Photographs: Jayanta Dey/Reuters Katya B Naidu in Mumbai

Bharti Airtel, the country’s largest operator of mobile services with a little over 200 million subscribers, was a distant second to Vodafone in Mumbai: as against Vodafone’s 7 million subscribers, it had only 4.2 million.

With the acquisition of Loop Telecom’s 2.9 million subscribers, reportedly for Rs 700 crore (Rs 7 billion) from the Dubai-based Khaitan family, Airtel will inch ahead of its rival.

Is this one-upmanship at the core of the acquisition announced earlier this week?

Clearly not: mobile telephony is no longer just about adding numbers.

The hara-kiri of 2010-11, when telcos acquired customers at a loss, drove home the lesson that the quality of customers matters more than anything else.

Actually, the numbers game is not in play at all.

. . .

Airtel gets Mumbai edge with Loop buy

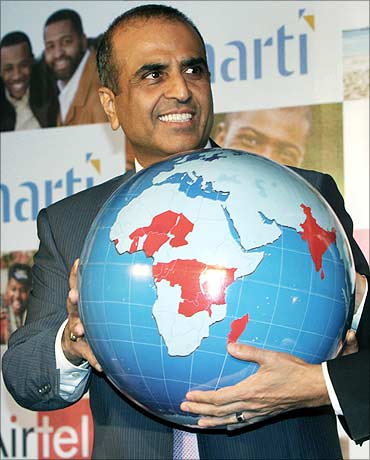

Image: Sunil Bharti Mittal, chairman of Bharti Airtel.Photographs: Reuters

While Loop does have 2.9 million subscribers, only 47.3 per cent are ‘active’ -- one of the lowest in the industry.

In other words, Airtel will get only 1.36 million active subscribers from the acquisition. But, Loop has a very large pool of post-paid subscribers: 40 per cent.

For most other telcos, the average is not more than 20 per cent.

These are high-revenue subscribers.

“The subscribers that have stayed on with Loop are loyal. It is very unlikely that they would port out,” says Alok Shende, principal analyst and co-founder of Ascentius Consulting.

To understand how this happened, one needs to go back in time.

When mobile telephony licences were first given out in 1994, two companies had got the lucrative Mumbai circle: Hutch Max (now Vodafone) and BPL Mobile Communications.

. . .

Airtel gets Mumbai edge with Loop buy

Photographs: Reuters

The second company was owned by BPL Communications (74 per cent) and France Telecom (26 per cent). Rajeev Chandrasekhar was the principal owner of BPL Communications with a 63.07 per cent stake.

As it was amongst the first two operators, it got high-value customers and was also able to lock in many companies.

That’s why Loop boasts of enviable average revenue per user, or ARPU: Rs 350-400 a month for post-paid subscribers and Rs 100-120 for the pre-paid category (which are both higher than Mumbai's average).

Its overall ARPU of Rs 225 is higher than Airtel’s (Rs 195) and more than double of the national average.

What makes it all the more interesting is that Loop has higher ARPU even though it does not offer high-speed data services like 3G.

Airtel, experts believe, will not let these high-quality subscribers remain on 2G data networks.

There is, therefore, a strong upside to the business.

. . .

Airtel gets Mumbai edge with Loop buy

Photographs: Reuters

The growth path

About 10 years ago, Chandrasekhar sold BPL Mobile Communications to the Khaitan family.

The business was renamed Loop.

At one time, the company had serious growth ambitions.

In 2007, when then telecom minister Andimuthu Raja decided to hand out new telecom licences, Loop applied for 21 circles: all the 22 telecom circles in the country minus Mumbai where it already owned spectrum.

By September 2009, Loop was assigned spectrum in all the 21 circles except Delhi where a queue had formed.

But the going was far from easy. Cut-throat competition had made tariffs plummet to unviable levels.

The whole sector began to bleed. Then, in March 2011, Loop made an offer in the Supreme Court to put up its licences for 21 circles along with spectrum for auction by the government.

. . .

Airtel gets Mumbai edge with Loop buy

Photographs: Reuters

Any amount that the government got over and above the Rs 1,454 crore (Rs 14.54 billion) that Loop had paid, the company said, it was free to keep.

Before that could happen, the Supreme Court in February 2012 cancelled all the 122 licences handed out by Raja.

Loop refused to participate in subsequent spectrum auctions.

It holds spectrum in Mumbai till November 2014, when the lease agreement signed 20 years ago runs out.

It had moved the Telecom Disputes Settlement & Appellate Tribunal to renew the licence, but the plea was struck down.

But that should not worry Airtel too much.

During the recent spectrum auction, it acquired 5 MHz in the 900-MHz band for Rs 2,800 crore (Rs 28 billion) and 6 MHz in the 1800-MHz band for Rs 1,600 crore (Rs 16 billion).

. . .

Airtel gets Mumbai edge with Loop buy

Photographs: Shannon Stapleton/Reuters

“Mumbai is likely to evolve as a 3G and 4G market and Airtel seems quite well equipped with its recent acquisition of spectrum,” say Suresh A Mahadevan and Varun Ahuja in a research report by UBS.

The spectrum will allow Airtel to launch 4G services along with the existing 3G services, and thereby sell more to its newly-acquired Loop subscribers. Airtel, like other top telcos, is now looking at growing margins as opposed to volumes.

“The challenge is to increase earnings from low volumes,” said Gopal Vittal, the managing director of Bharti Airtel, recently at a conference.

Thus, in addition to steadily increasing tariffs, selling more services to its existing subscribers is on the telco’s radar.

Shende says that Delhi and Mumbai, with the fastest growth in data usage, are the best targets as telcos make this strategic shift.

. . .

Airtel gets Mumbai edge with Loop buy

Image: A schoolboy uses his cell phone to take a picture of classmates hanging onto cement roots at Nek Chand's Rock Garden in Chandigarh.Photographs: Andrew Caballero/Reuters

A wise buy?

Though Airtel has acquired expensive spectrum in Mumbai, tariff increases, business integration synergies as well as reduction in brand spending by Loop will aid in lowering costs, according to experts.

“We believe there are several synergies in the transaction like billing, customer service, IT systems, network maintenance, marketing and sales,” the UBS report says.

Loop has been aggressively branding itself within the city using outdoor media, radio channels as well as other on-ground promotional activities, which will now vanish as Airtel will merge the brand into itself.

Some experts wonder if Airtel paid too much for the subscribers it is getting from Loop. Though the deal value was not disclosed, it is being pegged at Rs 700 crore (Rs 7 billion).

“This implies a valuation of Rs 4,880 per active subscriber for Loop, which may look expensive in comparison to Idea (a pan-India operator) which is trading at Rs 4,650 per subscriber,” says a research report by ICICI Securities.

. . .

Airtel gets Mumbai edge with Loop buy

Photographs: Reuters

Still others feel that Airtel has not overpaid.

“All acquisitions are at a premium.

“When Vodafone acquired the Hutch business, it was at a high valuation. But, going ahead the business did add value and generate revenues,” adds Shende.

Yet another concern analysts have raised is that the deal may worsen the debt burden of Bharti which is already over Rs 66,700 crore (Rs 667 billion).

Loop too comes with a debt of around Rs 460 crore (Rs 4.6 billion).

However, rating agency Moody’s downplays these concerns, and says that this acquisition is credit positive and also earnings before interest, depreciation, tax and amortisation accretive.

“This is a relatively small acquisition, and we expect it to have minimal cash impact on Airtel as a significant portion of the cost represents assumption of Loop’s outstanding loans.

Airtel will be able to fund the acquisition cost with existing funds without the need for new borrowings,” says Laura Acres, senior vice-president at Moody’s.

. . .

Airtel gets Mumbai edge with Loop buy

Photographs: Reuters

As Loop’s telecom licence is all set to expire this year, the only other asset that Loop adds to Airtel is its network infrastructure.

It has over 2,500 cell sites and 220 retail outlets, which will complement Airtel's already large network of retailers.

Loop also owns 400-odd telecom towers as well as fibre-optic network which will give the company the base to expand its 3G and 4G networks going ahead.

Consolidation ahead?

The BIG question is if the Loop acquisition will trigger a wave of consolidation in the sector?

Will the smaller telcos, with their lesser financial muscle, sell out to the larger ones? Some do believe that 11 to 12 telcos cannot survive in each circle.

A recent report by Fitch says that Airtel, Idea Cellular, Vodafone, Reliance Communications and Reliance Jio would be left standing after a consolidation that is likely to hasten after the recent spectrum auctions. Tata Teleservices, Sistema Shyam and Videocon could be amongst the telcos looking to exit, the report adds.

M F Farooqui, the department of telecom secretary, says the regulations for telecom mergers and acquisitions will be notified in 10 days.

article