| « Back to article | Print this article |

As an asset bubble, gold may burst after reaching $2,000

While India remains the largest consumer of gold ahead of China, our citizens unlike the Chinese are yet to start any meaningful diversion of their assets in the bullion to protect themselves against inflation, writes Kunal Bose.

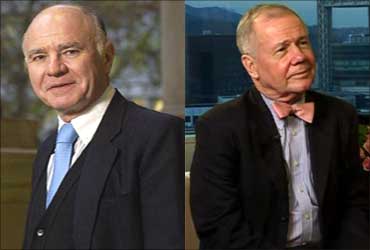

Investment guru Marc Faber is a zealot when it comes to promoting the cause of gold.

The publisher of the celebrated newsletter Gloom, Boom and Doom is at the same time rubbishing the dollar and currencies of countries which go on printing notes in attempts to stimulate their economies.

The contrarian investor often referred to as Doctor Doom has got another equally controversial investor Jim Rogers to keep company in celebration of gold at the expense of currencies.

So is not Faber happy that his favourite precious metal gold has once again moved beyond the $1,200 an ounce resistance level after moving sideways for a while?

What should be a cause of particular delight for Faber and Rogers is that their unbounded enthusiasm to make the public, going beyond the high networth individuals to see the virtues of regularly adding gold to the investment portfolios when the developed economies look wobbly is seeing its denouement.

Click on NEXT to read more...

As an asset bubble, gold may burst after reaching $2,000

We in India continue to buy gold mostly in the form of jewellery.

Therefore, the Indian consumer demand for gold surging hugely in the first quarter of this year to 193.5 tonnes could not have drawn inspiration from exhortations of Faber and Rogers.

The craving for gold jewellery here is so strong that the Indian womenfolk just needed some time to get reconciled to high prices of the precious metal before resuming buying and with some abandon.

The World Gold Council says gold jewellery demand in non-Western countries will continue to recover from the first quarter level of 470 tonnes.

For whatever reasons, while India remains the largest consumer of gold ahead of China, our citizens unlike the Chinese are yet to start any meaningful diversion of their assets in the bullion to protect themselves against inflation.

Click on NEXT to read more...

As an asset bubble, gold may burst after reaching $2,000

The world is seeing since 2002 when People's Bank of China shed its monopoly over gold coinciding with the commissioning of Shanghai Gold Exchange, Beijing is encouraging the people to acquire gold in physical form and also as investment products.

Consequently, in the three years since 2007, the Chinese demand for investment gold has more than quadrupled.

Unarguably China is playing a major role in the growing legitimisation of gold as an investment class.

Looking beyond China, which is showing seriousness in improving the liquidity in domestic gold market as it creates condition for its banks to cover gold risks abroad and India where retail interest is once again hardening notwithstanding high metal prices, the bullion is increasingly sought in new geographies.

The developed world has for long found in gold a reliable asset class and as a store of wealth.

Click on NEXT to read more...

As an asset bubble, gold may burst after reaching $2,000

Now with the world's largest economy presenting an increasingly gloomy sentiment manifest in the dollar losing its shine against a trade-weighted basket of currencies, the European gold investment demand, particularly in Germany and Switzerland has become exceptionally strong.

The recent leg up in gold prices is, however, linked to China allowing some more of its banks to conduct global trade in the bullion as it at the same time encourages creation of new gold linked investment products.

Later this year, the Hong Kong Mercantile Exchange will start functioning with a gold futures contract as the maiden product.

This, according to experts, will mark a watershed in China throwing open its gold market. All the reforms relating to gold are also a pointer to gradual globalisation of the Chinese banking system.

Click on NEXT to read more...

As an asset bubble, gold may burst after reaching $2,000

The growing appetite for gold in China and India has no doubt not been inspired by what the perky investment Gurus are loudly advocating for quite a while.

Nevertheless they will feel vindicated every time gold prices move forward irrespective of the trigger.

At this year's beginning, Faber said in a style remarkably his own that if he were to choose one asset class for a decade it had to be 'gold' and not cash or US bonds.

He finds gold at current price less expensive than when it was available at $300 an ounce because in the meantime there is an "explosion in foreign exchange reserves in the world, zero interest rates, huge debt overhang and further money printing."

Click on NEXT to read more...

As an asset bubble, gold may burst after reaching $2,000

If Faber nurses the regret that many disregarded his recommendation on gold earlier, Rogers says in these turbulent times there is no question of his selling the bullion.

"If gold goes down a whole lot I hope I'm smart enough to buy some more," he says.

At the same time, Rogers will want investors to put their money in silver, which remains far below its historical high, natural gas and a whole range of farm commodities.

The Gurus angst ridden over paper money want investors to stay clear of ponzi schemes which did them in in the past.

No doubt, the likes of Faber are acidly cynical about the dollar and US bonds.

But hasn't George Soros, the high priest of investment experts, described gold as the ultimate asset bubble which will burst when it becomes a huge balloon leaving no room for further inflating?

Soros thinks the burst may happen when gold rises to $2,000 an ounce.