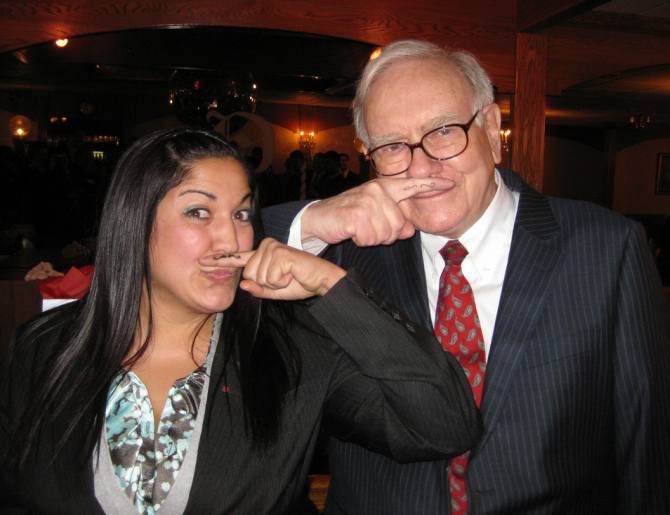

Fund manager Gautam Sinha Roy shares what he has learnt from Warren Buffett after attending Berkshire Hathaway AGMs over the years.

Come May, and tens of thousands of serious investors descend on the sleepy town of Omaha, in middle America. The purpose: Listen to the distilled thoughts of Warren Buffett and Charlie Munger.

The occasion: Berkshire Hathaway's annual general meeting. This year, I, once again, joined hordes of investors to learn and re-learn lessons from the greatest investing minds of our times.

1. Stocks vs other assets

While much changes in the nature of individual stocks and their underlying businesses, there are certain investment principles that remain timeless.

As he has done time and again, Buffett began his address to the 2018 AGM once again highlighting the merits of long-term investing in a steadily appreciating, productive asset class like stocks, vis-a-vis frequent trading, or investing in an unproductive asset like gold.

He highlighted that over the long term, stocks can create 100 times as much value as gold.

Over the long term stocks are the least risky asset class, when compared to, say, debt, that at best preserves the purchasing power of your initial capital.

He added that stocks should be the asset class of choice for all investors.

Take a few long-term calls on individual businesses based on their long-term potential and ride those investments to their full potential.

Buffett said you just had to make one smart investment decision based on a call on how American business would have done over your life and $10,000 in a US stocks index fund (invested in 1942) would have compounded to $51 million now, versus only $400,000 in gold.

2. Valuations do matter

While stocks are timeless investments, when buying assets, fund managers and investors will do well to remember that valuations matter a lot.

Berkshire shied away from fresh acquisitions in 2017 largely because assets were overpriced.

This over-valuation was driven by the cheap cost of debt which has fuelled leveraged buy-outs.

Low interest rates unfairly benefit "people like us in this room" (basically rich asset owners), said Buffett, by artificially inflating asset prices.

However, he added, we won't always be in a market that will have low interest rates and high private market valuations.

Hence fund managers should keep some gunpowder dry and ready for the eventual opening up of market opportunities.

When what you really want to buy as your first preference is off-the-shelf (due to over-valuation in the current context), what do you do?

You go for "lower but acceptable returns," said Buffett.

As prices of asset-light businesses have risen to crazy heights, one should be happy to buy asset-heavy businesses that are available at reasonable valuations.

These businesses will compound free cash flow at a lower pace, but offer a higher margin of safety.

3. Vanishing moats

Another issue that Buffett addressed this year was whether moats have become less relevant in businesses.

For decades, Coke, Gillette, and American Express have been cited as examples of companies whose moats were so deep and invincible that their dominance would continue in the foreseeable future. But now all three are under attack.

And as Charlie Munger, vice chairman of Berkshire Hathaway, said: "If you think you know what the state of the payments system will be 10 years out, you are living in a state of delusion."

In other words, only those who can adapt will survive.

While moats of current businesses are definitely at risk, that does not imply the end of moats. While newspapers have got disrupted, a few like The New York Times and the Washington Post have adapted well to the digital era.

Moats are still relevant in terms of brands that command pricing power.

So a fund manager or investor now has to be more mindful of shifting moats and take portfolio decisions accordingly.

4. To tech or not to

Buffett has been renowned for his negative stance on tech investing historically, citing the frequent disruptions in technology and the sector's unpredictability.

However, tech is accounting for an increasingly larger share of the world economy and constitutes a bulk of the top global companies now.

So, did he get it wrong?

One insight that came across clearly was that one shouldn't think purely of businesses as tech or non-tech.

What is more important is whether the fund manager or investor can understand the business, whether it has durable competitive advantages, and whether the price is favourable. That's the reason they now own Apple.

And simply because Buffett can't understand it should not be an excuse for others to not try. The younger generations especially have a much higher level of familiarity with technology.

Amazon's juggernaut act came in for special appreciation by Buffett and he said it was a stock that should have been spotted at an early stage.

5. The problem children

Every once in a while, a stock in your portfolio will go through problems due to errors by the management. What should you do then?

While mistakes are not completely preventable, the important thing to monitor is how the management handles them.

The ability to identify root causes and correct them is the hallmark of great management.

And when they do that, it is a great opportunity for the astute investor. Examples of Geico and Amex are often cited in this context.

6. The fattened balance sheet

Another question Buffett addressed was whether companies with high cash in their balance sheets should pay high dividends.

Buffett believes that share buyback is a more efficient way to return free capital to shareholders, compared to paying dividend.

But the buyback shouldn't short-change existing shareholders. Hence, corporates should only buy back below the intrinsic value.

This is an important rule of thumb that fund managers and investors should apply when evaluating buybacks.

7. Cryptic currencies

Anytime you buy a non-productive asset, said Buffett, you are basically hoping that someone else will buy it from you in the future at an even more inflated price.

These asset classes also lend themselves to manipulative practices by conmen who wish to take advantage of others' greed.

And this brings me to my favourite quote of the day from Munger: "I like them (cryptocurrencies) lot less than you do."

The message: Stay clear of unproductive or purely speculative asset classes.

Gautam Sinha Roy is senior vice president and fund manager, Motilal Oswal AMC.

Photograph: Kind courtesy Aaron Friedman/Creative Commons

© 2025

© 2025