For the mutual fund industry, 2009 was the year of reforms. Many regulatory changes happened, some in favour of investors, others in favour of the industry. The main aim of the market regulator Securities and Exchange Board of India (Sebi) was to empower the retail investor.

Apart from all the regulatory changes, there was a dramatic stock market recovery, with Sensex climbing from 9,000 to 17,000, a rise of almost 100 per cent in a year. Most investors must be feeling happier about their portfolios lately than they did in the beginning of the year.

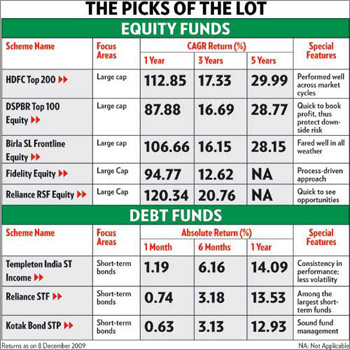

During this one-year period, the average returns of equity funds was around 90 per cent, and the maximum return which an equity fund delivered was around 160 per cent.

How is the MF investment outlook for 2010? Where should you invest? Will the promise of growth sustain in the future? These are among the questions running in our mind. Click NEXT to check out the 7 mutual fund investing rules to win. . .

7 mutual fund investing rules to stay ahead

1. Divide your allocation into two parts, short term (less than three years) and long term (more than three years).

2. Allocate your funds differently for different financial goals and invest according to your targets.

3. If your goals are short-term in nature, invest in debt-related instruments and take care that you monitor your funds regularly.

4. Mid-cap and sectoral funds should not form the part of your core portfolio. Mid-cap funds could fall faster than large-cap funds.

5. Keep an eye out for lull periods in the market, and there will be opportunities. They allow you to buy into mutual funds at lower prices.

6. Don't panic during a market downturn. It is neither the end of the world, nor does it mean that what comes down will remain down.

7. Make sure your portfolio is properly diversified across different asset classes. In this way, your investments will be protected against market uncertainities. Click NEXT to check out best mutual fund investment strategies. . .

Overall Scenario In 2010

The New Year will be a year of opportunities when you can enjoy to the fullest extent the changes that occurred in 2009. There are many things which we can expect in 2010.

Some time ago Sebi allowed MF trading through stock exchanges, but still not all the MFs can be bought and sold through the broker. Many fund houses are still evaluating these changes, while a number of brokers are not in a position to offer online MF services.

The other thing we can expect is systematic investment plan (SIP) to become available on the exchange platform. Once this new system comes into operation, investors from tier-II and tier-III cities, as well as from rural areas will be benefited along with investors in big cities.

Till recently, the reach of mutual funds was restricted to metros and tier-I cities. Close on the heels of these changes, some fund houses are planning to launch schemes with SIPs as low as Rs 50. Now, fund houses are focusing more on rural areas to tap the market.

In 2010, you should get better advice and services from your broker because you can now decide how much you need to pay, following the Sebi ban on entry load.

All these things are at an early stage, and we can expect all these to mature and fructify in the coming year. Click NEXT to check out where to invest. . .

Where to invest?

This is a very common question in the mind of every investor. Should it be equity, debt, gold or real estate? Experts say the overall outlook of our economy is quite good across all these asset classes.

Now, you have to decide how you plan your investment. We suggest you follow this very simple rule of investing: "Diversify your portfolio across asset classes, depending upon your financial goals."

Equity to stay ahead

If you are looking for an investment in equity, we would suggest that your time horizon should be at least three years, if not more. From the perspective of the equity market, the scenario is good.

We can expect a decent return from the market in the coming years. Along with that, we cannot rule out short-term volatility in the market.

"When the stimulus package is withdrawn, we will see some short-term volatility in the market," says Mahesh Patil, co-head, equity, Birla Sun Life Mutual Fund. He adds that we will see the actual recovery of the market in 2010, especially among mid-cap funds.

But if you are a conservative investor and not willing to take the higher risk inherent in mid-caps, then it is better to stick to large-cap funds. Large-cap funds also invest a part of their corpus in mid-cap stocks to get the benefit of mid-cap rally, which is usually strong. . . .

Steady as debt

The big concern for the Reserve Bank of India is rising inflation and, concurrently, the need to maintain the growth rate. In this situation, the RBI will try to suck out the liquidity, first through a hike in CRR, and make money dearer.

In the current market scenario, when the interest rates are expected to go up, we suggest that you keep away from long-term debt funds and gilt funds.

Consider long-term debt funds when the interest rates are high. "In this rising interest scenario, fixed income funds and short-term bond funds will be good choices for the debt investor. Investors should look for debt funds which have an average maturity period of one year," says Nand Kumar Surti, chief investment officer, fixed income, JP Morgan MF.

In a rising interest scenario, many of the fund houses may come up with fixed maturity plans. This could also be a good option for investors in 2010. The average return of short-term debt funds has been around 9 per cent in the last one year.

Some of the schemes in this category have given returns as high as 13 per cent. If you are shooting for a year or so, this would be a good destination for your money. Click NEXT to check out the threats and action you can take. . .

Threats

High Volatility: Last year's volatility could repeat in 2010 as fund flows could turn erratic and the global news flows on the recovery could trigger sudden dips.

No global recovery: The global market isn't still out of the woods and the signs of a sustained recovery aren't visible just yet. If the recovery is slow, it will translate into slower growth for asset prices.

Low returns: While this year saw funds deliver some fantastic returns, 2010 might not turn out to be as good. That's because stocks bounced back from their lows last year, and such rebounds might not be in the works.

Changing scenario: The economic recovery was helped by the stimulus package, but the government's fiscal situation might be a dampener and the stimulus could be withdrawn.

Changes in Direct Tax Law: The government is planning to introduce the long-term capital gains tax in the new Direct Tax Code for equity investments, which till now has been zero. Your returns from equity might be taxable.

Interest rate risk: Bond prices move inversely to interest rates. When interest rates go up, bond prices go down and vice versa. This could lead to a fall in the prices of long-term bonds.

Action

Spread risk: Nobody can predict how volatile the market would be. Therefore, diversify your portfolio across equity and debt funds, and stick to your investing plan to protect yourself from unpredictable fluctuations.

Stay invested: You may need to let your money stay invested for a long while, so when the recovery comes you are not left out and are not hit like short-term investors.

Don't chase yields: Only markets tend to have good years and bad, but over the long term, the returns are generally better than those elsewhere.

Keep a focused allocation: Do not get over optimistic about the market. Always keep your greed in control and do a proper asset allocation.

Opt for reinvestment: If you are in a higher tax bracket, the best way is to go for a dividend reinvestment plan because the net return in your hands is tax-free. The return from dividend reinvestment plan and growth plan is always the same.

Short-term solutions: Bonds with longer terms are more risky than bonds with shorter terms. Next year, stick with short-term bonds, which are less volatile.