Photographs: Reuters.

Earlier it was companies that were going bankrupt, now countries are turning belly up. The latest crisis in Greece threatens world's financial stability at a time when many countries are slowly recovering from the global recession.

Moody's rating agency has warned of a severe risk of contagion as it expects the euro zone's debt crisis to destabilise the banking sector in several European Union countries. Stock markets across Europe have already crashed, affecting markets across the world. The euro hit a 14-month low against the dollar.

Concern about soaring government deficits and debt levels, downgrading of European government debt has raised alarm bells again.On May 10, the Eurozone countries and the International Monetary Fund finally agreed to a $1-trillion financial aid package for Greece, on the condition of implementing several austerity measures. The rescue package is aimed at ensuring financial stability across Europe. Analysts say this could have come earlier to save many other countries from falling into a deeper crisis.

Eurozone countries have total government debt worth 6 trillion pounds. While Germany accounts for 1.4 trillion pounds, while Greece is liable for 250 billion pounds.

However, the crisis is unlikely to have a major impact on Asian economies apart from Japan. While countries like India may be unaffected by the Greece crisis, many countries in the Euro zone face a grave crisis.

''As far as India is concerned, the impact on us will be minimal. In fact, in the short run - that is, purely in the short run - it might help us in terms of India being regarded as a relatively safe haven,'' Finance Secretary Ashok Chawla has said.

Moody's rating agency has warned of a severe risk of contagion as it expects the euro zone's debt crisis to destabilise the banking sector in several EU countries. The aid package led to markets across the world surging ahead.

Here's a look at the Greece crisis and other countries in financial turmoil...

All about Greece and other shaky economies

Image: A giant banner protesting Greece's austerity measures.Photographs: Pascal Rossignol/Reuters.

Greece's downfall had been scripted deftly by its governments. From one of the fastest growing economies in the Eurozone during the 2000s, Greece has now become the main culprit for this financial crisis.

From 2000 to 2007, it grew at an annual rate of 4.2 per cent as with the inflow of foreign capital into the country.

However, the global financial crisis in 2008 had hit Greece severely. Two of its major revenue streams, tourism and shipping were badly hit. The government of Greece misreported economic statistics in a bid to keep up with the monetary union guidelines.

Corruption and cover-ups added to its mounting debt. Greece had paid Goldman Sachs and other banks hundreds of millions of dollars as fees for arranging transactions that hid the actual level of borrowing since 2001.

In May 2010, the Greek government deficit was estimated to be 13.6 per cent of its GDP, one of the highest in the world. Greek government debt was estimated at Euro 216 billion in January 2010. Several people led protests against tax hikes and spending cuts announced by the government.

. . .

All about Greece and other shaky economies

Image: Portuguese workers hold a banner, 'Don't explore us more with crisis'.Photographs: Hugo Correia/Reuters

Portugal is another country in the Eurozone facing a severe crisis. According to bond markets, Portugal is the riskiest country in the Eurozone.

The country's public debt was at 77 per cent of its GDP last year and the budget deficit at a shocking 11.4 per cent of GDP.

The EU's debt crisis could spill over into banks in Portugal, Spain, Italy, Ireland and the UK, according to Moody's.

. . .

All about Greece and other shaky economies

Image: An employee counts Euro notes.Photographs: Pichi Chuang/Reuters.

Ireland is also deep in crisis with a government deficit of 14.3 per cent of GDP. The recession-hit economy plunged further with the collapse of the construction industry. The cumulative fall in GDP over three years has been 12 per cent in real terms.

The country fell into recession for the first time since the 1980s. Ireland was also the first nation in the Eurozone to enter recession. The number of unemployed people in Ireland rose to 326,000 in January 2009, the highest level since 1967.

. . .

All about Greece and other shaky economies

Image: EU Economic and Monetary Affairs Commissioner Olli Rehn (L) and Spain's Economy Minister Elena SalgaSpain with 11.2 per cent of the GDP. The interest on two year sovereign bonds has zoomed to 20 per cent, signaling the huge defaults.

Rating agencies have downgraded the debts of Spain and Portugal in addition to that of Greece. Spain's 20 per cent jobless rate is the highest in the developed world.

Standard & Poor's lowered Spain's long-term sovereign credit rating to 'AA' from 'AA+'. There could be a further downgrade.

The Telegraph quoted Finance minister Elena Salgado saying, "In Spain we have time for measures to overcome the crisis."

. . .

All about Greece and other shaky economies

Image: Anti-capitalist student protestors demonstrate outside the Bank of England in London.Photographs: Luke MacGregor/Reuters.

The United Kingdom's budget deficit will surpass Greece's as the worst in European Union as the UK government faces higher debt levels. "The economy has been more harshly impacted due to the much greater reliance on the financial sector.

Any reduction of this excess liquidity or increase in interest rates could destabilise this fragile balance, especially given that the high leverage of households provides little cushion against such a scenario," according to the Moody's report.

A BBC reported quoting former IMF chief economist Simon Johnson saying, "The UK should be seen in the same category of countries as Greece and Spain, who are facing severe debt problems."

. . .

All about Greece and other shaky economies

Image: Iceland flag.Iceland's banking collapse is the largest suffered by any country. The national currency's value has dipped sharply, and the market capitalisation of the Icelandic stock exchange has dropped by more than 90 per cent.

At the end of the second quarter 2008, Iceland's external debt was Euro 50 billion, more than 80 per cent of which was held by the banking sector. Iceland is still reeling under a severe economic recession.

. . .

All about Greece and other shaky economies

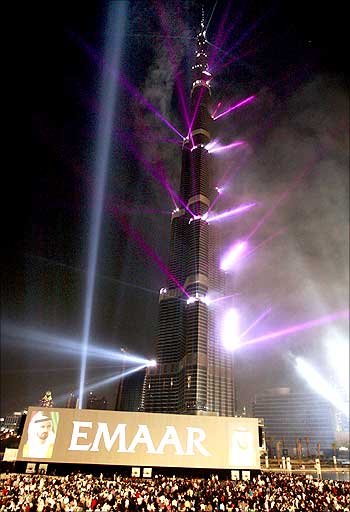

Image: Burj Dubai tower.Photographs: Mosab Omar/Reuters.

And the Dubai bust story proves that all that glitters is not gold. One of the richest cities in the world, Dubai sent shockwaves across the world when it asked creditors to freeze repayment of debt worth billions of dollars of two of its flagship firms - Dubai World and real estate developer Nakheel.

The emirate is immersed in a debt of $80 billion by expanding in banking, real estate and transportation. In November 2009, Dubai World with $60 billion liabilities sought a six-month standstill on its debt repayment to all its lenders.

article