Reliance Industries' gas field off India's east cost has been a subject of massive controversy for several months, with allegations of costs being inflated, and the government thereby being denied its fair share of revenue. There are allegations of price gouging, and of Reliance reneging on lower price contracts.

There are charges that so-called independent experts are not independent, and that a friendly minister is favouring the company.

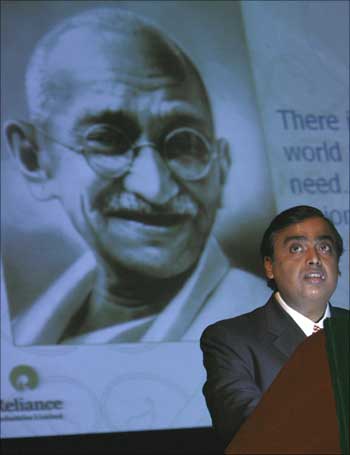

Some of the issues are in court, others are not. The litigants are Reliance Industries Ltd, managed by Mukesh Ambani, Reliance Natural Resources Ltd (managed by Anil Ambani) and the government-owned National Thermal Power Corporation.

Other than speaking through court documents, Reliance Industries has so far maintained a studied silence on most of the issues raised. Now, for the first time, a senior Reliance official has spoken to a newspaper, and addressed the key points of the controversy.

In an extended interview that lasted more than two hours, (RIL director) P M S Prasad, who has headed RIL's petroleum business for many years and who recently joined the company's board, defends the company's position and seeks to put the controversies to rest, while steering clear of all matters that he felt were sub judice.

Prasad contends that the gas price of $4.20 per million British thermal unit is fair, and in any case lower than what is being paid by companies in other deals. He also argues that Reliance's capital cost for developing the D6 gas field compares very favourably with other such fields.

He says Reliance offered a fair deal to NTPC which, however, did not accept it and went to court; he feels NTPC is the loser, because it is buying more expensive gas from elsewhere.

He also denies the charge that Reliance has stalled any audit of its costs by the Comptroller and Auditor General, arguing that there was no contact with CAG till April this year.

Prasad feels Reliance has not got the credit it deserves for having improved the country's energy security by producing so much gas, in such quick time, from a field where others have failed to find gas.

Excerpts from the interview:

Please respond to the charge that a gas price of $4.20 per million British thermal units (mBtu) is high, since current gas prices are at a seven-year low.

There is always a difference between contract and spot prices. Contract prices were still in $6-7 range, when spot prices went through the roof. We all know that spot LNG (liquefied natural gas) was coming to India in the $22-25 range, and we know of some deals which were done at spot prices of $27. Some contract prices are linked to the price of oil, but there too the indexation is not 100 per cent.

When this price of $4.20 was approved, spot prices were much higher at $6-8. I don't think these comparisons (with today's spot prices) are fair. I genuinely believe the $4.20 price, compared to other gas prices in India on spot or contract LNG price coming to India, is very competitive.

Your capital expenditure for developing the D6 field started at $2.5 billion, then became $5 billion and then $8.8 billion. This has led to charges of gold-plating and denial of revenue to the government. How do you explain such sharp increases in capital cost?

In October 2002, we announced the gas discovery and in September-October 2003, because we put in the bid to supply gas to NTPC, we wanted to see if we could develop the field as quickly as possible. We put together some concepts at the prices that were prevailing, and it would cost about $2.5 billion for initial development.

We continued to drill more wells, and do geotechnical investigations. We now knew that the reserves had gone up from the original 5 trillion cubic feet (tcf) of gas reserves that we thought were there, to 10-11 tcf. So we had to rework the original concepts. Also in 2005, we had the tsunami, so we had to do tsunami-proofing.

Prices, too, had gone up. I'll give you an example. In 2003, we were using the rig that helped us to discover this field, and the cost we were paying was about $110,000-115,000 per day. Add the service and it was of the order of $225,000-$250,000. For the same rig today, I am paying close to $800,000 a day. The rig that we hired in 2005 and 2006, we are paying over a million dollars. That explains the increase.

We were at the peak of the commodity cycle between 2006 and 2008. Most of our commitments were made in 2006. That is the time we went to the director-general of hydrocarbons, to say that we have bigger gas reserves here. The government said you go and produce more. So we scaled up our production plan from 40 mscmd to 80 mscmd (million standard cubic metres per day).

Meanwhile, with higher crude and gas prices, everybody in the industry was investing. What otherwise was a marginal field suddenly became a viable field. But service capacity did not go up proportionately, so there was a lot of pressure on the cost of these services. That's how our cost went up to $5.5 billion.

That was for the initial investment. When we went with the revised development plan, we did not project the cost over the life of the field, because we already had the bad experience of having estimated a cost in 2003 prices, and then revising it at 2006 prices.

But the government wanted to see what will be the cost through the full life of the field, and we were asked to cost the whole thing. That is how the figure of $8.8 billion came. There is a misconception that we have spent $8.8 billion; we have not spent it. It is the money that we will be spending over the life of the field.

At $8.8 billion, what is the capital cost per unit of gas? And how does it compare internationally?

If you take 11 tcf as the reserves, it converts to 1.8 billion barrels of oil equivalent. I will spend $8.8 billion, plus the $700 million spent initially on exploration and appraisal. The total will be $9.5 billion, which works out to a little over $5 per barrel of oil equivalent. The international benchmarks are $6-9 for comparable fields.

I cannot compare our cost to anything here in India, since ONGC is yet to produce from the KG basin. Internationally, you have three ways of comparison. You can compare it to the CERA (Cambridge Energy Research Associates) cost.

Then there is Goldman Sachs and another investment bank; they do cost comparisons every year in terms of reserves and development and production costs. The third is what has been announced for an international company's project. Using these three methodologies, I think we compare very favourably.

Goldman Sachs' benchmarking tells us that in the deepwater regime, we are among the lowest, in terms of capital cost in dollars per barrel of oil equivalent.

This is also the fastest discovery and development of a field, especially when there are no support services nearby, everything has to come from Singapore or Dubai. We are among the best among comparable fields, in terms of both cost and time.

It is said that the prices of services and rigs have fallen now.

Yes, some prices have come down but not for deepwater services, which is what we need. Deepwater rig prices are exactly the same as they were in 2008, when they were at their peak. Maybe there has been a slight softening.

When ONGC opened a bid for a deepwater rig in April or May, they had only two offers and one of the offers was based on the rig we were using, because that contract will be running out in one or one-and-a-half years.

If you look at what is called the effective cost per day, it is $560,000-630,000. If we include associated services, it goes to over $1 million today. We are spending a million dollars a day because most of our equipment, commodity, services and deepwater installations were contracted in 2006, when the market was at its peak.

Today, the market may have come off a little but only in some senses, like jack-up rigs have fallen. But we do not use jack-up rigs or shallow water floaters. We are unfortunately drilling 1,000-1,500 metres, so we need ultra-deepwater rigs. Some of our wells, which we will be drilling soon, will be at 3,000 metre.

If you want to get a good price, you have to contract for a long period of, say, two, three or five years. Contractors don't want to give a rig for a short period. Ultimately, there are only a few players in the deepwater drilling business.

The BPs and the Exxons and everybody did the same thing. They signed five-, seven- or 10-year contracts at high prices. But the market did not come off. Quite a few deepwater rigs were being built but, in this economic crisis, all finances had gone and all rig construction has stopped. So in reality the rigs that were to be built are not there, and the market is still strong.

The second thing is Petrobras, with their big discovery off the coast of Brazil, requires some 38 rigs for exploring and developing fields. So, big demand is anticipated, and the market remains firm. Today, if you see the earnings of most of the exploration and production companies, they are not great because they are still paying high costs, while the prices of oil and gas are not great.

If you are so confident about your costs, why have you stalled for two years the audit of your costs by the CAG (Comptroller and Auditor General)?

I am very surprised to hear this. We have had only one interaction with CAG - that was in April-May this year, when there was a meeting in the ministry to which eight operators were invited and the government said CAG will audit contractors.

This question of stalling for two years has come absolutely out of the blue. I must correct myself, there was a more recent interaction in August, which was a meeting specific for D6. We stated our contractual position. We said you are welcome to do the audit but the government has already appointed an auditor to do it till 2006-07, and our agreement provides for only one audit.

So, why doesn't CAG start auditing on a prospective basis? That was a suggestion we made. But after the meeting, we talked it over. We have nothing to hide. So, even though it is outside the scope of PSC, we have said we welcome the CAG audit and the scope of it.

If your first contact with CAG was in April, and they say you have been stalling it for two years, did you take this up with CAG?

No, because we have received only one letter from CAG inviting us for the meeting. They never asked for any specific records. There is no question of stalling CAG. Now a new date is being discussed some time in the third or fourth week of September to sit with CAG and the petroleum ministry to agree on the methodology.

Anything on which the government has a right under the production sharing contract, there is absolutely no question of stalling it. We will cooperate. If it is beyond PSC, if it is a question of showing how transparent we are, we won't mind considering even that.

Do you make money at a gas price of $2.34 per mBtu (the price offered to NTPC)?

What happens under the PSC is that the contractor recovers his investment first and then the government share goes up. Ten tcf of gas is 10 billion million Btu. You multiply that by $2.34, and you get total revenue from the field of $23.4 billion.

I have to recover all my costs, which are $9.5 billion. Government profit starts after that, and climbs progressively from 10 per cent and goes up to 80 per cent. If there is less revenue because of a lower price, it is government profit that gets impacted most, while I recover my cost over a longer period.

If the price is $4.20, the total revenue goes up to $42 billion, and the government's profit share goes up. My cost is fixed.

So, both you and the government have a stake in a higher price, except that the government also pays a higher subsidy on the end products of the user industries, which are fertiliser and power.

Yes and no. It depends on what we compare with. We end up comparing with the administered price mechanism. Typically, natural gas equals the crude oil price, divided by 10 or 15. In a depressed market, it will be 15. In a bullish market, it may be 10 or even less.

When we bid for NTPC, oil prices were $27 and we looked at the forward curve. After we recover costs, we do make money but it takes me longer to recover costs, and time is money. If NTPC had signed the contract in December 2005, we would have submitted the contract to the government. If approved, we could have been supplying at $2.34.

The NTPC-RIL gas dispute was over limiting liabilities at a time when production from the D6 field had not started. Now, when you have started production, what is the dispute?

Our disagreement with NTPC was not on price, tenure or the quantity of gas - none of the factors that would in any way negatively affect the economic value of the contract for NTPC.

Once we were seen to be the lowest bidder, NTPC and we engaged in extended discussion on various contract issues for more than a year. The main outstanding issue was about liabilities in case of failure to supply, which we felt had to be limited because we were not going to bet the entire company for the sake of a single contract.

We offered 50 per cent higher liabilities than what NTPC was giving us for non-acceptance of delivery of gas. We also said that if we produced any gas at all, the first gas up to the contracted amount would go to NTPC. What more could they have asked for?

In no other contract has NTPC got unlimited liabilities of the kind they wanted from us. Our bona fides were shown when we actually signed the agreement incorporating all the agreed clauses and a few other clauses where we had disagreement but where we thought we were right. The main outstanding issue was the extent of liabilities in case of failure to supply gas.

NTPC was silent towards the end, and then reverted to their position at the start of the entire exercise, thus wiping out all the subsequent discussions. Then the company went to court. At that stage, we had no option but to say that since you have not accepted what we signed, and have gone to court, we are withdrawing our offer.

We argue that there was no completed contract because NTPC did not sign. If the court determines that there is a concluded contract between NTPC and Reliance, then we would definitely sign the contract but we would still have an issue with unlimited liabilities.

We will also go to the government for approval of the price, according to the provision in the production sharing contract. This is our position today.

So, is NTPC the loser by not signing the contract you sent them and going to court instead?

I would think so. When the economic value of the contract is protected and a reasonable date of supply is known, liabilities are important but they cannot make or break the contract. They have been buying gas at much higher prices from elsewhere.

There is a perception that at $4.20, the price formula is structured in such a way that if global prices fall, you are protected on your revenues. But if they rise, you gain, and therefore it is an asymmetrical structure. Is it right that you are de-risked in this way?

We get a base price of $2.50 if the crude price falls to $25. Our price changes when crude varies between $25 and $60, at which stage it is capped. The gas price is capped at $4.20. There is a floor and a cap. Yes, it is de-risked, but remember that the contractor has taken the risk of exploration and put big money there.

When you come to market-based prices, right in shallow waters in the KG basin, gas is being sold at $4.30 which is due for revision; and on the west coast, the price range is $4.50-5.70. These are domestic prices and non-administered prices.

It is a market-based price and has no relation to the cost. There is the question as to why should it be linked to the international price. But then nobody asks why is Bombay High oil sold by ONGC linked to Brent, or why Panna-Mukta-Tapti or Ravva crude oil is linked to the international price.

The allegation is that at $4.20, you are not able to sell gas, because prices are lower elsewhere, which is why you are not meeting the production target.

If the government frees me to sell the gas, or alternatively establish a mechanism to give a list of customers, I can guarantee you the balance of 30-40 mscmd that we are ready to produce, we can contract immediately. I need 15 mscmd for my own captive plants. That's what we have requested the government.

The narrative that has been put out is that you have raised sharply your capex cost, you have thereby reduced the government's share of revenue, you have a gas price fixed in your favour, and you have a friendly minister. And you are taking a natural resource, where the cost of fertiliser and power depends on the price you get, and you are not allowing your cost to be audited, and your so-called independent experts are not independent at all. This is the picture that has gained currency, which seems to be completely at odds with what you are saying.

We are totally transparent and welcome any audit as long as it is within the borders of the PSC. Somebody's image and reputation has been tarnished. We didn't know Mustang (one of the independent experts). We never considered buying them. We are in the business of plants and assets, we do not want to buy engineering companies.

About Mustang saying that it was awarded a multi-million contract after this is not correct. Everybody knows in Panna Mukta Tapti, it is British Gas that is the operator. We are only a 30 per cent partner and BG is awarding contracts on the basis of competitive bids. It is bad to tarnish people's reputation.

As regards the other expert, Gopalakrishnan. I met him only once when he came to audit. I did not know him. He worked for many years in ONGC and went to Kuwait Oil. He had a good reputation as a reservoir engineer. If after that or before, he is a visiting faculty in Deendayal Institute of Petroleum where Mukesh Ambani is honorary chairman, I do not think they ever met.

If you put such linkages, and rubbish people's reputation, you won't find anybody. There are four or five people in this space. They might have worked somewhere or the other. It is not fair to criticise people. Does CAG have an industry expert? For that, they will need to get somebody.

You did not address the point on having a friendly minister.

I do not know. Ultimately, the government does what is good for it. You have Murli Deora as the honourable minister of petroleum and natural gas. I am sure he is known to the (Ambani) family and both the brothers equally. A friendly minister does not mean that he is going to favour us.

If that is the perception, I would wish that there was a different minister, because this perception would not have been there and things would have moved faster. Today, because of this, you have put the minister on the defensive.

The government has tied itself in knots by saying different things at different points of time. That is why there is a credibility issue, and the minister becomes relevant.

This is a path-breaking exercise, and the government is also interpreting as it goes along. We are the first. We ourselves did not understand what some things meant. We did not know what price approval meant. We thought a gas utilisation policy was something in broad terms.

We did not know that it was not only sectoral priorities but constraints on our marketing freedom and also that they can allocate customers in each segment by volume and then say you cannot give more or less.

Clarity came through the formation of EGoM and the government made decisions subsequently. Before that, we did not get any approval (from the minister). Price approval, utilisation and allocation came from EGoM. The development plan is approved by a management committee that has representatives of operators and government, and both government representatives have to sign on before we can get the green signal. The assets and resources belong to the government, the risks are of the contractor.

RIL says now that gas is a sovereign property and it is not the owner of the gas. Did Mukesh Ambani not know this at the time of signing the family MoU?

We signed the family MoU, thinking government approval will come later. We did not know the process and the utilisation policy. The PSC did cover issues but what the contours would be, we did not know. The MoU says both the groups will try to get government approval. When you do not know, you try to take risks but you hedge it.