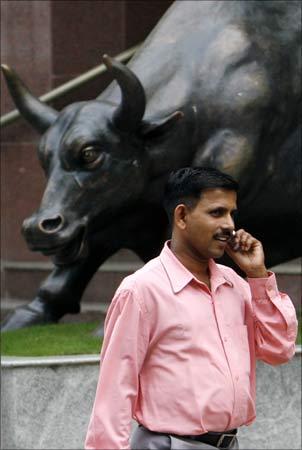

It took less than a minute for exuberant investors to weigh in on the results of India's elections. Buoyed by the weekend news of the surprisingly strong win by the ruling coalition, India's stock market soared on May 18, the first business day after the tally was announced.

When the market opened at 9:55 a.m., it quickly hit the upside barrier limiting the amount of one-session movement, and traders had to pause for two hours.

Trading briefly resumed at 11:55, and again, stocks soared before hitting their upward limit. By noon, the market was already closed for the day, with the benchmark Sensex index rising a record 17 per cent in just 55 seconds of trading.

Investors have good reason to be thrilled.

The Congress Party-led coalition scored a decisive victory on May 16, allowing India a stable government unencumbered by the demands of allies from the leftist parties that had fought major economic liberalisation in the past five years.

The returning Prime Minister, Manmohan Singh, is an economist by training and has shown a tendency to embrace economic reforms in the past.

This is the "strongest government platform in India over the last two decades, and the opportunities could be substantial," wrote Citigroup analyst Aditya Narain in a note to clients May 18.

"The big question: Is it a 'game changer'? Can India get back to the high growth-high valuation of recent years? This event probably does open up meaningful possibilities."

The thumping approval the stock market delivered on Monday may be premature. India's market is relatively volatile and has been a poor leading indicator in the past.

Until Friday, the market was up 26 per cent for the year, even though the broader Indian economy has shown few signs of a solid recovery.

Indeed, exports were down 33 per cent for the last quarter. With the Indian rupee advancing the most in two decades on the back of Monday's rally, exports will get more expensive.

"The elections are certainly good news from the perspective of economic reforms," says HSBC senior Asian economist Robert Prior-Wandesforde. "Whether it is worth 17% is debatable."

Until now, Indian institutional investors have spent much of the year on the sidelines.

Many of the largest Indian fund houses have been keeping as much as 20 per cent of their portfolio in cash and treasuries.

That's left the field clear for foreign institutional investors, who have bought a net $1.93 billion worth of equities in India since January, after having dumped almost $12 billion last year.

"There are so many (Indian funds) with a lot of cash desperate for an excuse" to get back into the market, says Prior-Wandesforde. "The elections were expected to produce a messy result, and the fact that it hasn't (means) they are definitely going to pile in."

Indeed, Madhusudhan Kela, who manages $18 billion in equities at India's largest fund, Reliance Capital Asset Management, was on TV most of Monday talking up the rally and encouraging more buying.

"If you are in cash, and the market is going up 20% in one day, you are going to be out of a job," he told anchors at CNBC-TV18, where the broadcast took on a celebratory note as the day's gains sunk in. Indian business was celebrating not just the Congress triumph but also the demise of leftist parties.

The Communist parties saw their seats in Parliament plunge to 20 from 60. During most of his first term, Singh had depended on support from the Communists.

Now, with Singh able to form a coalition with more like-minded parties and not reliant on the Communists, Indian business leaders are predicting rapid reforms.

"Our expectation from the new government would be that the economic imperatives are paid adequate attention to and the reform process is fast-tracked because the current situation demands it," says Venu Srinivasan, president of the Confederation Of Indian Industry.

The departure of the left doesn't necessarily mean business will get all its demands met. The Congress Party, led for years by India's first Prime Minister, Jawaharlal Nehru, and then his daughter, Indira Gandhi, still leans socialist, and campaigned on a manifesto focused on the aam admi, or the common man.

Most of its voters are rural, often poor farmers who benefited from the 68 per cent increase in government support prices for rice and wheat over the past five years and free electricity for their water pumps, and they flocked to the familiarity of the Nehru-Gandhi dynasty that has kept India's economy under tight government control for the majority of its 30-plus years of government.

The one reform that investors have been clamoring for - the modernisation of labour laws - is perhaps the most difficult to pass, since it will reverse a tradition of strong unions in organized labour markets and government protection from layoffs.

Business leaders will see soon enough whether Singh's government will be able to deliver on industry's agenda. The President of India, Pratibha Patil, will invite the Congress Party to form a government on May 19.

By June the government must present a Budget, which industry analysts expect to have at least a few business-friendly proposals and even further tax breaks or expenditures to stimulate the economy.

But after a campaign that largely ignored the urban and middle-class economies, the Congress Party may feel pressured to do more for its base.

Options include a revamping of the hugely popular National Rural Employment Guarantee Act and a loan waiver program from 2008 that costs an approximate $14.8 billion.

Those investments, and an approximately $85 billion expenditure on three stimulus plans, have pushed India's deficit past 10 per cent.

"Given what's happened in the Western world and how the unfettered capitalism model is perceived now, the government would be at least likely to go slow in the area of reforms, especially labor markets," says Prior-Wandesforde, the HSBC economist.