Sensex may hit 18,000 in April 2010

Last updated on: July 8, 2009

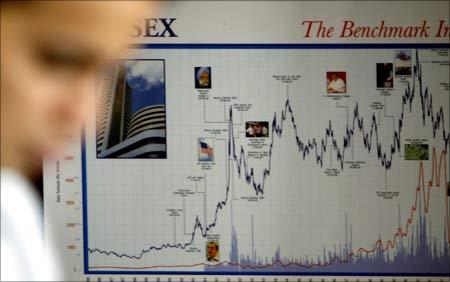

Image: A stock market chart at a brokerage in Mumbai.

Photographs: Reuters

The benchmark index Sensex will continue on its growth path and may even scale 18,000 level by 2010, experts say, notwithstanding the six per cent fall it saw on the day of the Union Budget.

According to a report by global research firm Macquarie, the six per cent fall in the Sensex was because of aggressive selling by investors after the Union Budget was presented, as the market became a victim of heightened expectations.

"We believe the markets have overreacted, and we maintain our positive stance on the market. We raise our April 2010 Sensex target to 18,000 from 15,000," Macquarie added.

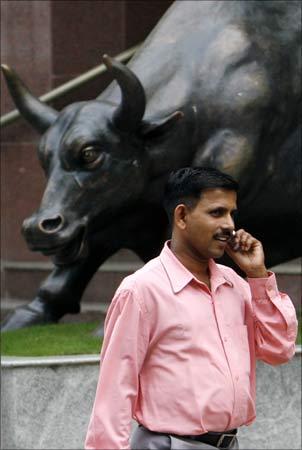

Image: A man speaks on a phone in front of a bronze replica of a bull at the gates of Bombay Stock Exchange

Photographs: Arko Datta/Reuters

Expressing a similar opinion, Citigroup Global Markets said, "We would expect the market to trade at 13,500-14,000 by December 2009. We continue to maintain a relatively defensive portfolio bias."

Explaining further, Citigroup said the market's 6 per cent drop yesterday reflects a possible mix of high expectations, fiscal deficit concerns, questions on the government's will to address market-friendly issues like divestment, FDI, broad-based reform among others.

Image: Sweden's Crown Princess Victoria poses with a bronze replica of the bull during her visit to the Bombay Stock Exchange.

Photographs: Punit Paranjpe/Reuters

Meanwhile, domestic brokerage firm Angel Broking in a report said that the markets' reaction was a kind of a "knee-jerk reaction" but overall they are likely to remain positive.

"Keeping this in mind and considering that the stimulus packages and low interest rates will help unleash the huge latent domestic demand in India going forward, we remain positive on the Indian stockmarkets," Angel Broking said.

Image: A woman lights up lamps in a flower decoration during Diwali mahurat special trading at the Bombay Stock Exchange (BSE).

Photographs: Punit Paranjpe/Reuters

As far as Sensex valuations are concerned, the benchmark index is well poised to touch 18,000 level over the next 12 months, which would translate into a 25 per cent return fromcurrent levels for the Sensex, it said.

Near silence on issues such as divestment, FDI,deregulation, policy initiatives and a reform roadmap were a dampener for the equity markets.

Image: A stock broker at him office in Mumbai.

Photographs: Reuters

However, this does not mean that these issues are off the table as there is scope for policy action outside the Budget also.

"While divestments, FDI, among others are conspicuously absent from the budget, we are still hopeful that measures in these areas could be implemented by the various ministries in the coming months," Citigroup said.

"We think the market is looking for...announcements in the wrong forum. The budget has limited itself (as it has for some years now) to issues pertaining to government finances - issues like fuel price reform and FDI liberalisation will be pursued on other forums," Macquarie said.

Source:

PTI© Copyright 2025 PTI. All rights reserved. Republication or redistribution of PTI content, including by framing or similar means, is expressly prohibited without the prior written consent.