Mismatch in valuations and clash of interest among stakeholders have resulted in some big ticket merger and acquisition deals in India, amounting to nearly $17 billion, going sour this year.

Mismatch in valuations and clash of interest among stakeholders have resulted in some big ticket merger and acquisition deals in India, amounting to nearly $17 billion, going sour this year.

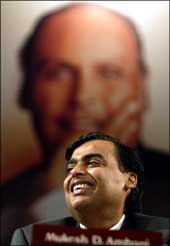

Deals worth nearly $17 billion have got cancelled including -- the $14.5 billion Reliance-LyondellBasell deal, the $2 billion Reliance-Value Creation transaction, the $12 million PVR-DT Cinemas deal and the $130 million Wockhardt-Abbott Laboratories deal.

Last year also two large deals -- Bharti-MTN and Sterlite-Asarco -- managed to reach critical stages of negotiation but got cancelled.

"Big ticket M&As involve a lot of variables and many things need to come together for the deal to go through. Mismatch in valuations and clash of interests of various stakeholders are some of the reasons for recent failed deals," VCCEdge research director Rohit Madan told PTI.

Echoing similar opinion SMC Capital's equity head Jagannadham Thunuguntla said, "The large M&A deals running into billions of dollars often come with a whole host of uncertainties. The uncertainties can range from regulatory related, valuation related, management related or deal structure related issues."

Besides, experts believe, merger and acquisition deals also get affected by extreme movements in the equity markets.

Moreover, the valuations which were low a few months back have risen on the back of overall strengthening economic scenario and bullishness in the stock markets.

However, according to PricewaterhouseCoopers executive director / partner, transactions group Sanjeev Krishan, "RIL & Sterlite apart, this trend also shows maturity on part of Indian companies, to be able to reject deals which they believe may not be fairly priced or from which they could not derive significant incremental value."

Thunuguntla further added that investors have to carefully assess the future M&A deals on merits of each case, before making their investment decisions in those companies.

Indian M&A deal tally would have been double its size if the Bharti - MTN deal had happened last year, or for that matter Sterlite's bid for Arasco or Reliance's bid for LyondellBasell had succeeded.