Photographs: Uttam Ghosh/Rediff.com

Asset bubbles recur from time to time, fuelled by animal spirits gone wild in irrational exuberance, soaring on a patently foolish belief that "this party will never end".

For the unwary investor, asset bubbles are like lethal land mines lurking just beneath the surface, ready to explode the moment you step on them, waiting to tear your carefully husbanded investment portfolio to shreds.

Which is why it is important to recognise signs pointing to an impending bubble and to take timely evasive action.

An asset bubble occurs when the prices of assets are over-inflated due to an excess of demand. It occurs when there is lot of money in the system, interest rates are relatively low, credit is easy, unemployment is low. It occurs at a time when economic confidence is high.

...

[Excerpt from Fundamental Analysis for Investors by Raghu Palat. Published by Vision Books.]

(C)All rights reserved.

How to protect your investments from asset bubbles

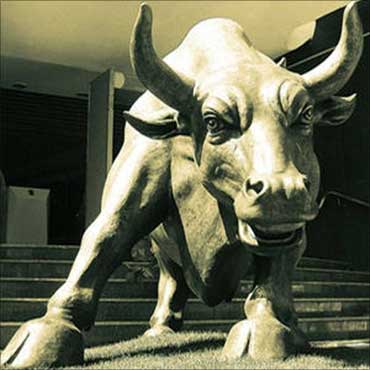

Image: Bombay Stock Exchange.Continuous rises in asset prices are justified by clever reasoning and the expectation of further increases in price.

After several years of a depressed market, prices begin to rise in the wake of an economic boom.

Stock Market Bubbles in India

Such a relentless price rise was witnessed in the Indian stock markets through 2006 and 2007, finally culminating on January 8, 2008 when the Bombay Stock Exchange Sensitivity Index (Sensex) soared to a high of 21,078.

At the time the euphoria was so great that there were predictions that the Sensex would soar to 50,000 by June 2008.

...

How to protect your investments from asset bubbles

Image: Harshad Mehta.Photographs: Reuters.

Bubbles burst. When the euphoria becomes unsustainable a crash is inevitable. In the third week of January 2008, the Sensex witnessed great falls. On 21 January 2008, the Sensex fell by 1,408 points.

Later, it went into a free fall, falling month on month to close below 9,000 in November 2008. Other assets too fell in sync as demand petered out in the face of an economic depression. There was a similar burst of an asset bubble after the Harshad Mehta scam in 1992-93, and again in 2001-2002.

...

How to protect your investments from asset bubbles

Image: Beware of asset bubbles.Photographs: Uttam Ghosh/Rediff.com

An asset is bought in the expectation that it would double or triple in a relatively short time.

Rumours fly. Examples are cited of investors who have made huge killings. Economic data and sensible thought are abandoned for greed.

Herd mentality takes over and the mass follow the leader - the bull - without thought or reasoning.

...How to protect your investments from asset bubbles

Image: Bombay Stock Exchange.In bubbles, it is of no consequence that the price is irrationally high. It only matters that it can be sold for an even higher irrational price at a later date.

As happened to the Sensex, bubbles end with steep declines, where most of the speculative gains are quickly wiped out.The problem is that it is hard to tell a bubble until it bursts. When central or other regulatory bodies intervene, it brings about what it was intended to prevent - a free fall.

Two types of bubbles

There are two types of bubbles.

The first type of asset bubble is created by banks or brokerage houses. They pump up the price of an asset. The assets can be shares, currencies or other financial instruments.

...

How to protect your investments from asset bubbles

Image: Uttam Ghosh/Rediff.comPhotographs: Do not det duped by false promises.

In India, the late 1980s and early 1990s witnessed many initial public offerings of investment and other companies which hinted at huge returns and ensnared gullible investors.

How to recognise a bubble in the making

When a bubble lasts, a whole host of pundits, analysts and schools try and justify it. I recollect during the Harshad Mehta led boom, pundits justifying it by stating Indian stocks were greatly undervalued and that they had nowhere to go but up.

During the boom of 2006-2007, the bubble was justified by saying that the potential of Indian companies was unimaginable - India is the glowing star and the economy is going to grow even faster, went the refrain.

...

How to protect your investments from asset bubbles

Image: Be wary of inesvting tips.They insisted that productivity had surged and established a steeper but sustainable, trend line. I remember an argument with regard to the valuation of ACC in the early 1990s.

The gurus argued that the company should not be valued on the basis of its fundamentals but on what it would cost to build a similar company.

The trouble is that these learned people sound authoritative and so sure of themselves that individual investors believe them.

As a fundamental investor, you must be wary of such "This time it's different" arguments.

...

How to protect your investments from asset bubbles

Image: Don't get carried away by newspaper reports.Photographs: Uttam Ghosh/Rediff.com

I remember in late 2007, a friend wondering when the boom would end and another replying that it would not happen in the foreseeable future. He said it so forcefully that a couple of others sought tips from this individual and bought shares.

To their horror, these shares fell by 300 per cent within six months. Also, you must not get carried away by television interviews and newspaper reports.

...

How to protect your investments from asset bubbles

Image: Grow your wealth.Photographs: Uttam Ghosh/Rediff.com.

Claud Cockburn, writing for the Times of London from New York, described the irrational exuberance that gripped the United States prior to the Great Depression. He wrote:

"The atmosphere of the great boom was savagely exciting, but there were times when a person with my European background felt alarmingly lonely. He would have liked to believe, as these people believed, in the eternal upswing of the big bull market or else to meet just one person with whom he might discuss some general doubts without being regarded as an imbecile or a person of deliberately evil intent - some kind of anarchist, perhaps."

How to protect your investments from asset bubbles

Image: The New York Stock Exchange on Wall Street in New York.Photographs: Reuters.

Robert Barsky and Bradford De Long wrote in an article entitled "Bull and Bear Markets in the Twentieth Century":

"Major bull and bear markets were driven by shifts in assessments of fundamentals; investors had little knowledge of crucial factors, in particular the long run dividend growth rate and their changing expectations of average growth plausibly lie behind the major swings of this century."

I agree with this view.

...

How to protect your investments from asset bubbles

Image: Do not invest on hearsay.One bubble burst in 2008. The next bubble may not be far away. You must always beware of such a possibility.

[Excerpt from Fundamental Analysis for Investors by Raghu Palat. Published by Vision Books.]

(C)All rights reserved.

article