Insurance, by definition, is morbid. What if I die suddenly? What if my home caught fire? What if I had to undergo expensive medical treatment? What if something that I thought happened only to others befell me?

Insurers, who work with large samples, calculate the probability of such an event and, hence, the possibility of them having to pay out a sum of money to mitigate, to the extent possible, the effects of that disaster.

However, the possibility of you undergoing some kind of expensive medical treatment during your lifetime is far more likely than you dying suddenly or your house burning down. Given that costs at private healthcare facilities, where you are most likely to land up, is high, and, doubling every four years 10 months or so, the rest of your money life could easily go out of whack if you had to incur such expenses.

Just 12 per cent of India's population is covered with some sort of health insurance. Pared to the bone, for a comparatively small price, health insurance provides you the money you need, and you do not have to undergo expensive medical treatment of some varieties, mainly involving hospitalisation.

The basic type is an indemnity cover, i.e., the insurer only reimburses costs. As cost is the primary point of pain, there's sense in buying it. Click on NEXT to know about the different plans on offer...

What's on offer

Once you have decided to buy health insurance, the next step is to try to figure out what you want to buy, and from whom.

This is the tougher bit, for there is a bewildering array of products in the market. Earlier, only general insurance companies sold such covers.

With 21 of them in the market, including three pure health insurance companies, it was bad enough. As nine more life insurers are offering health insurance covers, finding the solution has become the problem.

Let's take a look at the kinds of health insurance covers on offer.

| Individual Health Plans | Plan Name |

| Apollo Munich Health Insurance | Easy Health |

| Bajaj Allianz General Insurance | Health Guard |

| Cholamandalam MS Gen. Insurance | Chola Health Insurance |

| HDFC ERGO General Insurance | New Healthwise |

| ICICI Lombard General Insurance | Health Advantage Plus |

| IFFCO Tokio General Insurance | Individual Medishield |

| National Insurance | Mediclaim |

| Reliance General Insurance | Individual Mediclaim |

| Royal Sundaram Alliance Insurance | Health Shield Online |

| Star Health and Allied Insurance | Medi Classic |

| The Oriental Insurance | Individual Mediclaim |

| United India Insurance | Mediclaim |

| The New India Assurance | Mediclaim |

| Family Floater | Plan Name |

| Apollo Munich Health Insurance | Easy Health |

| Bajaj Allianz General Insurance | Insta Insure |

| Cholamandalam MS Gen. Insurance | Chola Family Health |

| HDFC ERGO General Insurance | Family Floater |

| ICICI Lombard General Insurance | Comprehensive Health Plus |

| National Insurance | Parivar |

| Reliance General Insurance | Health Wise Policy |

| Royal Sundaram Alliance Insurance | Family Health Floater |

| Star Health and Allied Insurance | Medi Classic |

| The Oriental Insurance | Family Health Floater |

| Critical Illness Plans | Plan Name |

| Bajaj Allianz General Insurance | Critical Illness |

| ICICI Lombard General Insurance | Critical care Insurance |

| IFFCO Tokio General Insurance | Critical Illness |

| National Insurance | Critical Illness |

| Tata AIG General Insurance | Criticare |

| Senior Citizens Plans | Plan Name |

| Bajaj Allianz General Insurance | Critical Illness |

| National Insurance | Varistha Mediclaim |

| Star Health and Allied Insurance | Senior Citizen Red Carpet |

| The Oriental Insurance | Hope |

Individual health plan. These are the so-called 'traditional' health insurance covers, commonly known as 'mediclaim' policies. They mainly cover hospitalisation expenses provided it is for at least 24 hours. The expenses for hospital bed, nursing, surgeon's fees, consultant doctor's fees, cost of blood, oxygen and operation theatre charges are the usual inclusions.

However, unlike the past, most plans now come with sub-limits for each of these heads. They usually do not cover pre-existing diseases or complications arising from them for the first four years of the policy. Besides, claims for specific ailments may not be allowed in the first or second year. For every claim-free year, most plans add 5 per cent to the sum insured.

Family floaters. These can be seen as agglomerations of IHPs for a family. The benefits remain largely the same, but the sum insured can be availed by any or all members of the family and not a single person. Rather than buying, say, a Rs 200,000 health cover for each member of the family of four by spending for a total cover of Rs 800,000, if you bought an FF for Rs 800,000, each person covered under it can avail benefits up to Rs 800,000 as opposed to Rs 200,000 in the earlier instance.

This reduces the need for you to pay from your pocket. Also, it comes at a lower premium than otherwise. A FF can be bought by an individual who becomes the proposer along with spouse, dependent children up to 25 years or even unmarried, divorced, widowed daughter and dependent parent. Even a parent-in-law can be covered.

Critical illness plan.

This is not a substitute for a 'mediclaim', but you should ideally add this layer to the latter. It provides financial assistance if the insured develops a serious ailment, such as cancer, or has a stroke. Each cover has a list of ailments, usually 9-12 of them.

One can get it in the form of a rider attached to a life insurance cover, or as a standalone policy from either a life insurer or a non-life insurer. If critical illness occurs, it pays the entire sum insured and terminates and can happen only once for any particular illness.

To get the payout, the insured has to survive for 30 successive days after the diagnosis. No claim can be made during the first 90 days of the inception of the policy. The policy term is usually longer (10-20 years) if this cover is bought from a life insurer as a rider than from a general insurer (1-5 years).

Senior citizens health plan. Most IHPs cap the entry age at around 60 years, while SCHPs are generally for the age group of 60-80 years. Most can be renewed lifelong or up to the age of 90, and have a fixed coverage of, say, Rs 100,000 or Rs 200,000. Besides looking for sub-limits, those taking SCHP should watch out for certain illnesses as many ailments are excluded from the plan. SCHPs might even have the option to attach a CIP.

Daily hospital cash. This should be the last option when buying health plans. Most hospital cash plans might also inconvenience you as they offer the benefit after discharge from the hospital, and only after the policyholder produces proof of the number of days he stayed there.

Hospital cash benefit has a pre-defined limit in most cases, say Rs 500 per day for up to 50 days in a year and up to 250 days during the entire term.

Unit-linked health plans. These are mostly defined benefit plans - usually for the long term - and, unlike a standard health insurance policy, the payout is not dependent on the costs actually incurred.

Health Ulips are made up of two parts - a health plan and a unit-linked investment plan. Although these policies are being sold by life insurers, they may not cover life risk. Out of the premium one pays, a portion goes towards medical coverage and the rest of the premium is invested in a fund that operates like a mutual fund.

Covers from life insurers. Life insurance companies, too, have started offering health plans. Most of these are, however, defined benefit plans - the pre-specified amount which is the sum insured is paid as compensation, irrespective of the actual amount of expenses incurred.

Also, these are long-term, having a fixed premium for, say, three, five, or even 10 years. Most of the types of plans discussed above are on offer. Some will even throw in a life cover for good measure.

What to buy and when

The strategy. An IHP should form the base of your health insurance portfolio. Alternatively, if you have a family, you could go for a FF to form the base cover. To add a second layer of protection, you could go for a CIP. For most, this will be adequate.

If you have a special condition, such as cancer or diabetes, add the third layer of a special cover, such as a cancer plan or diabetes cover. Do not mix up your life and health policies. The needs are different and cannot be compromised. If, by linking the two, you are doing so, we suggest that you keep them separate.

The timing. Buy a cover as early on in life as possible and definitely before you turn 45. If you procrastinate, diseases could surface and get excluded from your cover under the 'pre-existing disease' clause.

Of course, lately there have been products where pre-existing diseases are being covered, but that is subject to specific conditions. As you are likely to make no or few claims in earlier stages of life, you can get the benefit of no-claims bonus for every claim-free year. Do not rest assured in the fact that your employer covers your medical expenses. What if you fall ill between jobs? And buying a health cover without exclusions after you retire at, say, 60, will be much tougher.

The maximum renewal age. One of the most important things that one needs to look at the time of buying a health plan is the maximum age up to which the the insurer would allow renewals. The higher this is, the better, since your medical expenses are likely to increase with age. Changing insurer at a higher age has a high probability of being looked at as a fresh policy with no prior coverage.

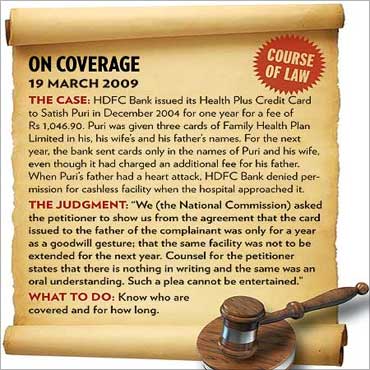

Common oversights

Maybe because the maximum number of claims are made on health policies, possibly apart from motor insurance, the number of rejections, rendering a policy worthless, arising here is also quite large. Many of these arise because of the policyholder's lapses.

Things such as missing documents or late renewals can lead to rejection and, consequently, substantial medical debt. Here are the common oversights to avoid.

Pre-existing diseases. This is a common problem area since there was no standard definition of pre-existing illness earlier. In June 2008, the General Insurance Council said "the benefits (of health insurance) would not be available for any condition, ailment or injury or related condition for which the insured had signs or symptoms, and/or was diagnosed and/or received medical advice/treatment, prior to inception of the first policy, until 48 consecutive months of coverage have elapsed, after the date of inception of the first policy."

Ajay Bimbhet, managing director, Royal Sunadram Alliance Insurance, says four years is the maximum period prescribed by the Insurance Regulatory and Development Authority, but companies may offer products that could have a shorter waiting period under the 'pre-existing' clause.

When buying a policy, you should know:

From when claims on which pre-existing diseases will be allowed. The waiting period is not the same for all of them;

That the definition excludes all diseases arising out of earlier complications, such as obesity and hypertension;

That the period of four years does not include the track record from another insurer;

That the buyer should disclose the known pre-existing diseases at the time of application.

Claim problems. An insurance company cannot pay a claim unless it is in line with the agreed terms and conditions. If you provide incorrect information at the time of applying, your claims could be rejected.

To prevent that:

Keep the company informed. Limited information including illness and policy number is sufficient.

Give the correct papers when making a claim in a proper file. Keep in order the following: (i) covering letter, original claim form and copy of the policy, (ii) note from the concerned doctor describing the illness and the recommended treatment, (iii) original prescriptions from the doctor for medical tests (investigation) and medicines and original medical test (investigation) reports, (iv) sheet listing down bills and the amounts, (v) doctor's and medical test bills, (vi) hospital or nursing home bills, (vii) medicine bills, (viii) hospital bills, and (ix) original discharge card.

Get an acknowledgement of receipt of the claim before submitting the file and retain a photocopy of the complete set of documents submitted to the insurance company.

Keep the number of the third-party administrator and your insurer ready if you have a cashless policy. Try to inform them around 48 hours before the admission in general and 24 hours if it is an emergency.

Spell the name correctly. The patient's and his or her doctor's name should be spelled correctly, wherever required.

Jargon. Incomplete and incorrect understanding of the legal language of the policy by the policyholder can lead to claim rejections. So you must:

Be careful in deciding the sum insured you need;

Be aware of the sub-limits under the policy for specified illnesses or expense heads, the waiting period, permanent exclusions, and so on.

Coverage. A family floater can be bought by an individual, who becomes the proposer, along with spouse, dependent children up to 25 years, or unmarried, divorced or widowed daughter, and dependent parents. Even parents-in-law can be covered.

Similar to IHPs, a discount of 10 per cent is allowed on renewal premium by most insurers if there is no claim in the year immediately preceding the year of policy renewal. Similarly, in group health plans of your employers, you should know who are the ones it covers and the limit to which they are covered. So you need to be aware of:

Who are included in a family floater health policy and till what age;

What the inclusions and exclusions are (and for how long) for each of the insured as enumerated in the 'inclusions' section of the policy document; and

The age till which the policy can be renewed.

Gap in renewals. Renewal of the policy on time is very important for health covers. Apart from no-claim bonus, after a certain period it could start covering your pre-existing ailments. For every no-claim year, most plans add up to 5 per cent of the sum insured as cumulative bonus. So you need to:

Renew your policy a month before the due date to to prevent a lapse so that waiting periods do not start afresh; and

Read policy wordings every time it is renewed so that you do not miss out on new inclusions or exclusions.