Bhupesh Bhandari and Amit Ranjan Rai in New Delhi

The Bharti Group, promoted by the Mittal family, had searched high and low for a foreign partner when it wanted to start its cash & carry (organised or modern wholesale) business.

The expertise just did not exist in the country. The only way to begin was with help from a large foreign player. And most of them were indeed interested in India, the last virgin territory.

After playing footsie with Carrefour, Tesco and Walmart - the three biggest names in the business -- the Bharti Group finally walked the altar with Walmart in August 2007. Thus was born the 50:50 joint venture, Bharti Walmart.

The first Bharti Walmart store, called Best Price Modern Wholesale, opened in Amritsar in May 2009. Walmart India President and Bharti Walmart managing director & CEO Raj Jain says it is still early days to discuss performance.

But a clear outline of his strategy has begun to emerge. And it straddles the entire gamut from market segmentation to prices, supply chain, real estate and human resource.

How Bharti Walmart runs its business

Image: A Wal-Mart worker.Small is big

There are close to 7 million grocers in the country. Out of these, not more than 80,000 are serviced directly by companies like Hindustan Unilever, Procter & Gamble and Colgate-Palmolive.

The others depend on wholesalers. Their large numbers mean they account for large volumes. Jain reckons that even in highly-evolved categories like toothpaste or tea, over 40 per cent of the volumes pass through the wholesalers to the small grocers.

This is the market Bharti Walmart has set out to tap.

At the Amritsar store, grocers comprise almost 70 per cent of the company's customers -- the rest are bunched together as Horecas (hoteliers, restaurantiers and caterers), though some wholesalers also pick up merchandise from there.Out of these, almost half are small grocers. Jain, in fact, wants to go down one step further. He has an eye on the green grocers who sell their stuff on pushcarts in most towns and cities.

Bharti Walmart has, to begin with, obtained licences for 10 such pushcarts from the Amritsar municipality; they will pick up the green groceries from the Best Price store every morning and then fan out in the city.

If the experiment succeeds, the company could make available more pushcarts.

The all important question is that why should small grocers pick up their wares from the Best Price stores? The wholesale network may be antiquated but it has worked. Wholesalers extend credit to the retailers. The relationship often spreads itself over generations.

How Bharti Walmart runs its business

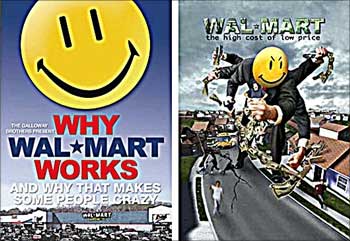

Image: A Wal-Mart ad.Price matters

The biggest attraction, of course, is the price. Jain says that Bharti Walmart prices are 1 to 7 per cent lower than those of the wholesalers. This, mind you, has happened when the company has just started out and supply chain efficiencies are yet to be maxed. Once that happens, says Jain, Bharti Walmart prices could be up to 15 per cent lower.

There is another way the smaller grocer benefits from buying his stuff at the company's store. Most companies and wholesalers give volume discounts. Larger the order placed by the retailer, lower the price. This is where the smaller grocer happens to be at a disadvantage.

Bharti Walmart has the same price for all - there is no volume discount. This works in favour of the small grocer.

Walmart the world over is known for the tough prices it negotiates with its suppliers. Because of the large volumes it can offer, it squeezes the last penny out of its suppliers. But that strategy it can hardly use in India -- it has only one store in operation and can, therefore, not leverage volumes for low prices.

"We are able to negotiate better prices than the wholesale market," Jain puts it candidly. "We may be small and new to India but a lot of our suppliers work with us globally. So they understand the fact that we are going to become big as we go along. That's why we can negotiate better terms than the wholesalers."

Jain says there is another advantage that Bharti Walmart has built into its business model over the wholesalers. Most wholesalers are reluctant to stock a new product because of the risk involved - it can block shelf space but may not sell.

"We can have a dialogue with the producer that we can help it establish the product. This can help us get better leverage and price," says Jain.

How Bharti Walmart runs its business

Image: A cashier at work at a Wal-Mart store.Variety, variety

The other factor that draws grocers and Horecas to the Best Price store, says Jain, is the range of products available. All told, the company keeps around 6,000 SKUs (stock-keeping units). Several of these cannot be found elsewhere in the market, he adds.

"Horecas come to us because they get all they need under one roof and we keep specialty items they need -- broken cashew nuts, for example. Halwais need it to for the sweets they prepare. That may not be easily available in the Amritsar market. We have big kadhaisand spatulas with a special handle. We have dish to buy which caterers earlier came to Delhi," says he.

The store even stocks machines that can detect fake notes. "There is a huge problem of fake notes in India, especially in the border towns. There is a machine to identify fake notes of Rs 100 and Rs 500. We find a huge market for these machines.

Even banks are negotiating. Shopkeepers are buying it in large numbers," says Jain.

This is the kind of stuff, he adds, which is not available anywhere else in the market.

Also, the supply chain created by Bharti Walmart ensures that product availability is not erratic. This is a problem grocers often face with wholesalers. In case of a disruption, the wholesaler has no means to repair it. Two months ago, there was a severe shortage of butter across the country.

Thanks to inadequate monsoon rains, milk production had gone down. Cities had consequently run out of butter. "Since we deal with large manufacturers, we were able to move in refrigerated trucks from Anand (in Gujarat) and other bases to Amritsar. We sold lots and lots at a time when no butter was available on the regular channels for three to four weeks," says Jain.

How Bharti Walmart runs its business

Image: A Wal-Mart store.Supply score

What is critical, therefore, is the supply chain. Bharti Walmart has put its 1,000-odd suppliers in four buckets. On the top are about 50 large suppliers like Hindustan Unilever and Procter & Gamble. "These are easy to work with because they understand modern trade and know us globally," says Jain.

"But the truth is that many of them are not used to dealing with this kind of trade in India. So, they have to develop skills and capabilities in this area. The information technology systems of some of them are not geared to supply online. Their pack sizes are largely designed for wholesale trade. We can't sell that."

All suppliers, big and small, are given a time for delivery. They need to supply within two hours of that. Once the window shuts, they are asked to wait till the next slot on the unloading bays is available -- that could happen a full day later.

The demurrage charges are borne by the supplier. Bharti Walmart maintains a score card for each supplier. Any consignment that arrives bang on time gets full marks (100 out of 100) and the one that rolls in once the window is shut gets zero.

"That is the negotiation that we have with the supplier - what is the scorecard vis-a-vis what was committed. That's how they get penalised. In most cases, as of now, there is no financial penalty. It is more a question of negotiations on promise versus performance, how to improve it," says Jain.

So, what is the score of the large suppliers -- the companies that have some exposure to modern trade? "The average score has seen double-digit gains in the last six months for all the large suppliers. Some of the best scores are in the 90s and the worst in the 50s," says Jain.

"Our objective is that everybody should be in the 90s. Globally, you can expect to be as high as 97 or 98. So there's a lot of work that still needs to be done." But Jain cautions about irrational expectations: "We need to design systems that are centric to India, which is a very unique place in terms of logistics and sanctity of deadlines."

The next bucket is 20 to 30 Indian companies that do not have global exposure but have the financial capacity and the managerial wherewithal to be able to become a part of an efficient supply chain - companies like Marico and Dabur.

"There is some little work that needs to be done to help them in their exposure to modern trade," says Jain. And what does their scorecard say?

"Their score would be lower, so we thought, but some of them have improved very well. They are hungry to learn and perform better," says Jain.

The third bucket has hundreds of small- and medium-sized suppliers. These are essentially regional players who make stuff like soap, papad and pickle. Some of them are strong regional brands but have no national exposure. Their financial capacity is limited and they have almost no managerial bandwidth.

Their exposure to modern trade is almost zero. "Here the task is huge because they need technology, financial and managerial help," says Jain.

"We are working with them on how to bring up their capacity and capability to deal with us. We don't give them financial aid. But their relationship with us helps them get money from banks."

Jain has put together a team of ten to deal with such suppliers. Independent auditors help them raise their standards in issues like food safety, ethical compliance and child labour.

Finally, there are the co-operatives. Some of them could have strong brands like Verka. "Here the challenge is quite different. They have the financial capability but they don't have the commitment. In some cases, it is simply too bureaucratic to improve things. It's a much slower burn than we would like it to be," says Jain.

In sum, how does the Indian supply chain compare with the Walmart chains abroad in efficiency? Jain admits that such benchmarking is being done internally but a comparision is unfair at this moment.

"We are just about showing up in the radar -- it is still too early to compare us with the international standards. You can't do in six months or one year what others have done over ten years."

How Bharti Walmart runs its business

Image: Policemen stand inside the first cash-and-carry Wal-Mart store during its inauguration ceremony in Amritsar.Photographs: Munish Sharma/Reuters

Space and people

The cash & carry segment in the country is still small. There are only two players -- Metro of Germany with five stores and now Bharti Walmart. Technopak Advisors Associate vice-president Purnendu Kumar thinks the size of the cash & carry market is around Rs 800 crore (Rs 8 billion at the moment but could grow to Rs 15,000 to 16,000 crore or Rs 150 to 160 billion in the next five years.

"Others like Carrefour and Tesco are bound to enter in the days to come," says he. "The next year should be good to watch as more players will speed up operations. We should see the segment mature a bit which is not the case now," adds Ernst & Young Partner & National Leader (retail and consumer product practice) Pinakiranjan Mishra.

Cash & carry are large boxes located outside the town. Bharti Walmart had initially planned to open 12 to 15 such stores in five years. With the correction in real estate prices over the last one year, Jain says this target will be achieved in three years' time.

The company could own these boxes or take them on lease from landowners. Rentals, Jain has decided, should be between 2 per cent and 5 per cent.

"Ideally, it should be 2 per cent. But in India it is not possible right now. Anything above 5 per cent doesn't work for us," says Jain. Most retailers fork out up to 20 per cent of sale as rent. This tight control over real estate price, Jain admits, has made site-selection difficult.

"As we have established ourselves, people have understood what we want. We have a lot of people who come to us and offer their land," says he.

More than real estate, Bharti Walmart needs to have the right mix of people -- men and women with exposure to global best practices in supply chain and inventory management, and store attendants who ought to make sure the small grocer does not get intimidated.

Jain says all the people in the Amritsar store are locals, except perhaps the store manager, who speak the same language as the smallest grocer. The company puts all attendants through a finishing school it has set up in the city with the Punjab government.

The Walmart business model has begun to unfold in India.

article