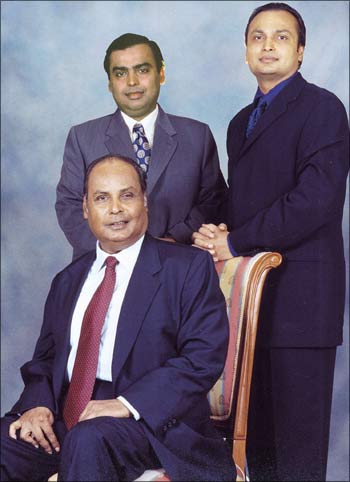

Photographs: Reuters BS Bureau in New Delhi

Reignited fraternal ties, it seems, form the basis of Mukesh Ambani's dream to build an 'ignited corporation'.

This underlying fact comes through very clearly from the growth strategy spelt out by Mr Ambani at the annual general meeting of Reliance Industries Limited.

'Think Growth' and 'Think Transformation' while thinking of Reliance, said the backdrop to the stage where Mr Ambani posed for photographs.

The growth that the elder Mr Ambani seeks now comes at least in significant part from business areas that had been given away, through a non-compete agreement, to younger brother Anil Ambani.

. . .

Ambani family truce: Good news for investors

The recent rapprochement between the brothers will enable the cash-rich elder brother to seek growth through investment in areas like power and telecommunication.

In both sectors, the synergies are significant.

The win-win deal between the brothers is based on the acknowledgment of the fact that the elder's cash will now be available to the younger Mr Ambani's plans and possibilities.

The latter needs liquidity, the former needs growth opportunity.

The potential for synergy and growth also exists in areas like retailing where the elder Mr Ambani did not do very well in the past but can now benefit from the experience of the younger Mr Ambani, who has a proven track record in the retail business.

. . .

Ambani family truce: Good news for investors

Image: The bull and the bear.The bottom line, however, is that while Mukesh Ambani has plenty of investible resources and needs new avenues for growth to deploy these resources, Anil Ambani needs the cash to grow his businesses.

This is the kind of portfolio rebalancing that the shareholders of both brothers will be happy about.

Perhaps there is some nervousness among shareholders that the rapprochement is not yet complete and irreversible.

Which is probably why the stock market reacted with some concern when the younger Mr Ambani failed to show up at the AGM.

. . .

Ambani family truce: Good news for investors

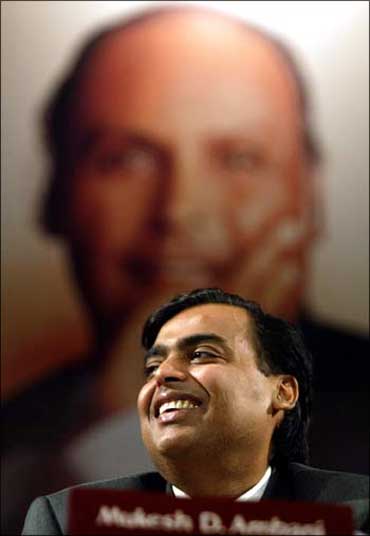

Image: Mukesh Ambani.Photographs: Punit Paranjpe/Reuters

Mukesh Ambani, however, had good reasons for offering an upbeat assessment of his company's future prospects. Both in power and telecom, RIL can find new growth opportunities.

It remains to be seen if RIL is equally lucky in retail having so far failed to make an impact.

The elder Mr Ambani's strengths thus far have been in manufacturing and infrastructure, not so in services.

It is the younger Mr Ambani who has done well in the services sector.

What is clear, however, is that the coming together of the two quarrelling brothers can help not just their respective families but also their shareholders and, it seems, all the stakeholders.

While the new brotherly bonhomie and the optimism about new growth prospects for the family's businesses give a whole new meaning to the concept of 'inclusive growth', the

Ambani brothers must pay equal attention to the challenge of the other contemporary buzzword -- good governance.

. . .

Ambani family truce: Good news for investors

Image: Anil Ambani.More so because if the two companies truly join forces, there could be the risk of excessive concentration of market power within one family.

Given the size of the family's businesses, and the share of their market capitalisation in national income, it is imperative for India's future development that RIL and ADAG also acquire a sterling reputation for good governance.

Mukesh Ambani's decision to borrow a term from former President A P J Abdul Kalam (Ignited Minds) suggests that his growth strategy is based on 'unleashing the power within' -- the book's sub-title.

The new unity within the family, it seems, is expected at least in part to unleash this internal power, to the benefit of the shareholder.

article