Photographs: Kamal Kishore/Reuters

If it pans out, it will be the biggest M&A deal involving an Indian company. The proposed $23-billion mega deal between Bharti Airtel and South Africa's MTN is even bigger than Tata Steel's takeover of European steel major Corus for $12.2 billion. Other mega M&As have been taking place over the last few years.

In their book, India's Global Powerhouses. Nirmalya Kumar with Pradipta K Mohapatra and Suj Chandrasekhar explore how India is becoming an incubator for multinational firms poised to take on the world. From this new India, they say, major players are emerging not only as customers, but also as collaborators, competitors and acquirers.

Yet, in their hurry to become global powerhouses, Indian companies often prefer the acquisition route...

Under the radar, numerous smaller deals are also taking place -- for example, DLF, a leading Indian property developer, bought the luxury Aman resorts; Dr Reddy's acquired Germany's Betapharm; Vijay Mallya, India's liquor baron, bought the Spyker Formula One team and renamed it Force India; and Videocon purchased Thomson's picture tubes business.

India's Global Powerhouses: How They Are Taking On The World by Nirmalaya Kumar with Pradipta K Mohapatra and Suj Chandrasekhar, Harvard Business Press, distributed in India by Tata McGraw Hill Education Pvt Ltd, Rs 695, with the publisher's permission.

Foreign buyouts: Is India Inc on right path?

Image: Lakshmi Mittal's buyout of Arcelor became an issue of national pride.Photographs: Vivek Prakash/Reuters

Containing ambition

Some of the reasons for the spurt in foreign acquisitions, such as the desire to compete on the world stage and the need to grow beyond the scale possible in India, are solid. The favourable Indian economic environment, fat profits, higher valuations and weakening of government regulations on overseas acquisitions have all helped in successful takeovers.

However, the recent spate of high-profile acquisitions by Indian companies has led to a national euphoria. For example, 'The Empire Strikes Back' was a common headline in Indian press coverage of the purchase of the iconic British brands, Land Rover and Jaguar, by Tata Motors.

This national pride means that Indians have also been quick to take offence when they have encountered resistance by target companies such as Arcelor, Jaguar or Orient-Express. The Indian newspapers have been full of reports of perceived racism and high-profile Indian politicians have weighed in on the issue.

More reflective Indians may have noted that hostile takeovers of Indian companies by foreign companies are almost impossible within the current regulatory framework in India.

Foreign buyouts: Is India Inc on right path?

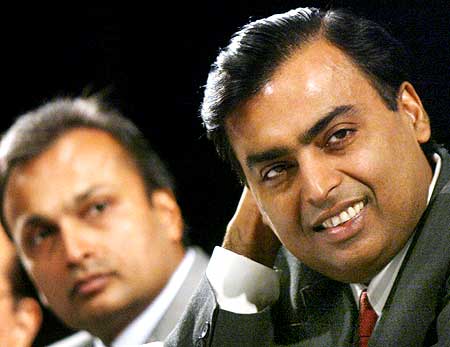

Image: Mukesh Ambani foiled his brother Anil's bid to take over South Africa's mobile operator MTN.Photographs: Arko Datta/Reuters

The current nationalistic euphoria prevailing in India sometimes appears more like jingoism. It needs to be tempered as it can induce corporate overreach.

The tribalistic rivalry between the large family-controlled groups that dominate Indian business (most recently observed when Mukesh Ambani foiled his brother Anil's bid to take over South Africa's mobile operator MTN) has the potential to turn into a race to win status by snapping up ever-larger trophy assets.

In India's closely knit business community, it is almost becoming a kind of fashion statement for companies to make foreign acquisitions.

The result may be that Indian companies embark on ever more audacious international megadeals, inspired by aggressive empire-building ambitions rather than by the solid commercial logic and a careful appraisal of investment returns that have characterised past Indian acquisitions abroad.

Foreign buyouts: Is India Inc on right path?

Image: In India's biggest acquisition deal, Ratan Tata spent $12.2 billion to take over steel major Corus.Photographs: Arko Datta/Reuters

The impetus for many of the acquisitions in 2006-2007 was not that the Indian companies were particularly globally dominant in their industry or rich. Rather, one of the primary facilitators was the easy liquidity prevailing in the markets.

Big deals based on easy liquidity, however, tend to load a company with debt or dilute shareholders' equity through the needed issuance of new stock.

Both Tata Steel and Hindalco were put on a credit rating watch after they announced their foreign acquisitions. For both companies and for Suzlon, announcement of cross-border deals saw immediate drops in their stock price.

Foreign buyouts: Is India Inc on right path?

Image: Suzlon Energy Ltd, headed by Tulsi Tanti, bought Germany's REpower Systems AG.Photographs: Chip East/Reuters

As a result of the financial crisis of 2008, one can safely say that for the foreseeable future, gone are the days when acquirers could use the assets, and sometimes even the cash flow, of the target company as collateral.

We are back to the traditional conservative practices for now -- when lending institutions will ask for the core assets of the acquiring company, at 50 to 90 per cent of actual valuation, as the collateral. This will slow down the cross-border M&A activity that we have seen from Indian firms between 2001-2007.

The academic research is pretty unambiguous on the success of mergers and acquisitions. Approximately half of all M&A deals fail, and the casualty rate increases with the size of the deal as well as for cross-border deals versus domestic deals.

The foreign acquisitions experience of other Asian countries, like Japan and China, also indicates a high failure rate. Therefore, there is no reason to believe that India's success rate will be significantly different.

Foreign buyouts: Is India Inc on right path?

Image: There was a sense of euphoria when Tata Motors bought Jaguar Land Rover.Integrating capabilities

Indian foreign acquisitions have typically sought access to technology (product innovation capabilities), brands, and distribution. However, product innovation and branding are creative functions, which have to be managed differently from the efficiency-driven manufacturing function.

Indian firms are excellent at optimising existing businesses by squeezing economies and managing costs. But innovation, and even branding to some extent, requires 'waste' as it is hard to predict which idea will ultimately succeed. Several dead ends must be pursued in order to find one successful new product.

Furthermore, unlike the quick payback one can obtain by pursuing efficiency gains, product innovation and branding have to be managed with much longer time horizons.

These are finely tuned functions, and integrating them smoothly into existing businesses is hard enough even for experienced operators; doing so across borders is harder still.

Foreign buyouts: Is India Inc on right path?

Image: Liqquor baron Vijay Mallya bought the Spyker Formula One team and renamed it Force India.Photographs: Sanjay Sawant

The short-term business culture combined with a typically top down corporate model controlled by a single all-powerful leader still prevail too frequently in Indian companies.

These attributes work well for serving the volatile local market, which requires speedy decision making, and for managing efficient manufacturing systems.

But these are not the ideal attributes for firms seeking innovation with a creative workforce and inspirational processes. Nor are they appropriate for complex multinational organizations, staffed by a culturally diverse workforce with their own values and a perplexing habit of doing things their own way.

Foreign buyouts: Is India Inc on right path?

Image: Hindalco bought the US company NovelisIndian managements, never very deep, are becoming seriously stretched as they integrate complex acquisitions in different time zones while managing their businesses in a domestic market under attack from foreign competition.

Foreign acquisitions increase execution risk dramatically, especially since Indian companies lack experience in absorbing international businesses with different corporate cultures and employment rules.

The hunger to become a global powerhouse may not always be matched by a company's current capabilities.

In the case of both Japan and Korea, it took several decades to build the required capabilities. But, sometimes, one wonders whether this patience exists in India.

India's Global Powerhouses: How They Are Taking On The World by Nirmalaya Kumar with Pradipta K Mohapatra and Suj Chandrasekhar, Harvard Business Press, distributed in India by Tata McGraw Hill Education Pvt Ltd, Rs 695, with the publisher's permission.

article