Photographs: Reuters Clifford Alvares in Mumbai

The six-week-long elections in the world’s largest democracy are finally drawing to a close and the Indian stock market is bracing for what could be the most volatile period in a long time.

Past election-verdict days have seen the sentiment vary from extreme euphoria to downright pessimism.

If the latest NSE Volatility Index reading of 37.71 is any indication, major volatility is on the cards on May 16, the day the results of the Lok Sabha elections are set to be announced.

Since the ongoing elections began, the VIX has risen 37.8 per cent, showing investors are paying a huge risk premium to hedge positions.

. . .

What should you do with your investments on May 16?

Image: RBI Governor Raghuram Rajan.Photographs: Reuters

Premia on call and put options have been steadily rising, and this is reflected in the rising prices of the VIX, as last-minute buyers aren’t shying away from paying a hefty price to hedge positions.

Alex Mathews, head of research, Geojit BNP Paribas, says, “It’s a mega-event and the VIX is more likely to rise higher and peak on May 16.

“But even then, no one can say with certainty it won’t rise even after that day.”

He adds mega events such as elections draw investors to hedge, even at the last minute.

In the past, important events across the globe have led to such indices surging 50-60 points.

During the financial crisis of 2008, the VIX was regularly at more than 35. In the previous election in 2009, the VIX surged to 83.71

. . .

What should you do with your investments on May 16?

Image: Stock brokers at work.Photographs: Reuters

The stage is set

Significant movements in the VIX could start on Tuesday, a day after the exit polls are announced.

Market watchers reckon there could be some churn between sectors from Tuesday; if exit polls show a surprise outcome, a lot could happen next week.

Dilip Bhat, joint managing director, Prabhudas Lilladher, says: “In the previous two elections, we saw markets hitting the circuits. Investors are hoping there is a decisive mandate.

“The margin of safety is slimming down and it’s getting difficult to avoid volatility.” Markets could also record significant churn the week after the election results are announced.

In May 2009, the Nifty had gained 15 per cent through the five days after the results were announced.

. . .

What should you do with your investments on May 16?

Image: Bharatiya Janata Party's prime ministerial candidate and Gujarat Chief Minister Narendra Modi.Photographs: Reuters

The final countdown

Analysts say if the verdict isn’t as expected and if the Bharatiya Janata Party doesn’t manage to secure at least 200 seats, there could be a major sell-off in the market and that could push the VIX higher.

If the BJP’s seat tally is 200-220 seats, the markets could hold on to their range.

But investors would be jittery because of coalition politics coming into the picture. However, if the BJP secures more than 220 seats, there will be expectations of a revival in the investment cycle.

Experts reckon if the mandate shows a decisive number for the leading party, markets could even hit the upper circuit.

. . .

What should you do with your investments on May 16?

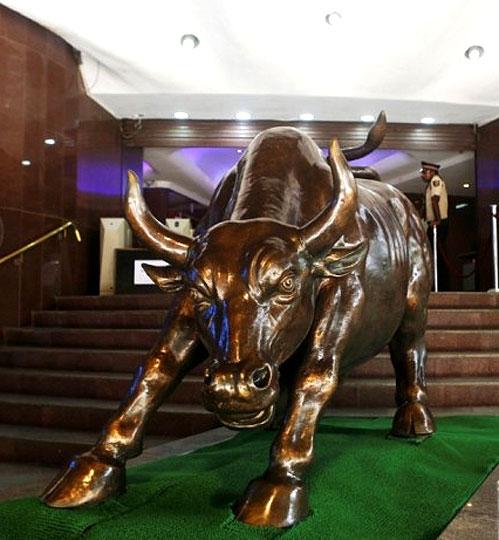

Image: The BSE.Photographs: Reuters

How to brace for volatility?

Experts say if one is planning to buy put options to hedge the downside, it could prove costly, as premium rates are very expensive.

Instead, if one has a large portfolio invested in stocks worth at least about Rs 30 lakh (Rs 3 million), he/she should buy a VIX futures, says Mathews, to cover the volatility.

If one wants to speculate on the market direction on that day, one can buy call and put options of the same strike price and expiry.

For retail investors with portfolios of less than Rs 500,000, pulling out some funds from the already high market might be a good idea.

Mathews says one can sell 15-20 per cent of one’s portfolio and stay in cash to scout for buying opportunities after the election results are announced.

. . .

What should you do with your investments on May 16?

Image: A stock trader talks on his mobile phone.Photographs: Reuters

Agrees Bhat: “One can stay in cash for at least 30 per cent of one’s portfolio and look for opportunities post elections and during the budget time.”

On the other hand, if there’s huge sell-off the in the market, investors who have booked some profits could switch to dollar-earners and export-oriented sectors such as information technology and pharmaceuticals.

Most of the stocks in these sectors are available at cheap valuations, with good cash flows; these should hold up in case the market falls.

If there’s a favourable verdict, shift to cyclicals, financial sectors and beaten-down stocks.

Some of these are in the infrastructure, capital goods, power, power equipment and roads & construction spaces, which could witness a surge in orders.

Also, these are high-beta segments and here, gains could be significantly higher than in other spaces.

Book profits in low-quality, heavily indebted companies that gain due to market euphoria.

. . .

What should you do with your investments on May 16?

Image: The Bombay Stock Exchange.Photographs: Reuters

This will provide an exit opportunity in highly overvalued sectors. If the election results are favourable, the big movers are likely to be in the small- and mid-cap spaces.

Experts say there are compelling valuations in this sector, especially for some fast-growing companies, with good earnings potential.

These firms could even see rating upgrades.

Therefore, put about 20 per cent of your portfolio into these stocks.

In case the verdict goes haywire, it could lead to a sharp reaction and markets could tumble for a few weeks.

If that happens, ensure you stay in defensives and, subsequently, build a portfolio of stocks that are undervalued and have good cash flows.

If the economy recovers, you should be able to recover your portfolio within two years.

article