Photographs: Andrew Winning/Files/Reuters

United Kingdom-based Cadbury, the world's second biggest confectionery company with huge operations in India, on Tuesday agreed to being taken over by Kraft Foods after agreeing to an improved offer from the US food giant.

The improved takeover offer is worth $19.6 billion.

Earlier, Cadbury had consistently rejected the takeover bid made by America's Kraft Foods Inc. However, Kraft, was hopeful that the share-and-cash offer for Cadbury would go through, and it has.

Kraft, the American food giant, said in a statement on Tuesday that Cadbury's board had unanimously endorsed the offer worth 840 pence per share. The revised offer is for 500 pence cash and 0.1874 new Kraft shares for each Cadbury share. further. . .

Kraft to buy Cadbury for $19.6 billion

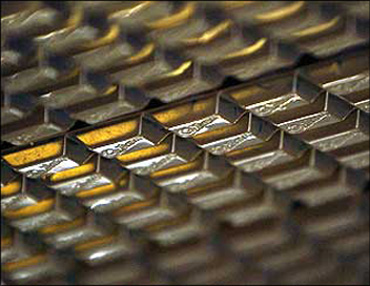

Image: Kraft products displayed at the company's headquarters in Northfield, Illinois.Photographs: Kraft products displayed at the company's headquarters in Northfield, Illinois.

The earlier Kraft offer was of $ 17.1 billion, at 770 pence per share.

In a joint statement, Kraft and Cadbury said: 'The boards of Kraft Foods and Cadbury confirm that they are finalising the terms of a recommended offer for Cadbury. A further announcement will be made shortly.'

The combination now creates a global leader in the global foods and confectionery sector. . . .

Kraft to buy Cadbury for $19.6 billion

Image: Kraft Foods Inc CEO Irene Rosenfeld.Photographs: John Gress/Reuters

Meanwhile, Cadbury shares rose by over 3 per ecnt soon after the statement.

'In addition, Cadbury shareholders will be entitled to receive 10 pence per Cadbury share by way of a special dividend following the date on which the final offer becomes or is declared unconditional,' the statement added.

'Kraft Foods believes that the final offer represents a compelling opportunity for Cadbury securityholders, providing the ability to receive approximately 60 per cent of their consideration in cash and long-term value creation potential through a continued shareholding in the combined group,' the statement said. . . .

Kraft to buy Cadbury for $19.6 billion

Image: A bar of Cadbury Fruit and Nut chocolate moves along the production line of the Bournville factory in Birmingham, central England.Photographs: Darren Staples/Reuters

'Kraft Foods believes a combination with Cadbury will provide the potential for meaningful cost savings and revenue synergies from which Cadbury securityholders will benefit,' the statement further added.

Commenting on the offer, Irene Rosenfeld, chairman and CEO of Kraft Foods, said: 'We have great respect for Cadbury's brands, heritage and people. We believe they will thrive as part of Kraft Foods. This recommended offer represents a compelling opportunity for Cadbury shareholders, providing both immediate value certainty and upside potential in the combined company. For Kraft Foods shareholders it transforms the portfolio, accelerates long-term growth and delivers highly attractive returns, while maintaining financial discipline.'

. . .

Kraft to buy Cadbury for $19.6 billion

Image: Sanjay Khosla, Kraft Foods Inc executive vice president and Kraft International president.Photographs: John Gress/Reuters

Commenting on the offer, Roger Carr, chairman of Cadbury, said: 'We believe the offer represents good value for Cadbury shareholders and are pleased with the commitment that Kraft Foods has made to our heritage, values and people throughout the world. We will now work with the Kraft Foods' management to ensure the continued success and growth of the business for the benefit of our customers, consumers and employees.'

article