In a tussle between two index heavyweights, it seems like ICICI Bank won the battle for the day as Reliance Industries, which also reported better-than-expected results pared gains as the day progressed.

In a tussle between two index heavyweights, it seems like ICICI Bank won the battle for the day as Reliance Industries, which also reported better-than-expected results pared gains as the day progressed.In fact, ICICI Bank was the biggest contributor to the market's up move.

The private sector banking major -- ICICI Bank -had come out with its numbers late on Friday.

It reported a 22% jump in Q2 net at Rs 1,395 crore (Rs 13.95 billion).

The Nifty helped by these strong corporate earnings and renewed buying in realty space surged to a high of 6132 in late noon trades.

The index finally ended at 6,118 -- up 100 points.

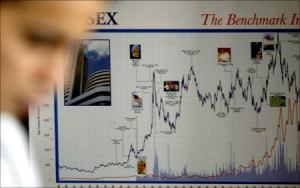

The Sensex ended at 20,356 - up 323 points. Trading in the BSE had been halted for over three hours today, from 1200 hrs to 1430 hrs due to some technical glitches whereby members were facing problems in getting trade confirmations.

Meanwhile, the Euroepan markets too reaffirmed the bullish global trend. The FTSE, CAC and DAX were up around 1% each in morning trades. Also, the US market futures - the Dow Jones futures are trading 70 points higher.

Rate sensitive banking and realty stocks rose. Realty's star was Jaiprakash Associates which came out with its numbers today. The company reported a 87% drop in Q2 net profit at Rs 115 crore. The stock, however, jumped 3.7% to Rs 125.

"Triggers in terms of timely commissioning of Hydro power for JPVL, increased land sales in JPI and JPA and pick-up in cement cycle fares well for upsides in stock.

"We maintain an 'Accumulate' rating on the JP Associates," as per research report from Prabhudas Lilladher.

Bank Nifty gained 3.5% on buying in ICICI Bank. Canara Bank, HDFC Bank, Axis Bank, Bank of India and Oriental Bank of Commerce are some of the other gainers. Investors are now awaiting the RBI policy review scheduled for Tuesday.

A rate hike of 25 bps is being expected by analysts. The Reserve Bank of India has decided to extend the special liquidity measures up to November 4.

"There are few data points which may keep RBI in a double-mind

to increase the interest rate this time. RBI may wish to hike Reverse Repo rates in line with their recent efforts of reducing the 'interest rate corridor," said Jagannadham Thunuguntla, Strategist & head of research, SMC Global Securities.

Market heavyweight, Reliance's strong quarterly performance had a positive response in morning trades as the stock gained to its highest in six-months.

However, it started slipping in noon trades and dropped below the dotted line towards close.

The stock finally ended marginally in red at Rs 1,093. Mukesh Ambani-led RIL had on Saturday posted a net profit of Rs 4,923 crore, a jump of 27.8% in the July-September quarter, as opposed to Rs 3,852 crore in a year-ago period.

IT stocks gained on a buying spree. CMC soared 12% to Rs 2,1,375. Financial Technologies, OFSS and Infosys were the big gainers in the space today.

Asian markets also ended in green as China's Purchase Managers Index spiked to 54.7 from 53.8 in September higher than the median projected pulling the Shanghai Composite up 2.5%. The Hang Seng jumped 2.4% to 23,652.

Tokyo market was weighed by concerns over the outlook for earnings and a strong yen.

Suzlon surged 6% to Rs 59 - recovering from its low of Rs 55. Mahindra & Mahindra, BPCL, Bharti Airtel, HDFC and Sun Pharma were some of the other Nifty gainers.

However, Maruti Suzuki slipped 3% to Rs 1,507. Credit Suisse downgraded the stock to neutral from outperform following the run up in the stock price.

Hero Honda, NTPC and Gail were some of the other losers. SAIL was down marginally at Rs 193.