Photographs: Reuters Bhupesh Bhandari

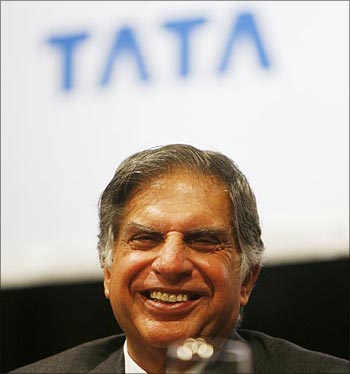

India Inc entered the 21st Century more confident and more competitive. Many of the previous decade's top ten were not even around a decade earlier. In this era of change few thought in year 2000 that by 2010 Ratan Tata would continue to head any list of high performers. He did!

Life began for Ratan Tata in 2000. That year, Tata Tea acquired Tetley of the United Kingdom. This was the first major acquisition of a global brand by an Indian company.

Four years later, it was Tata Motors' turn -- it bought the heavy vehicles business of bankrupt Daewoo Motors in South Korea. Next year, Tata Steel acquired NatSteel in Singapore. All of this paled into insignificance in 2007 when Tata Steel bought Anglo-Dutch steel maker Corus for $12 billion. It made Tata Steel the fifth largest steel company in the world.

A year later, Tata Motors became the new owner of marquee brands Jaguar and Land Rover after it paid Ford $2.3 billion. The crowning glory came in 2009 when he launched an ultra-low-cost car, the Nano. Not bad at all.

The decade that draws to an end will go down in history as the one in which Indian business spread its footprint across the globe. Strong economic growth till 2008, which was driven by domestic consumption, had filled the coffers of most companies.

The flow of global capital had taken the stock markets to new heights, which made Indian businessmen rich beyond compare. The list of Indian billionaires had become long. They had the money to buy assets that were on the block. further. . .

Top 10 Indian companies of the decade

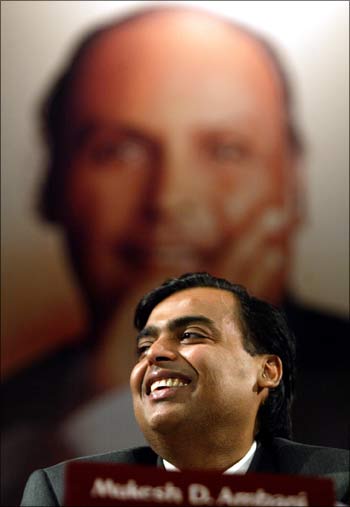

Image: Reliance Industries chairman Mukesh Ambani.Photographs: Reuters

Reliance Industries got even bigger in 2002 when it announced India's biggest gas discovery in the Krishna-Godavari basin.

That year it acquired Indian Petrochemicals Corporation and merged Reliance Petroleum to become the country's largest company in the private sector. RIL entered the Fortune 500 list two years later.

In 2000, Reliance Industries' assets were worth Rs 50,000 crore -- not small by any standard. Today, the assets are worth Rs 2,45,706 crore. The revenue of the unified Reliance Group stood at Rs 21,541 crore in 2000. In 2008-09, in contrast, Reliance Industries clocked a turnover of Rs 1,39,269 crore.

Top 10 Indian companies of the decade

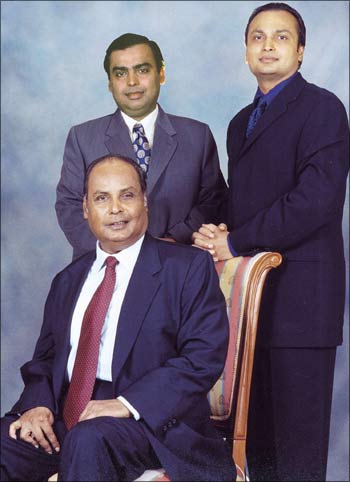

Image: Reliance founder late Dhirubhai Ambani (seated), with his sons Mukesh and Anil (right).Photographs: Reuters

But the decade's big story for the Ambani family was sibling rivalry. Anil, the younger of the two Ambani brothers, accused Mukesh of usurping the family stake after the death of patriarch Dhirubhai in July 2002.

It turned out to be a no holds barred fight, which should come to a head early in the New Year in the nation's Supreme Court. In the settlement of 2005, Mukesh retained control of the oil & gas and petrochemicals business, while Anil got power and telecom.

Mukesh has since then diversified into retail, while Anil has taken strides in entertainment -- he acquired Adlabs and Steven Spielberg's Dreamworks studio. The Reliance business empire thus looks very different from ten years ago.

Top 10 Indian companies of the decade

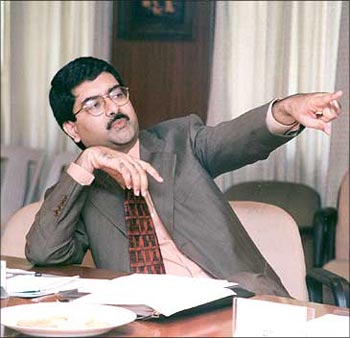

Image: Aditya Birla Group chairman Kumaramangalam Birla.Photographs: Rediff Archive

Hindalco, of the Aditya Birla Group, bought Canadian aluminum maker Novelis for $6.4 billion.

Suzlon, set up in 1995 by Tulsi Tanti and now the world's third-largest wind energy company, shelled out $525 million for Hansen Transmissions of the Netherlands and $1.6 billion for REpower of Germany.

Vijay Mallya downed Scottish whiskey maker Whyte & Mackay for close to $1 billion. Dr Reddy's paid over $500 million for Betapharm of Germany, Ranbaxy $324 million for Terapia of Romania.

There were numerous other buys across the world in telecom, engineering, financial services, FMCG, information technology et al. In addition, Indians began to get plum projects. GMR bagged a $2.57 billion project to modernise an Istanbul airport. Indian business, in short, acquired a global spread.

Top 10 Indian companies of the decade

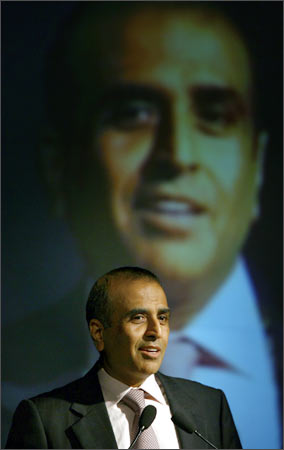

Image: Bharti Airtel chairman Sunil Bharti Mittal.Photographs: Reuters

Almost 530 million Indians own a phone now and Bharti Airtel has grown to cater to a 110 million of them. It has a 24 per cent share of the GSM mobile phone market, though its share of revenue is 31.8 per cent.

This clearly shows that the company has moved up the value chain -- it has managed to acquire better customers than rivals. Airtel, surveys have shown, is the second most-admired Indian brand after state-owned Life Insurance Corporation.

The company wants to take it to the top slot as quickly as possible.

Growth of homespun information technology companies has been no less spectacular.

Top 10 Indian companies of the decade

Image: Former TCS chief executive officer S Ramadorai.Photographs: Reuters

The big three -- TCS (Tata Consultancy Services), Infosys and Wipro --all earn over a billion dollars in revenue every quarter.

From a few thousand at the turn of the last decade, TCS has on its rolls 143,000 men and women in 42 countries. Infosys employs 105,000 people in its 50 centres spread across India, China, Australia, the Czech Republic, Japan, Poland, Canada and the United Kingdom.

Wipro has 95,000 people in its 50 centres across the globe -- it is the world's largest independent provider of research and development services. These companies have used the organic as well as inorganic route to growth.

Top 10 Indian companies of the decade

Image: Malvinder Mohan Singh who sold Ranbaxy to Daiichi of Japan.Photographs: Rediff Archive

It was a paradigm shift. Businessmen were no longer ashamed of selling off their businesses. It came to be known as unlocking value.

Apart from Ranbaxy, quite a few other Indian pharmaceutical companies changed hands during the decade -- Matrix Labs, Panacea Biotech and Dabur Pharma.

In other sectors, Gujarat Ambuja was sold to Holcim, Shaw Wallace breweries to SABMiller and distilleries to Mallya, and Maruti Suzuki became a subsidiary of Suzuki Motor Corporation. It became a long list. Investment bankers say more iconic names will be sold in the years to come.

Top 10 Indian companies of the decade

Image: ITC chairman Yogi Deveshwar.This was also the time Indians began to innovate their business model. Take ITC, for example. It was in the 1990s a largely cigarette company. But YC Deveshwar, who took over as the company's chairman in 1996, was quick to realise the need to spread the risks.

Tobacco was hardly a sunrise business. As it was not a "public good", the government was always ready to increase the taxes. So, the company expanded its hotel and paper business, and, more important, made a big splash in FMCG -- from personal care to snack food, stationery, lifestyle retail, matches and even incense sticks.

This part of the business has grown from Rs 109 crore in 2002-03 to Rs 3,014 crore in 2008-09. It was the first to seize the opportunity in the rural markets when it set up e-choupals which dispensed market-related information to farmers.

Top 10 Indian companies of the decade

Image: ICICI Bank CEO Chanda Kochchar.Photographs: Reuters

The decade will always be remembered for the way Indians bought, shopped and banked. There was a virtual credit explosion -- people bought everything from automobiles to homes and even a pair of jeans on installments. Credit card numbers recorded a huge jump. Banks automated rapidly and sold more than just deposits and lockers.

Such a strategy helped ICICI Bank race past all banks in the sweepstakes, except State Bank of India. In the early parts of the decade, it brought its wholesale and personal banking operations under one roof.

This gave it added muscle. It was at the forefront of installing ATMs (automated teller machines) across the country, which cut the queues in its branches and therefore improved service standards. It went aggressive on credit cards, personal loans and cross-sold products to depositors -- life insurance, automobile finance, housing loans, advisory services etc.

It made Indian banks rethink their business model, including SBI. Its assets stood at $77 billion in June 2009, up from around $3 billion ten years ago.

Top 10 Indian companies of the decade

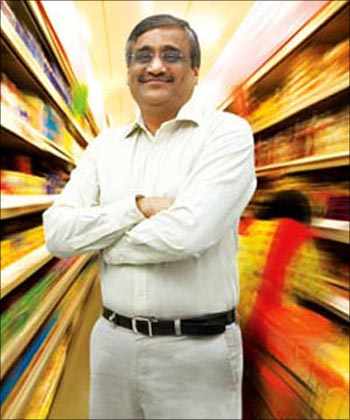

Image: Future Group chairman Kishore Biyani.Photographs: Rediff Archive

ICICI Bank's counterpart in retail was Kishore Biyani. The unassuming Marwari from Mumbai first got into organised retail with the Pantaloons family store in 1997. This was followed in 2001 with the launch of Big Bazaar, a hypermarket format that democratised shopping in India.

It blended the look, touch and feel of Indian bazaars with aspects of modern retail like choice, convenience and quality. Supply chain expertise did not exist in India.

Biyani built it from scratch. When commodity prices shot up to unheard of levels in 2007 and 2008, he held on to his prices. His people in the store wore T-shirts that said "Garv se kaho hum kanjoos hain" (Say with pride we are misers).

When large FMCG companies didn't agree for higher margins, he stopped stocking their merchandise -- such was his clout. With his large scale of operations, he always paid the lowest rent in the industry. He introduced the concept of store brands or private labels in the country.

Big Bazaar was followed by a number of other formats including Food Bazaar, Central and Home Town. He also diversified into finance, logistics and media. In between, he even wrote a book which was aptly titled "It happened in India".

article