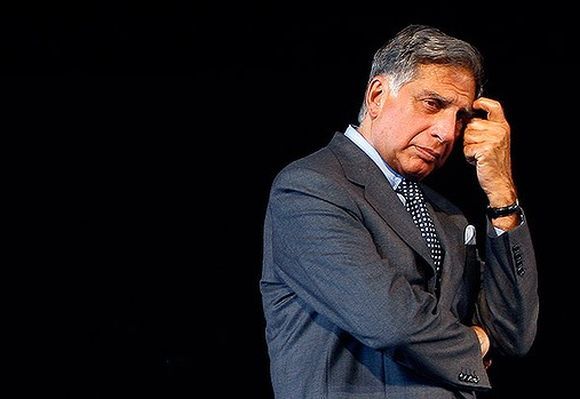

What would happen to the ownership after Ratan Tata?

The succession plan for the 263,862 Tata Sons promoter shares owned by seven Tata Trusts and other holdings of Tata brothers?

Would a younger family member inherit?

N Sundaresha Subramanian reports.

A lot has been said about the Tata group in seven days, more than probably in the past seven years.

The reasons for the sudden replacement of Tata Sons Chairman Cyrus Mistry, possible pain points, financials, potential successors, past follies, future strategy, and corporate governance issues -- all have found their way to the press.

The manner and speed at which Ratan Tata could execute his decision on Monday, October 24, showed who was always in control.

Mistry's leaked letter confirmed it.

Tata Sons has said Mistry was empowered adequately. Evidently, such empowerment was just short of what was required to protect his job.

The structure of the shareholding of Tata Sons is fascinating. I believe it is by no means a coincidence.

The Sir Dorabji Tata Trust owns 113,067 shares or 27.98 per cent. From a company law perspective and voting rights, this is special.

The Sir Dorabji Tata Trust remains the only Tata Sons shareholder with an individual veto to block special resolutions (which require 26 per cent).

Anyone who controls the Sir Dorabji Tata Trust controls this veto.

The second largest shareholder is the Sir Ratan Tata Trust with 95,211 or 23.56 per cent. The combined holding of these two trusts is 51.54 per cent.

In case you need a two-thirds majority, the smaller trusts come into play.

The JRD Tata Trust had 16,200 shares (4.01 per cent); the Tata Education Trust and Tata Social Welfare Trust had identical holdings of 15,075 shares (3.73 per cent each).

The R D Tata Trust owned 8,838 shares (2.19 per cent), followed by the Sarvajanik Seva Trust with 396 shares (0.1 per cent).

Thus, the seven sisters held 65.29 per cent.

Add to this Ratan Tata's holding of 3,368 shares (0.83 per cent) and the voting power crosses two-thirds.

Younger brother Jimmy Naval holds 3,262 shares (0.81 per cent) and the M K Tata Trust owned 2,421 shares (0.60 per cent).

These three holdings are not part of the promoter group.

Then come the holdings of five operating companies.

Tata Steel and Tata Motors own 12,375 shares each (3.06 per cent each).

Tata Chemicals, Tata Power, and Indian Hotels hold 10,237 (2.53 per cent), 6,673 (1.65 per cent) and 4,500 shares (1.11 per cent), respectively.

Again, the chairman of Tata Sons is usually the chairman of these companies. That link, now broken, creates another set of possibilities.

One thing from all this is though there was succession in management four years earlier, there was no succession in ownership.

And, the return of owners, the trusts led by Tata, to management means even the half-hearted succession planning four years ago has been nullified.

At 78, Ratan Tata is not as young when he first got the reins 25 years ago.

By giving himself a four-month tenure as interim chairman, he has indicated a new management soon. That would be the smaller of the Street's worries.

The bigger worry for hundreds of institutional shareholders and numerous smaller ones, and employees and business partners, would be:

- What would happen to the ownership after Ratan Tata?

- The succession plan for the 263,862 Tata Sons promoter shares owned by seven Tata Trusts and other holdings of Tata brothers?

- Would a younger family member inherit?

- Would the professionals managing the trusts take over?

- Or would there be an international search?

© 2025

© 2025