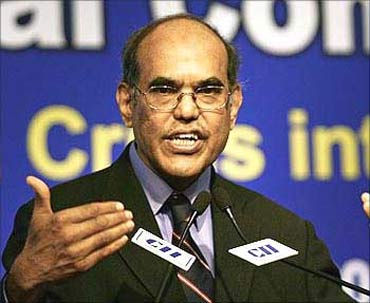

Photographs: Reuters Sumit Sharma in Mumbai

Reserve Bank of India Governor Duvvuri Subbarao says its forward guidance on a pause in policy rate hikes is in tune with best practices.

In an interview with Business Standard, he justified action against the real estate sector, saying home prices in most metros have crossed pre-crisis levels.

Excerpts:

You have held out the promise of not raising rates in the immediate future. Why this pause?

There have been six rate increases so far (this year). Monetary transmission has been good, but is still in progress.

Over the next few months, we will see a further response to actions taken since March.

The forward guidance we have given is in tune with best practices.

We are trying to manage expectations and give comfort on when we might act.

Partly, it's the media that keeps playing up when RBI may act. So, we thought we might give some guidance.

. . .

How RBI plans to tame inflation

As current account deficit widens, which is a more important variable: inflation or exchange rate?

It's difficult to say which is more important. Both are important.

Food inflation in a poor country is critical because inflation is a regressive tax on the poor.

We have also said there is a structural dimension to food inflation and a supply response to solving that takes time.

On exchange rate, it is not just one linear statistic -- whether you take the rupee-dollar reference rate or the REER of six currencies. I want to mention two things.

We don't use exchange rate for inflation management.

Secondly, there has been nominal appreciation since the beginning of this fiscal year. The real appreciation with reference to 36 currencies has been relatively modest.

The current account deficit has been widening and is close to the 3-per cent limit that you said is unsustainable in the medium term. Does that also become critical?

I don't want to sound alarmist, but 3.5 per cent, or whatever might be the outcome this year, on a single-year basis is okay.

We can live with that. But a sustained current account deficit beyond 3 per cent year after year will be difficult to manage by flows that are not of a stable nature.

We have said in the policy that the challenge is to narrow the current account deficit in the medium term and finance it in the short term.

. . .

How RBI plans to tame inflation

Do you expect the full-year current account deficit at 3.5 per cent?

It is difficult to put a number.

The first quarter, depending on what number you take for CAD, if annualised comes to 3.5-3.7 per cent.

If you extrapolate that for four quarters, it comes to 3.5 per cent. But one must also recognise that the deficit for September was significantly lower than for August.

We expect (the current account deficit for the full year) will be about 3 per cent.

One word the policy document keeps mentioning is inflation -- domestic and potentially overseas. What tools would the RBI recommend to best address inflation, especially food inflation?

Policy rates, which we have been using, certainly are a response from the demand side. Liquidity management is another instrument.

CRR, for example, is for liquidity management and liquidity has an impact on inflation management.

Even though we use CRR for liquidity management, it has an indirect impact on inflation.

On the supply side, the response for managing the structural dimension of food inflation has to come from the supply side.

That extends beyond the single-crop cycle in as much as from meat, eggs, milk and vegetables, which go beyond crop cycles.

. . .

How RBI plans to tame inflation

There are domestic supply constraints and prices globally are rising. Doesn't that put us in a bind?

Yes, of course; it put us in a bind before.

Import is not an option because most global prices are above our prices.

And whenever India enters international markets, the markets are sensitive to India entering -- these are all considerations that exist.

Home prices have risen to pre-crisis levels and RBI has begun taking action. Are we witnessing initial signs of an emerging bubble?

No, we don't see a bubble. We see a price build-up, which is what we said.

Home prices in most metros have not only reached pre-crisis levels, but have even crossed that. We wanted to ensure that this is not credit-driven.

There are also some loose practices developing such as 90/10 (loans up to 90 per cent of property value).

We wanted to curb that. There is no bubble. We just wanted to rein in the housing sector's credit growth.

. . .

How RBI plans to tame inflation

How do you feel when you raise rates today and commercial banks almost immediately say they don't plan to increase their lending rates. Are there gaps in monetary transmission that need to be plugged?

Yes, on a systemic basis, our monetary transmission system is not as efficient as the transmission system of advanced economies.

We need to improve that. But since March, whatever actions we have taken has transmitted.

Banks have raised deposit and lending rates.

I believe that's still work-in-progress, even though their response today has been whatever it is.

I can see there is room for a further increase in lending and deposit rates.

But if banks almost immediately say they won't raise rates, doesn't that dilute, maybe not defeat, the policy objectives?

Banks may have their own motivations for responding in a certain way immediately and responding later on as, indeed, has been the practice over the past several months.

Banks have said they may not respond immediately, but they have responded. So, we must give them time to understand, appreciate and respond.

. . .

How RBI plans to tame inflation

Some industry associations have termed RBI ultra-cautious and said its move could end up hurting other core industries.

It's a fair criticism and we are open to criticism. Some people can call us ultra-cautious.

In terms of flow of credit to the housing sector, I can visualise certain interest groups -- legitimate interest groups -- seeing it as ultra-cautious, but we believe that it is prudent.

Any other sector where you feel RBI needs to be cautious?

If we needed to be cautious, we would have acted. So, this is the only sector we thought should receive attention at this point of time.

On liquidity, you have almost changed your stance from 'in deficit' mode to Rs in balance'. How will it affect your battle against inflation?

I don't think it will affect the battle against inflation because we have said that it will be in deficit mode and it is in deficit mode.

The question now is by how much. We should give some guidance in that regard so we said the liquidity adjustment facility corridor should be plus-minus 1 per cent of NDTL (net demand and time liabilities).

In an extreme case, if it is plus 1 per cent, it will still serve the inflation management purpose.

I don't think the cost of managing inflation is any different if the deficit is Rs 75,000 crore (Rs 750 billion) or Rs 50,000 crore (Rs 500 billion).

. . .

How RBI plans to tame inflation

Is there a mechanism you plan to set up for more effective assessment of and timely response to liquidity situations? Also, what led to a situation where call rates rose to 12 per cent last Friday before RBI had to act?

(Laughs) The liquidity situation over the last two weeks was an outcome of both structural and frictional factors.

The structural factors were deposits being sluggish and credit expansion being rather rapid relative to deposits.

The frictional factors were built up in government cash balances.

They were also caused by the Coal India IPO.

We have responded over the weekend to frictional factors.

Today, we have responded to the structural factors.

We believe it will resolve itself as the government starts spending, as deposits grow and as open market operations progress.

On the first question, the market has matured to take care of lumpy flows, which are known to reverse in a short period of time, as we saw in the Coal India experience.

. . .

How RBI plans to tame inflation

What prompted moves to improve regulation of financial conglomerates?

Financial conglomerates have been big issues in the financial crisis.

If there is problem in one, it transmits and the contagion effect is quite high.

So, we thought whatever prudential regulation we apply at the institutional level must also apply at the conglomerate level.

When could we see more bank licences issued?

That's a question the finance minister asked me, too.

We expect the guidelines in January. I am told this is a very rigorous and extended process of calling for applications, evaluating them and taking a decision. I think the timeline will come along with the draft guidelines.

Could we consider a Tobin tax or other measures to ensure capital flows are not unbridled?

We have some restrictions. We are known to manage our capital account cautiously, some people say ultra-cautiously.

That has stood us in good stead in times of crisis and normal times. We keep calibrating these measures all the time.

A Tobin tax is not off the table, but it is not something we will take lightly because it is distortionary and its effectiveness is not proven.

It's difficult to implement and easy to evade, and even countries that have imposed a Tobin tax have problems with it.

As much as it is on the menu of options, it is not an immediate option.

. . .

How RBI plans to tame inflation

We have read about currency wars. How well prepared are we? Quantitative easing, or QE-2, threatens to increase liquidity and change the entire scenario.

On currency wars, we are on the sidelines as it were. We are quite uniquely positioned in the sense that we have a current account deficit. We have not built our reserves as a measure of self insurance.

We don't intervene in the foreign exchange market as an instrument of trade policy. It's only for macroeconomic management that we intervene on the foreign exchange market. So, we are neatly placed in that regard.

As much as 'currency wars' is an unfortunate phrase, the adjustment has to be by countries, which are chronically in surplus or chronically in deficit because of circumstances which are different from ours.

On QE-2, we have taken that into account. But it's yet to be announced and should it be totally out of line, we will take action. But if it's along expected lines, we will be able to mange that.

article