Photographs: Vivek Prakash/Reuters

The natural gas pricing problem seems to be far from getting over for Reliance Industries. Despite having a Cabinet nod to increase price for gas produced from its KG-D6 fields, RIL and its partners Niko Resources and BP may no be able to do so due to technical issues. And this in turn can lead impact gas buyers. However, the government can devise forumale that can help RIL get good price for gas it produces.

The government’s mismanagement of India’s natural gas resources has clearly not run its course. The Union Cabinet had recently agreed to allow Reliance Industries Ltd (RIL) to increase the price of gas from its fields in the Krishna-Godavari (KG) basin, provided it executed a bank guarantee that would cover its liability if charges of hoarding gas proved to be true.

....

Here's a quick fix to resolve RIL's natural gas pricing issue

Image: RIL's KG-D6's control and raiser platform is seen off the Bay of Bengal in this undated handout photoPhotographs: Reuters

However, these terms do not seem to be applying to Reliance’s partners in the field -- Niko Resources and the international petrochemicals giant BP.

Only RIL is part of the arbitration process for the dispute; Niko and BP aren’t.

Thus, according to recent reports, they may be excluded from the deal -- and so the whole purpose of the Cabinet decision, which was to restore certainty to gas supply, has been thrown into jeopardy.

RIL has a 60 per cent stake in the KG-D6 block production; BP has 30 per cent; and Niko has 10 per cent.

....

Here's a quick fix to resolve RIL's natural gas pricing issue

Image: RIL complex petrochemical refinery in Jamnagar,GujratPhotographs: Reuters

For the already-explored and controversial D1 and D3 gas discoveries, the question is whether the agreement that RIL would, subject to an investigation of the accusations of hoarding, be allowed to sell gas at a higher price from D1 and D3 also applies to BP and Niko.

That the petroleum ministry failed to foresee this situation is quite in keeping with its completely haphazard and problematic approach to pricing KG gas.

Various aspects have been the source of problems: the original production-sharing contract itself, which was open to exploitation by the producer; the inability of the government to independently determine the exact quantity of gas in the fields; and the questionable gas pricing formula suggested by the Rangarajan committee on pricing, which links the well-head price of domestically produced gas to the spot price of gas in some of the world’s most expensive markets.

.....

Here's a quick fix to resolve RIL's natural gas pricing issue

Image: RIL's KG-D6 facility located in Andhra PradeshPhotographs: Reuters

It is this price that RIL hopes to receive now after the Cabinet has agreed to accept a bank guarantee to cover its liability; whether the bank guarantee is large enough is open to question, too.

Given the problems that the hasty acceptance of a flawed formula has caused, the government must reconsider its approach. Instead of working to determine whether Reliance is accurate in its claims that there is considerably less gas in the D1 and D3 fields of its blocks than it earlier estimated -- an effort that is, clearly, beyond the government’s capabilities or its willingness -- it should use basic economic incentives. Here’s what it should do: it should ensure that all gas that’s produced from D1 and D3 is sold at the old price, of USD 4.2 per million metric British thermal units, instead of the higher price of around USD 8.4 per mmBtu.

.....

Here's a quick fix to resolve RIL's natural gas pricing issue

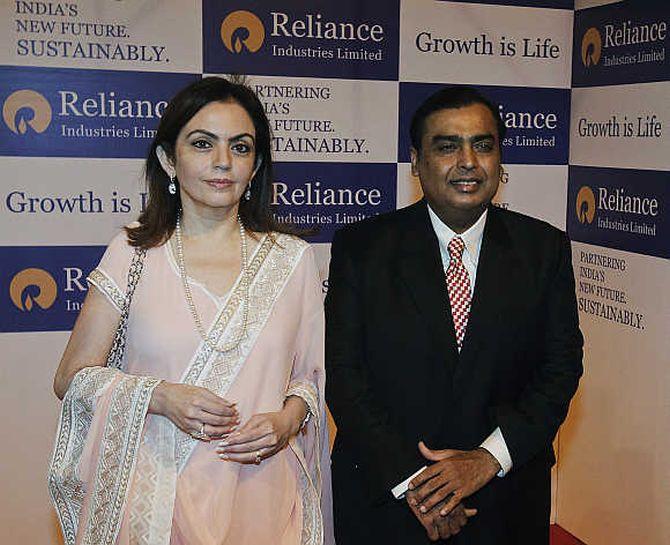

Image: Mukesh Ambani after signing an agreement to sell stake in 21 oil blocks to BP in August 2011.Photographs: Reuters

If it is indeed the case that there is not much gas in the D1 and D3 fields, RIL can benefit from the higher price as a result of new discoveries elsewhere in the block.

If it is the case, however, that the government is right and there is more gas than RIL claims, then Reliance-- and BP and Niko-- will not benefit from any hoarding. This is one way to recover the situation, to correct past mismanagement, and answer political accusations of cronyism and corruption.

article