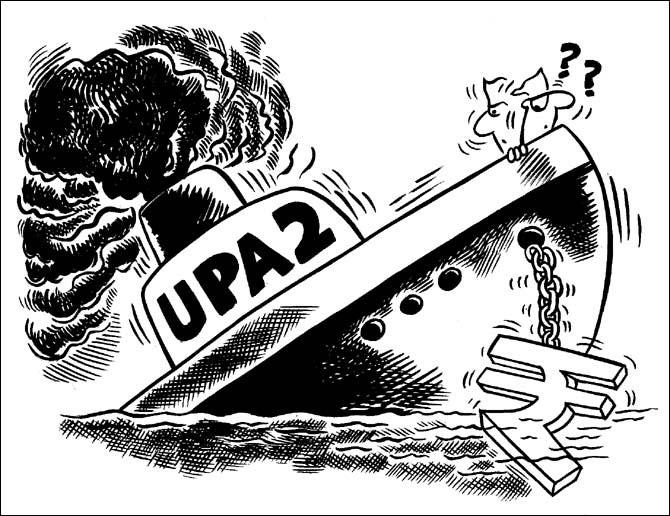

The controversy over India's fiscal deficit

Image: Former Finance Minister P ChidambaramPhotographs: Reuters

Indeed, he did much worse, straying from it year after year, never reaching the goal.

When the United Progressive Alliance (UPA) unexpectedly won the 2004 election, Mr Chidambaram returned as finance minister. His first act in the Budget that replaced the interim Budget of the previous National Democratic Alliance government was to postpone the deadline for eliminating the revenue deficit stipulated in the Kelkar-inspired Fiscal Responsibility and Budget Management (FRBM) Act.

The FRBM Act had set the target of eliminating the revenue deficit in the fiscal year 2007-08. Mr Chidambaram shifted this deadline to 2008-09 on the pretext that it coincided with the last year of the UPA term.

The following year, when presenting the Budget for 2005-06, he went on to deviate from his own revised path, stating that he was pressing the "pause" button on the FRBM Act obligations. Indeed the failure to stay on the FRBM path continued during the subsequent years.

…

The controversy over India's fiscal deficit

Photographs: Reuters

The result is that the revenue deficit remained a gigantic 3.2 per cent even till as late as the year just ended, 2013-14. In a similar vein, in contrast to the original fiscal deficit target of three per cent of GDP in 2007-08, the actual deficit in 2013-14 remained 4.5 per cent of GDP.

The second political answer to Mr Chidambaram is that soon after he presented the interim Budget, commentators overwhelmingly questioned his 4.1 per cent fiscal deficit figure, characterising it as unrealistic. Among other agencies, these commentators came from Citibank, Kotak Mahindra Bank and ratings agency ICRA.

A note issued by ICRA stated, "Curtailing the fiscal deficit to 4.1 per cent of GDP in 2014-15, as indicated by the interim Budget estimates, seems challenging, given the optimistic assumptions for nominal GDP growth (13.4 per cent), net tax revenue growth (18 per cent) and disinvestment receipts from sale of stake in government companies (Rs 37,000 crore)."

The Budget also held the subsidy bill virtually unchanged in nominal terms from the fiscal year 2013-14. Indranil Pan of Kotak Mahindra Bank took this view: "According to our current estimates, we think that a more realistic GFD [gross fiscal deficit]/GDP for FY2015E [estimate] could be at 4.5 per cent, leading to a gross borrowing number of Rs 6.3 lakh crore." Mr Pan went on to characterise the fiscal consolidation by Mr Chidambaram as "optical".

…

The controversy over India's fiscal deficit

Photographs: Uttam Ghosh/Rediff.com

But, for the sake of argument, let us take the Chidambaram figure of 4.1 per cent at face value and assume that the alternative estimate of 4.5 per cent, which I suggested, represents an increase.

Is such an increase defensible? Here we come to the economic part of the response to Mr Chidambaram and must address two key concerns: (a) could the higher fiscal deficit lead to increased inflation and debt-to-GDP ratio, with the latter signifying increased risk of a macroeconomic crisis; and (b) could the deficit lead the ratings agencies to downgrade the sovereign rating of India?

Taking the former concern first, if the extra 0.4 per cent of GDP is spent prudently, it could help mitigate the risks of inflation and increased debt-to-GDP ratio.

For example, if we devote this expenditure to boosting capital expenditure rather than handing out doles, we would be relaxing some of the severe infrastructure bottlenecks facing the economy.

…

The controversy over India's fiscal deficit

Image: Narendra Modi (L) and Mukesh Ambani, attend a convocation ceremony at Pandit Deendayal Petroleum University in Gujarat.Photographs: Amit Dave/Reuters

In turn, this would help boost growth directly, as well as through increased productivity of private investments. If this growth effect is sufficiently large, we might actually see the risk of inflation as well as the debt-to-GDP ratio decline.

In the present context, this argument is reinforced by the fact that the Narendra Modi government fought the recent election on a reformist platform, including the promise to relieve infrastructure bottlenecks.

If the forthcoming Budget speech were to reiterate this commitment to reforms, outline the reform agenda to be implemented in the first year and include the road map of substantial reforms the government contemplates in the following two years, the growth effect would be greatly enhanced.

Such enhanced growth would make credible the ability of the government to achieve fiscal consolidation faster in the future.

…

The controversy over India's fiscal deficit

Image: Finance Minister Arun Jaitley.Photographs: World Economic Forum/Wikimedia Commons

Could the higher deficit lead the ratings agencies to downgrade sovereign rating of India? Once again, contrary to the popular belief that ratings agencies base their decisions solely or even overwhelmingly on the aggregate fiscal deficit figure, they actually look at the quality of expenditures, overall policy framework and all other factors bearing on the risk of default by a country.

Indeed, even if we were to leave fiscal deficit at 4.1 per cent but converted all capital expenditures to doles, you can be sure that the risk of a downgrade would significantly rise.

On the other hand, if we raised capital expenditure, credibly committed to growth-friendly reforms and presented a credible medium-term plan for fiscal consolidation hereon, ratings agencies would accept the 0.4 per cent increase in the fiscal deficit without hiccups.

The bottom line is that the new finance minister has more flexibility in reframing the Budget than his predecessor would have us believe - but only if the marginally higher deficit is devoted to boosting capital expenditure and comes with a clear and credible road map of reforms to rejuvenate growth.

The writer is a professor at Columbia University.

article